Here comes T+1 and the US buy-side has questions

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Lead Industry Analyst Larry Tabb, with contributing analysis by Jackson Gutenplan, Nicholas Phillips, Deniz Besiroglu, and Geovanni Alvarado. It appeared first on the Bloomberg Terminal.

Sparse initial public offerings and lackluster trading volume not only took the wind out of US equity commissions in 2023 but pushed asset managers to concentrate more fees at their largest three brokers and shift more flow toward high-touch sales traders to pay for research, corporate access, conferences and market data services.

While asset managers are concentrating more flow with their largest brokers, which tend to be bulge-bracket US bank/brokers (Morgan Stanley, Goldman Sachs, Bank of America and JPMorgan), they increasingly are ranking the value received from mid-tier brokers as differentiated, making it worthwhile to send them more execution volume.

Finding liquidity is the asset manager’s most challenging obstacle and the key reason for order allocation and distribution, as the average equity trade has declined to about 150 shares, pushing many buy-side traders to increase the use of high-touch brokers, specifically from large, US banks.

The most important projects to the buy-side are the move toward reducing the settlement cycle (T+1), increasing the transparency of odd-lot quotes (sub-100 share orders, which in many cases aren’t displayed), and reducing the SEC-mandated access fees of 30 cents/100 shares. Many believe these fees, which haven’t been altered since 2005, stand in the way of brokers’ lowering commission rates.

Asset managers are clearly concerned about the SEC’s regulatory agenda, which includes changes to equity market structure, who is required to register as dealers, the definition of exchanges and alternative trading platforms, increased short seller/financing transparency and a host of other major issues. Increasingly, asset managers are even suing the regulator, given how severely these rules affect their business.

Key Findings

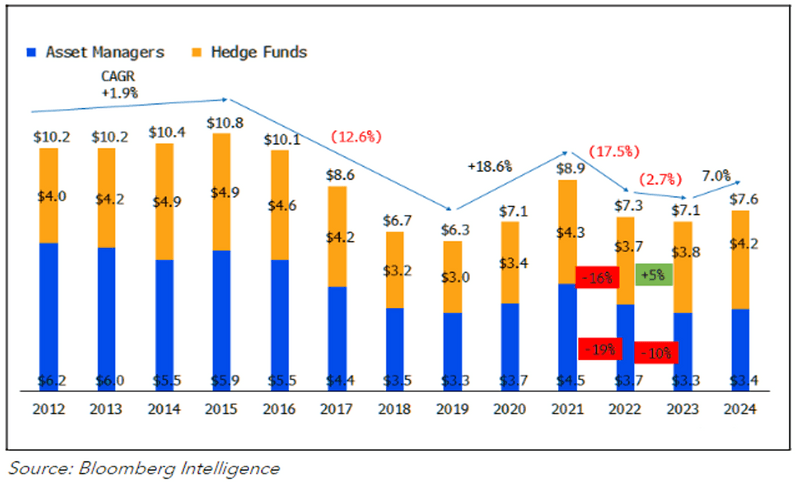

- Commissions decline 2.7%: Lower trading volume decreases total wallet.

- Hedge funds ascendant: Bucking the trend, commissions at these funds overtake traditional long-only managers for the first time in our study.

US Institutional Equity Commission Estimate

- It pays to be No. 1: A fund’s top US equity broker captured upward of 24% of the asset manager’s commission wallet.

- Algos top service: Trading algorithms are a fund’s most important broker service, yet high-touch offerings aren’t far behind, with the buy-side angling to do more.

- Services spending flat: Asset managers spent $3 billion on brokerage services in 2023, the same as in 2022, with 53% allocated to broker ($1.1 billion) and independent ($500 million) research.

Bloomberg Terminal customers can read the full report, and if you are not already a customer, you can learn more here.

This is a synopsis of the full report. This is not an investment recommendation. All investors are advised to conduct their own independent research and consult a licensed investment professional before making a purchase decision. In addition, investors are advised that past investment performance is no guarantee of future price appreciation or performance.