Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analysts Catherine Lim and Trini Tan. It appeared first on the Bloomberg Terminal.

Alibaba needs to attract 70% more active users on AliExpress during June 14-July 14 to raise the likelihood that its marketing spending on the 2024 UEFA European Football Championship can aid its e-commerce expansion overseas, as PDD did for Temu with its US Super Bowl advertising. But competition from PDD, Shein, Amazon and TikTok may limit AliExpress’s user gains and revenue.

Focus on Alibaba’s UEFA Euro 2024 scorecard

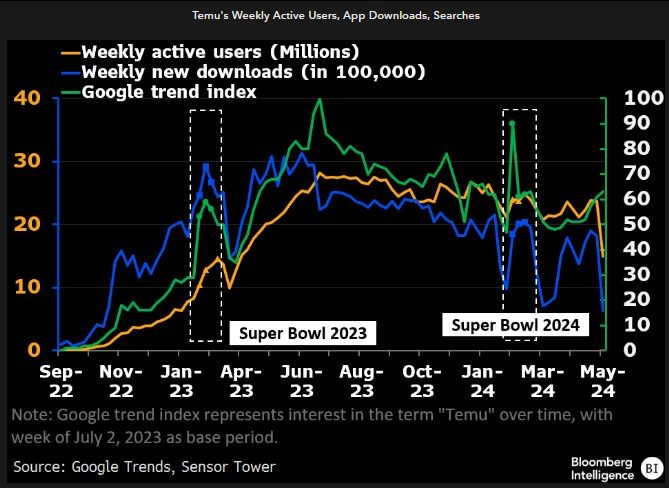

Alibaba needs to raise weekly active users (WAUs) on AliExpress during June 14-July 14 by up to 70% vs. a month earlier to prove that its marketing expenditures on this year’s UEFA European Football Championship can aid its e-commerce expansion outside China, in the same way that Temu’s advertising at the US Super Bowl had an impact. WAUs for Temu in the US surged more than 70% in February 2023 vs. a month earlier as the platform rolled out its first Super Bowl promotional blitz. Weekly downloads of the Temu app jumped 32% during the period to drive a 90% surge in PDD’s 2023 revenue.

The jump in US shoppers’ awareness of Temu and the shopping platform’s low-price strategy helped PDD overtake Shein and Alibaba’s AliExpress in terms of monthly active users (MAUs) within six months of its launch in the country.

Push for more shoppers globally on AliExpress app

Early indications of the effectiveness of AliExpress’s marketing campaigns for Euro 24 could emerge next week with the start of the Choice Day sale on June 1. This “global bazaar” has been endorsed by the platform’s newly appointed global ambassador, former UK footballer David Beckham.

During matches from June 14 to July 14, AliExpress plans to offer online prizes after every goal scored. Users must log into their AliExpress apps and shake their smartphones after each goal for a chance to win.

AliExpress may narrow gaps to Temu, Shein, Amazon

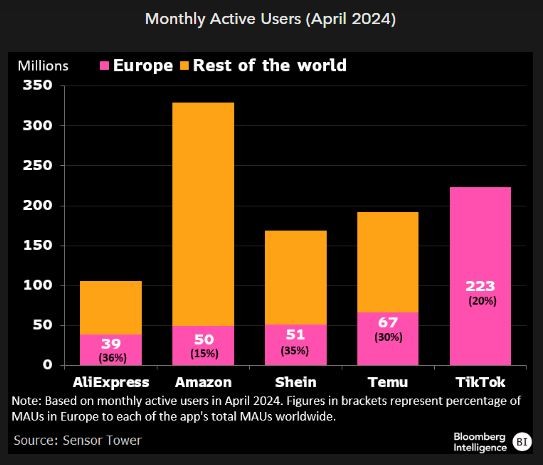

AliExpress could raise its MAUs and narrow shortfalls against PDD’s Temu, Shein and Amazon if its marketing campaigns around Euro 24 prove effective in winning over new shoppers from these rivals. A recent rise in AliExpress’s European MAUs, which grew 16% year-on-year in the first four months of 2024 vs. Temu’s doubling of MAUs and Shein’s 42% gain, could accelerate as a result.

AliExpress may face fiercer retaliatory moves from Temu and Shein than from Amazon, which relied on Europe for about 15% of its worldwide MAUs as of April 30. Plans by ByteDance to officially launch TikTok Shop e-commerce operations in major European markets such as France, Germany, Italy and Spain this summer may threaten AliExpress’s gains.

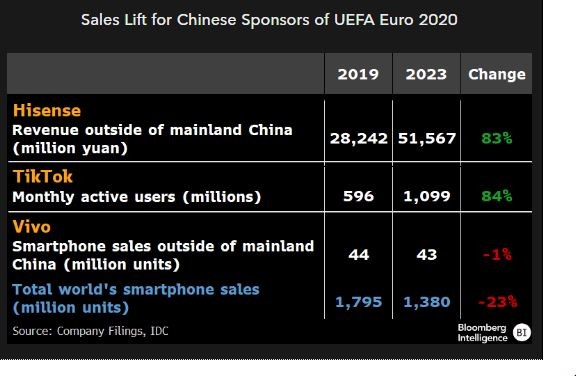

Overseas Uplift Likely for AliExpress, BYD

AliExpress and BYD, which join Alipay, Hisense and Vivo in 2024 as two of the five Chinese sponsors for Euro 24, will likely lean on their affiliation with the tournament to expand into new overseas markets and strengthen their presence in existing ones. The success rates of such plans appear high, based on the 83% jump in the overseas revenue of Hisense after the TV maker became a sponsor of the tournament in 2016. Vivo’s marginal 1% fall in smartphone sales outside China in 2019-23, vs. a 23% slump in handset sales worldwide, also suggests a lift in global brand awareness from the sponsorship. Vivo was a global sponsor of Euro 20.

ByteDance’s sponsorship of Euro 20 via TikTok likely helped contribute to the 84% jump in the app’s MAUs over the last four years.

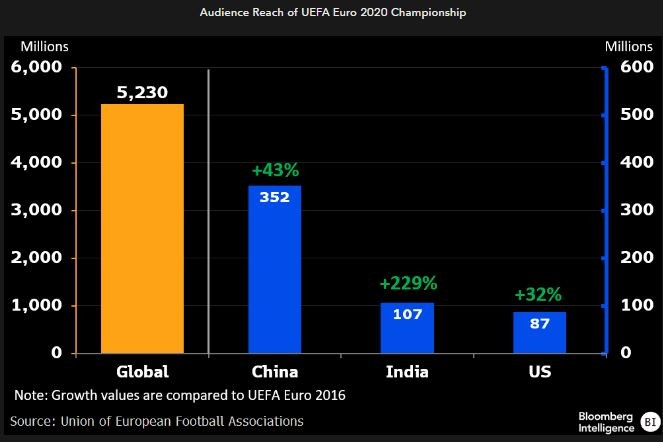

May reach more than 60% of world’s population

Sponsors of the quadrennial Euro 24 could lean on the month-long tournament to connect with more than 60% of the world’s population. Live matches of Euro 20, held in 2021 due to the Covid pandemic, drew a combined audience of 5.23 billion onsite and via TV and other streaming channels, according to UEFA. A rise in digital engagements, which jumped fivefold during the 2022 FIFA World Cup in Qatar vs. the previous contest, may offset the drag on viewership from holding Euro 24’s matches in a single country (Germany) compared with 11 nations four years earlier.