Bloomberg Intelligence

This analysis is by Bloomberg Senior Intelligence Analyst Kunjan Sobhani, with contributing analysis by Oscar Hernandez Tejada. It appeared first on the Bloomberg Terminal.

After turmoil through 2023 across most cyclical semiconductor markets — as the sector grappled with inventory gluts, weak end-market demand and geopolitical tensions — optimism for a slow but steady recovery in 2H continues to rise. AI exposed names have shown no signs of slowing, both across fundamentals and valuations, and are likely to continue showcasing strengths in 2H across chipmakers, memory and advanced-packaging providers. Valuations and estimates for non-AI cyclical players seem to be pricing in a 2H recovery. Incremental beats and raises could be a tailwind here, though any misses may drive significant volatility.

Focus has shifted to a rebound in end-market demand and AI growth. Despite geopolitical and economic uncertainties, increasing semi valuations signal optimism for a strong sales comeback in 2H.

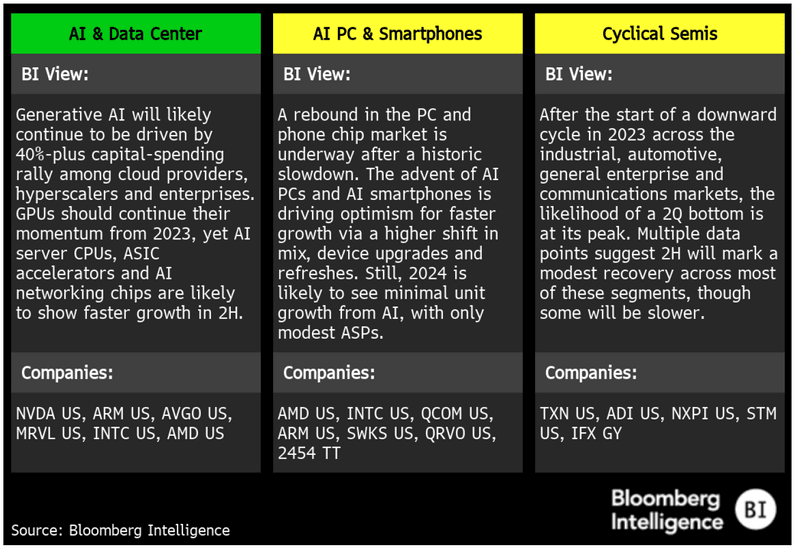

Three keys for 2H: Global semiconductors

Key Drivers

Chip valuations signal optimism on cyclical rebound, AI

The Philadelphia semiconductor index, up about 27% this year, has been buoyed by the surge in generative AI and optimism that growth will return across most end markets. That’s after a 2023 trough driven by an inventory glut and lack of demand across most non-AI cyclical markets. Multiples at chipmakers with high exposure to secular end markets, especially AI, have expanded, and these producers could continue to beat and raise estimates, while 2Q results and 3Q outlooks for non-AI cyclical semis will remain a key driver of further performance.

Cyclical rebound, AI bolster 2024 and 2025 outlooks

Optimism for a 2H recovery, especially in the cyclical non-AI segments, has increased following 1Q results. Uncertainty about end-market demand is waning, inventory gluts are easing and a surge in orders from generative AI is driving the outlook for expansion. About 90% of the companies in the BI global semiconductor peer group are expected to post half-over-half revenue gains vs. about 33% that did so in 1H. The SOX index’s forward-PE multiple is above its five-year historical average of 17x, yet there’s still potential for further beat and raises to estimates in select names.

At the same time, we expect caution over end-market exposure, economic uncertainties (interest rates, recessionary fears) and US-China trade tensions to cloud the outlook for businesses with high exposure to secular generative-AI trends.

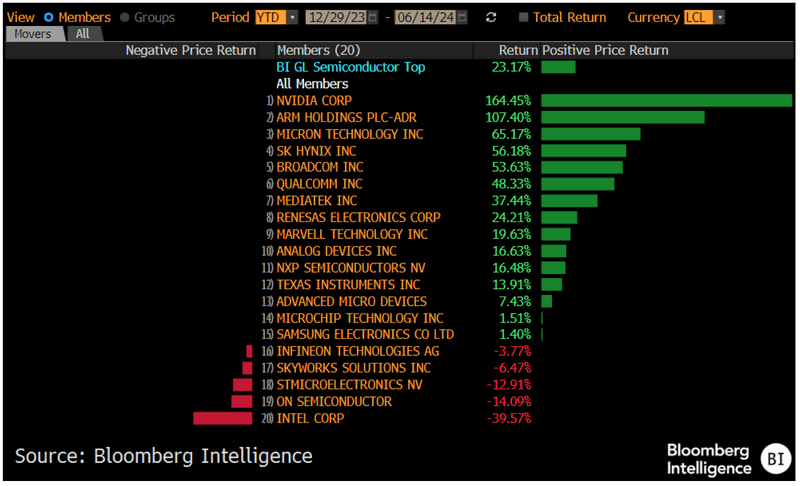

Company Total Return Performance

Higher channel visibility into the cycle

The forward-P/E ratio of the BI semi peer group has risen to 18x, slightly above its historical average of 15x. We believe the bottom of the cycle, especially in PCs and smartphones, has likely already passed, given the normalization of chip inventories across these industries. Uncertainty persists over the strength of recovery in select consumer-exposed products, and growth in auto and industrial sectors has slowed vs. expectations amid rising US-China tensions, but there’s potential for a rebound in 2H. Global demand from select markets with secular tailwinds like AI could offset those hindrances in the near term

Most chipmakers believe they’ve seen the bottom. We think the likelihood of significant cuts to earnings forecasts remains low heading into 2H, especially given the many rounds of estimate reductions in 2023.

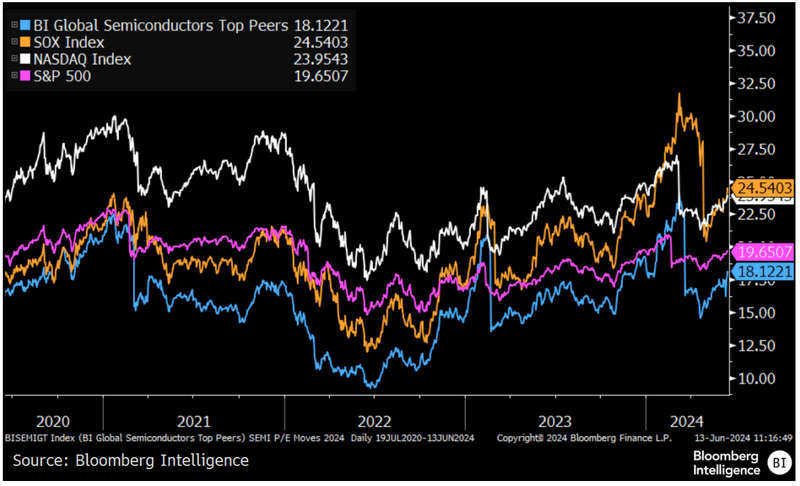

Industry Forward P/E Valuation

Looking beyond the inventory glut

The outlooks for 2Q and 3Q from chipmakers suggest better demand visibility in 2H and 2024, with most of the inventory correction behind. Semi companies typically bottom a few quarters ahead of fundamental troughs, and there’s substantial evidence that the worst came in 2023, specifically for smartphones and PCs. Despite an uncertain economic environment, we believe most chipmakers exposed to smartphone, PC and data-center markets will meet earnings expectations due to easier year-over-year comparisons after demand slumped.

Orders driven by the surge in AI-server spending are likely to remain robust, which would buoy sales prospects for companies with high exposure to such secular-growth markets. Yet non-AI and enterprise-server demand remains mixed, albeit with some signs of the slower but gradual comeback expected in 2024.

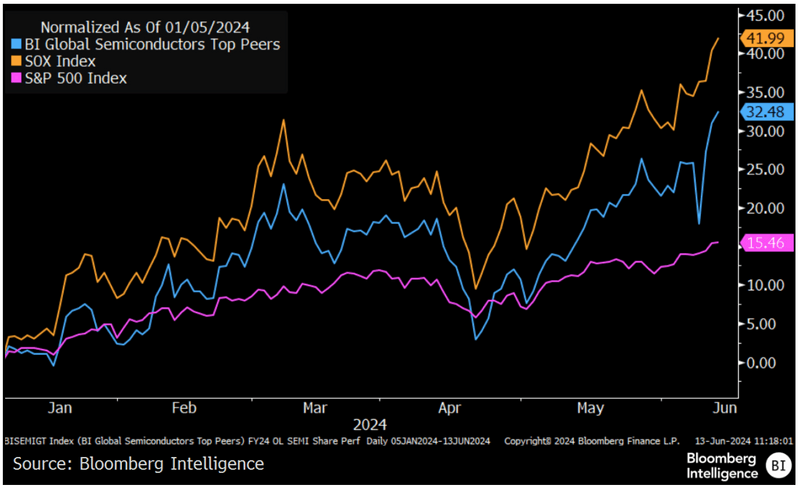

Industry Share Performance

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.