May commodity outlook: Reflation or fleeting bounce?

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Mike McGlone. It appeared first on the Bloomberg Terminal.

Evidence that the Chinese economy is following some combination of Japan and the Soviet Union about three decades ago may come from plunging China government bond (CGB) yields, with implications for commodities. WTI crude oil might have peaked in April around $87 a barrel, akin to $95 in 2023, if managed money futures positions (hedge funds) are a guide, with implications for copper. A key question for 2024 is whether the industrial metal can sustain above $10,000 a ton. We expect copper to continue outperforming crude but see greater headwinds for both due to some beta back-and-fill.

Supply-elastic grains have seasonal tailwinds but may be an average Corn Belt growing season away from following natural gas toward the low-price cure. Gold is the only major commodity making record highs, which appears enduring to us.

Inflate more or fleeting bounce? Rising commodity headwinds

The Bloomberg Commodity Spot Index has bounced in April to levels first reached in 2011, and this year may mark either a sustainable recovery or further reversion from the 2022 highs. Our bias is the latter due to typical cycles, plunging bond yields in China, crude oil’s potential peak and elevated US interest rates vs. low stock-market volatility.

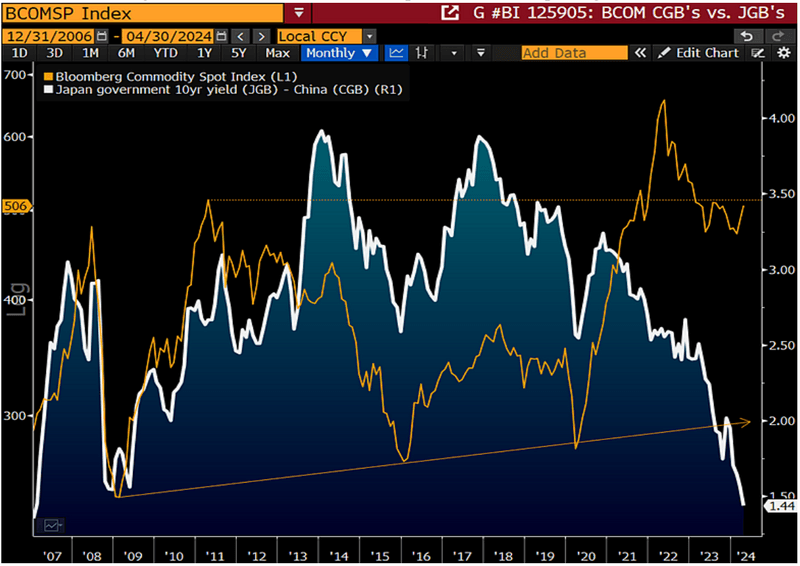

Commodities may fall 40% if CGBs a guide

A bit of overdue reversion common in rapidly growing emerging markets may pressure the Bloomberg Commodity Spot Index toward its upward sloping trend line since the 2009 bottom. Our graphic shows a potential leading indicator pointing that way — CGB yields dropping toward JGBs. China’s 10-year government bond yield is at the lowest since 2009 vs. Japan. That commodity prices have bounced in 2024 along with the US stock market, sticky inflation and diminishing Federal Reserve rate-cut expectations, may not be coincidence.

BCOM May Follow CGBs to Upward Sloping Trendline

Our take is the high-price cure that has afflicted broad commodities from the 2022 peak may be trickling down to beta, with implications for all markets. Declining bond yields in China, the world’s largest commodity importer, aren’t encouraging signs of thriving demand-pull forces.

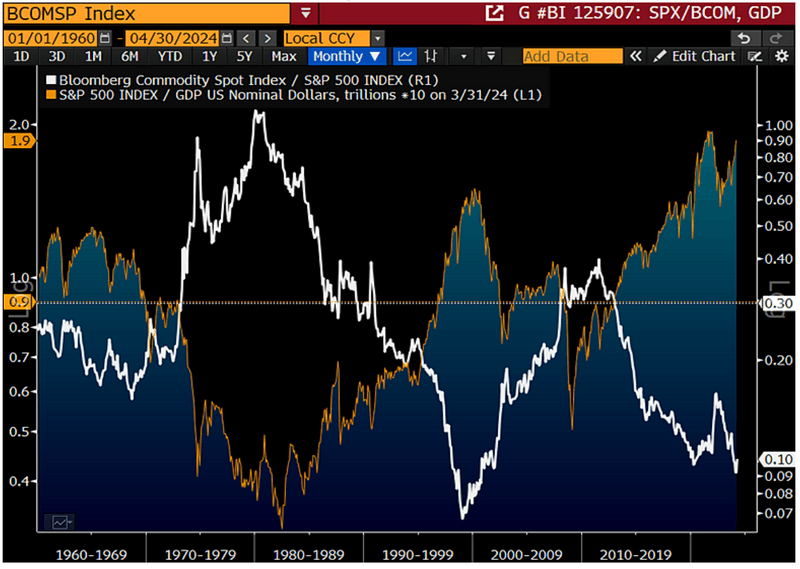

Gold may be signaling a bit of normalization

It may take a minor catalyst to trigger some upward reversion in the Bloomberg Commodity Spot Index (BCOM) vs. the S&P 500 (SPX), notably if the stock market backs up a bit. Our graphic shows the BCOM/SPX ratio potentially bottoming in 1Q from the lowest since 2000 and the stock index approaching the 2021 peak vs. GDP, which was the highest since the 1930s. A key takeaway is the increasing necessity of the US stock market to remain elevated to buoy all boats, and risks of reversion.

S&P 500 Multidecade Highs vs. GDP, Commodities

At 1.9x on April 29, the ratio of SPX vs. GDP in US dollar trillions (times 10) compares with the mean since 1960 of 0.9. At 0.1, the BCOM/SPX ratio is well below the mean of 0.3. Gold being up about 13% in 2024 to April 29, beating the SPX total return by about 2x, may be a disconcerting sign for the AI-driven stock market.

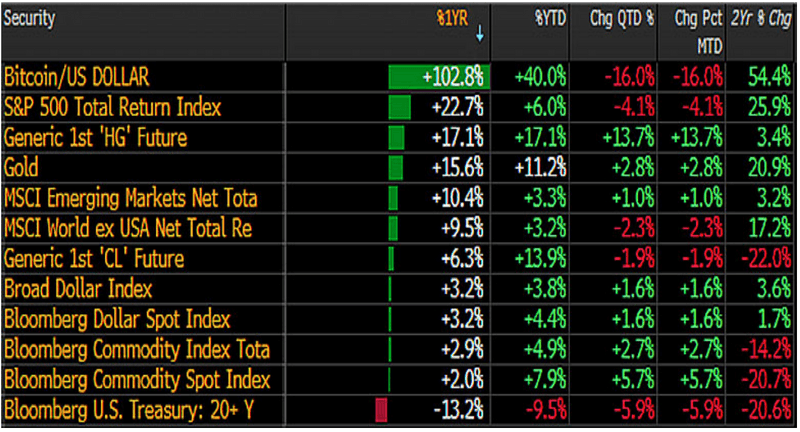

Is the commodity high-price cure trickling down?

The Bloomberg Commodity Spot Index’s about 2% gain on a one-year basis, vs. the S&P 500’s total return near 25% to April 29, may portend a burden on the stock market to keep rising and buoy commodities. Both indexes have advanced about 7% in 2024, but gold has almost doubled that. It’s a question of which takes the performance medal this year, and our bias is with the metal. The high-price cure that’s afflicted most commodities since the 2022 peaks could be trickling down to equities, as evidenced by sticky inflation and declining expectations for Federal Reserve rate cuts.

Gold Is Beating Beta in 2024; Can Copper Win?

The combination of Chinese government bond yields falling to the lowest in our database since 2005, high US rates and low stock-market volatility may augur commodity headwinds. Copper at $10,000 a ton could mark inflection-point resistance.

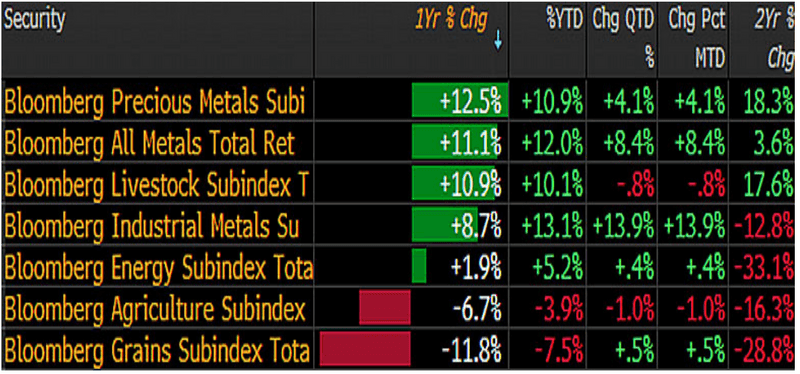

Inelastic precious metals beating elastic grains

The most supply-elastic sector — grains — at the bottom of our annual performance scorecard, coupled with least-elastic precious metals at the top, may portend enduring broad commodity headwinds stemming from the price spikes to the 2022 highs. Energy and industrial metals in the middle appear dependent on a rising US stock market and global economic recovery, which could require a long lag to central bank easing if history is a guide. That the top commodity importer — China — appears increasingly reliant on fiscal and monetary stimulus for economic resilience might be a primary tailwind for gold.

Precious Metal’s Upper Hand May Be Enduring

With the exception of the grains, most commodities have bounced in 2024 along with the US stock market and inflation, which may indicate that high prices haven’t yet been sufficiently cured.