Managing a multitude of environmental risks in the supply chain

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Gail Glazerman, with contributing analysis by Conrad Tan. It appeared first on the Bloomberg Terminal.

Companies must manage a wide range of environmental risks across their supply chain. Warmer, hotter climate threatens many agricultural raw materials. Increasing scrutiny and regulation is holding companies accountable for supplier behavior, such as deforestation. And product environmental claims can be undermined by suppliers.

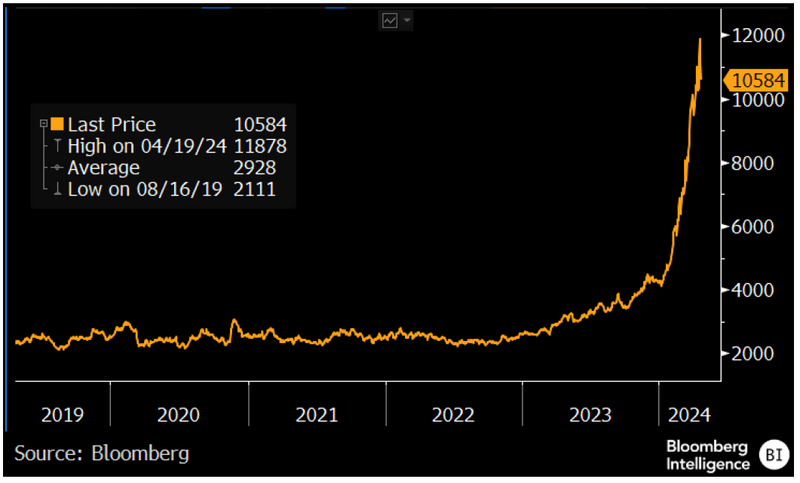

Increasingly extreme weather jeopardizes raw materials used across food, beverage and restaurant industries at risk of cost spikes and product shortages. Cocoa prices have soared, in part due to extreme drought in West Africa, forcing food companies to reformulate products and market less chocolate-intensive goods. Beer producers are investing in research to find drought-resistant barley. A hotter, drier climate can make grapes sweeter, altering the taste of wine; Taittinger now produces some sparkling wine in England in response. Wendy’s shifted to indoor tomato and lettuce due to climate risk.

Companies exposed to these commodities need to be proactive — potentially diversifying supply chains to new regions, developing resistant crops or finding ways to reformulate products in a way that will still appeal to customers.

Cocoa Price Hits Records (US$ per Metric Ton)

Raw materials can bring unexpected risks

As the auto industry transitions to electric vehicles, their raw material needs are changing, raising new supply-chain risks. EV batteries require significant volume of materials like lithium and nickel, which can drive up the environmental footprint of the car (eventually offset by use phase efficiencies). Companies need to be mindful of where and how they source these materials. Several automakers like Volkswagen preemptively committed to avoid materials sourced via deep-sea mining due to biodiversity concerns. Some are innovating battery technology to limit the use of sensitive materials. Other automakers have considered direct investment in mines, which would exchange supply chain for more direct risks.

Automakers have been criticized for sourcing “green steel,” which isn’t yet being produced with clean energy.

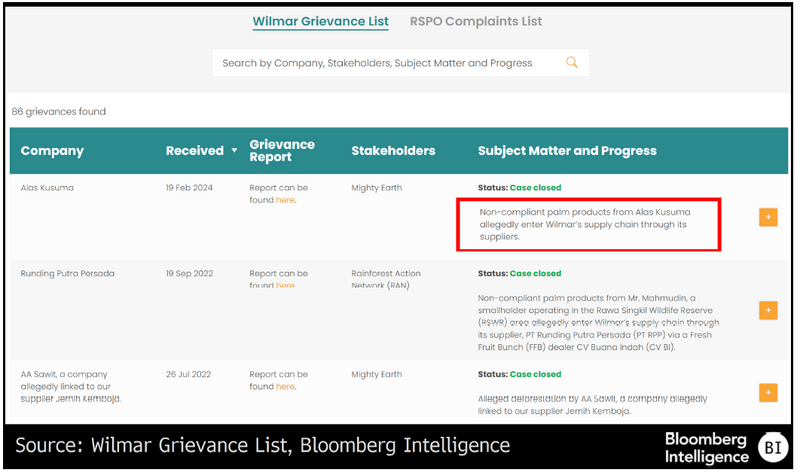

Ag companies face scrutiny on harms deep in supply chains

Agricultural companies like Wilmar and Golden Agri-Resources face pressure from investors, big customers and activist groups to weed out environmental harms throughout their supply chain. In 2023, consumer giant Procter & Gamble asked Tier 1 suppliers, including Wilmar and Kuala Lumpur Kepong, to stop sourcing from First Resources and FAP Agri after complaints of violations, including deforestation. P&G expects its suppliers to have a public grievance policy and to publish allegations received and actions taken to mitigate concerns. In June 2023, Japan’s Nissin Foods said it stopped buying from several palm-oil suppliers for violations of its no-deforestation, no-peat and no-exploitation policy.

New EU rules on deforestation-free supply chains may push more firms to declare their products free of environmental harms.

Wilmar Grievance Tracker (May 2024)

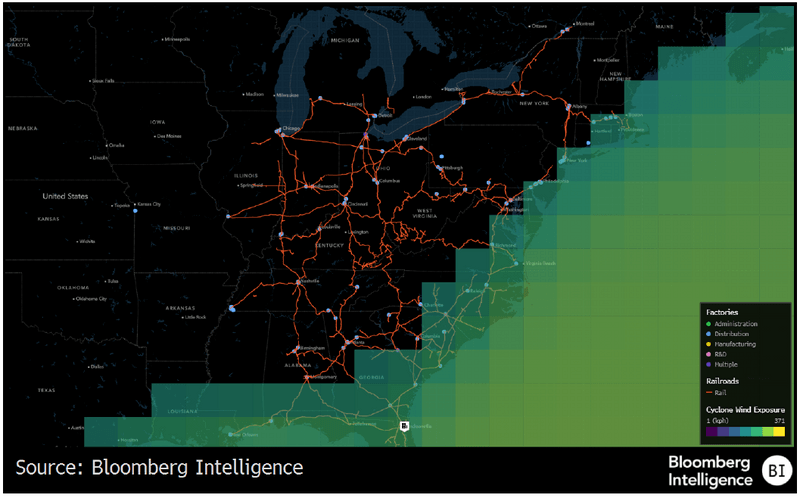

Extreme weather threatens to snarl supply chains

Transport links critical to global supply chains for many industries are exposed to climate risks including drought, hurricanes and floods. Severe drought hurt Panama Canal traffic for months, with ship crossings cut as much as 36%. Authorities say the disruption could cost them as much as $700 million in 2024. Low Mississippi River water levels sent barge rates soaring last year, pushing up costs of US corn and soybean. In Europe, a 2022 drought forced vessels on the Rhine to cut freight volume by up to 75%, snarling traffic and raising prices for cargo owners.

On land, freight railroads face frequent weather threats. Union Pacific incurred over $100 million in lost revenue and costs from storms, wildfires and heavy rain in 2021. CSX spends 14% of its annual capital expenditures (over $240 million), managing climate risk.

CSX’s Rail-Network Exposure to Cyclone Risk