Emerging markets 1Q24 earnings review

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Marvin Chen, with contributing analysis by Sufianti Sufianti. It appeared first on the Bloomberg Terminal.

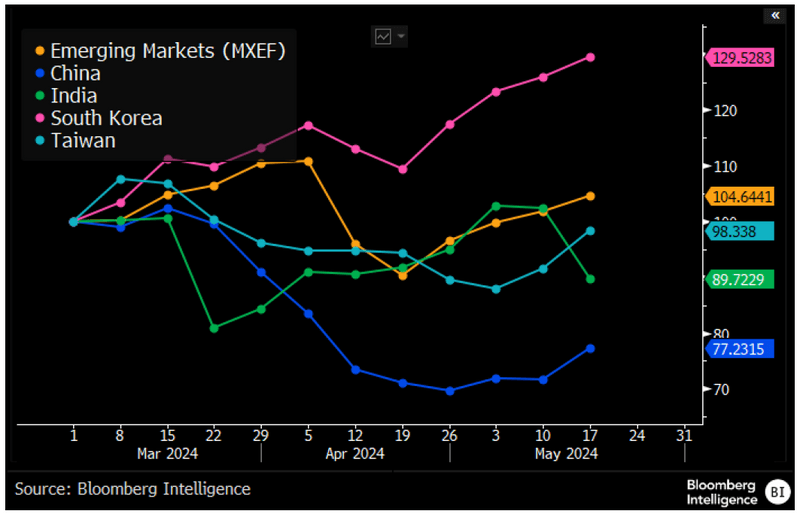

Moderately positive earnings surprises may be enough to keep MSCI EM on track to deliver double-digit aggregate earnings growth this year after roughly 80% of members reported 1Q profit, with overall results topping consensus. Growth and earnings revisions have ticked up as the season closes, with South Korea leading revisions higher while China’s negative outlook appears to be easing.

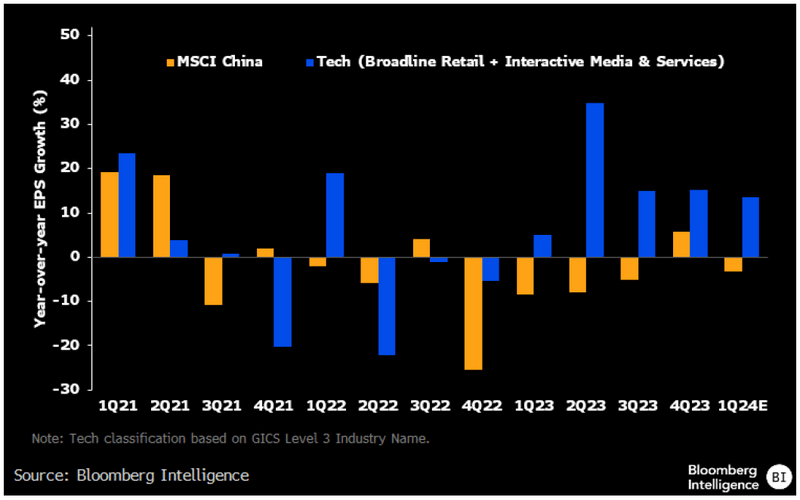

China tech earnings stand out amid lackluster results

China’s tech and e-commerce earnings continue to stand out in terms of growth in 1Q24, in part due to cost-cutting, while the broader market is still showing earnings contractions compared with a year ago. Tencent profit rose 62% in 1Q, beating consensus expectations and driving estimates for full-year earnings higher by more than 5 percentage points. Baidu and JD.com also surpassed estimates, with the latter seeing moderately stronger upward revisions. Alibaba’s performance was mixed, with revenue topping 1Q consensus, but EPS falling short.

Overall MSCI China is tracking a 3.1% contraction in 1Q earnings from a year ago, with consensus estimates for full-year growth of around 12.3%, down from more than 15% at the beginning of 2024. That’s still higher than the 10% estimate in our model.

MSCI China 1Q24 Earnings Growth Estimates

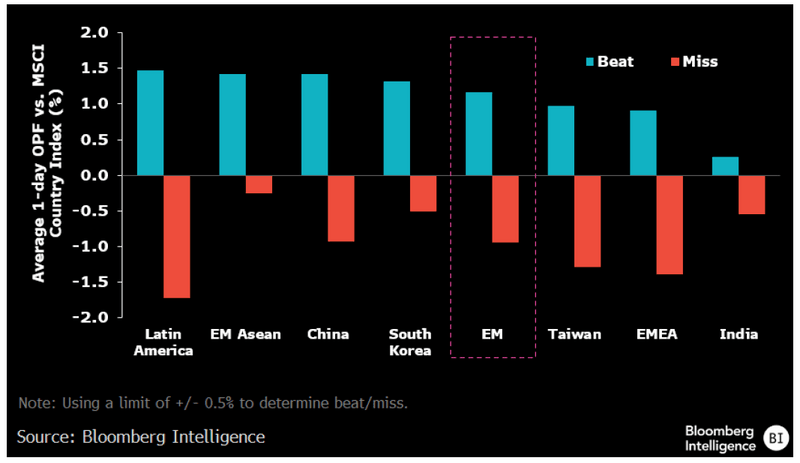

Price reactions to earnings surprises

Price reactions to emerging-market 1Q earnings have been relatively balanced, with stocks rising and falling by 1.2% and 0.9% respectively on average to beats and misses, suggesting company fundamentals remain in focus. Shortfalls have prompted bigger reactions than business outperformance for Taiwan, India, EMEA and Latin America, while the opposite is true for the rest. Latin America saw the largest gap in performance, with stocks of companies beating expectations rising 1.4% on average while those missing falling 0.9%. A notable divergence was observed in Southeast Asia, with a net gain of 1.4% for companies surpassing expectations, while shortfalls were barely punished. Better-than-expected results have received a cool reception in India, with beats only rewarded by a 0.3% gain.

MSCI EM 1Q24 Earnings Season: Price Reaction

Growth expectation bottoming out as earnings season wraps up

MSCI EM: 2024 Earnings Growth Estimates

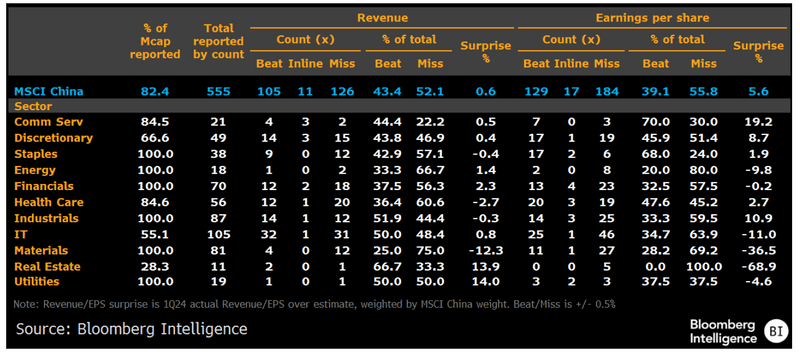

Tech the bright spot amid China’s mixed 1Q result

MSCI China 1Q24 Earnings Season

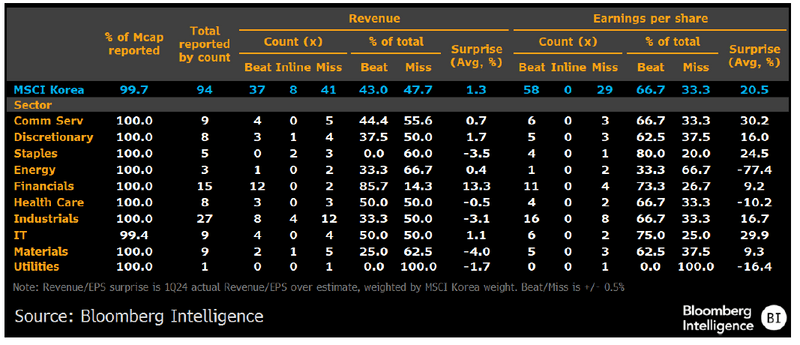

Korean tech earnings lead the way higher

MSCI Korea 1Q24 Earnings Season

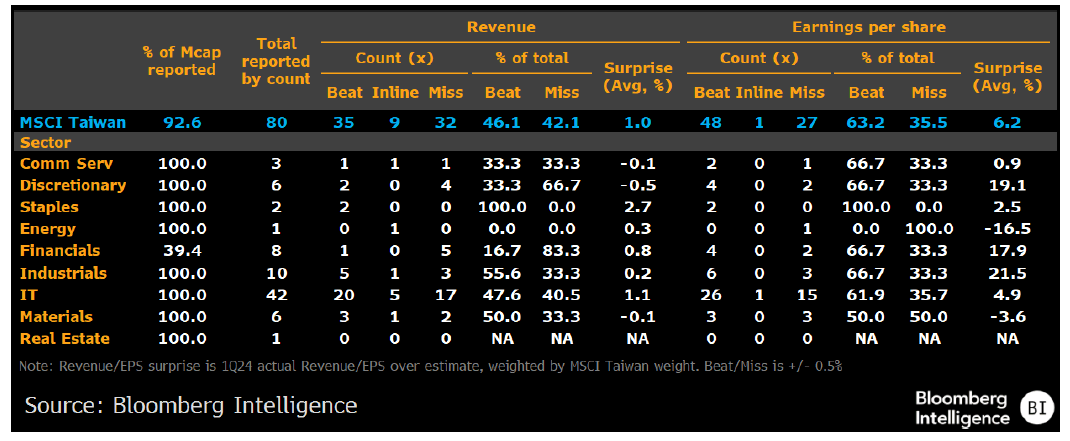

63% of MSCI Taiwan Index members beat expectations

MSCI Taiwan 1Q24 Earnings Season

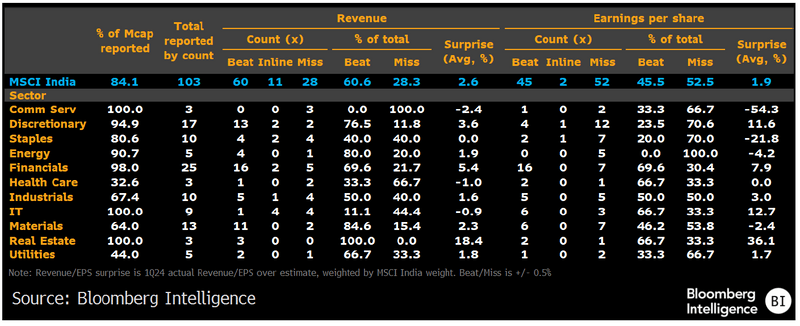

Financials, IT shine in India; Consumer staples struggle

MSCI India 1Q24 Earnings Season

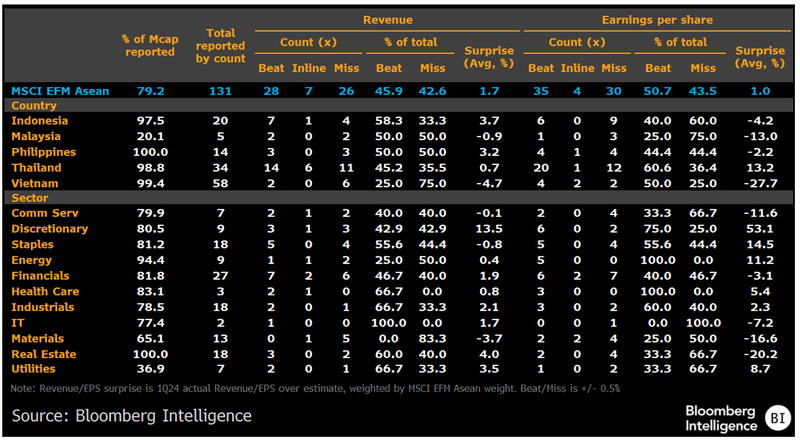

Thailand sets performance pace in Southeast Asia

MSCI EFM Asean 1Q24 Earnings Season

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.