Data Spotlight: Sustainability-Linked Bonds, ESG backtesting & more

Welcome to Data Spotlight, our series showcasing insights derived from Bloomberg’s 8,000+ enterprise datasets available on data.bloomberg.com via Data License.

In this edition of our series, we focus on data insights related to sustainable finance: Sustainably-Linked Bonds, ESG backtesting, the European ESG Template, and Bloomberg’s updated GHG model estimates accounting for financed emissions.

1. Systematic tracking of Sustainability-Linked Bonds performance

Sustainability-Linked Bonds (SLBs) are a relatively new and popular type of sustainable debt instrument, accounting for almost 8% of the total sustainable bond issuance in 2023.

SLBs aim to align the issuer’s interests with climate and environmental goals as its structural characteristics are tied to predefined sustainability/ESG objectives. To help investors evaluate SLB performance, Bloomberg’s Sustainable Debt Data Solution provides a range of data points such as Key Performance Indicator (KPI) name and Sustainable Performance Target (SPT) value. The depth and breadth of this dataset is key since conducting systematic analysis on SLBs has historically been a difficult undertaking as objectives and performance indicators vary for various issuers.

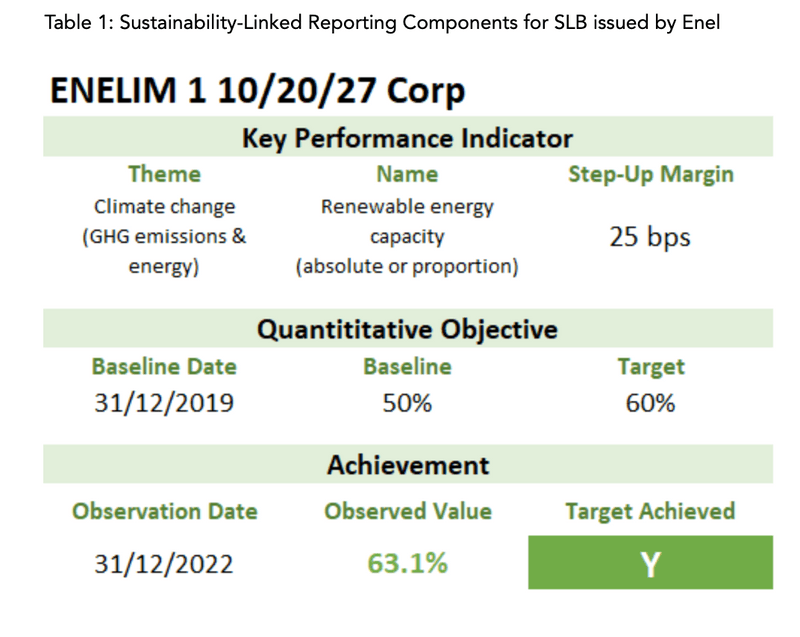

Table 1 shows how investors can monitor in detail the performance indicators as well as the current status of performance for a given bond.

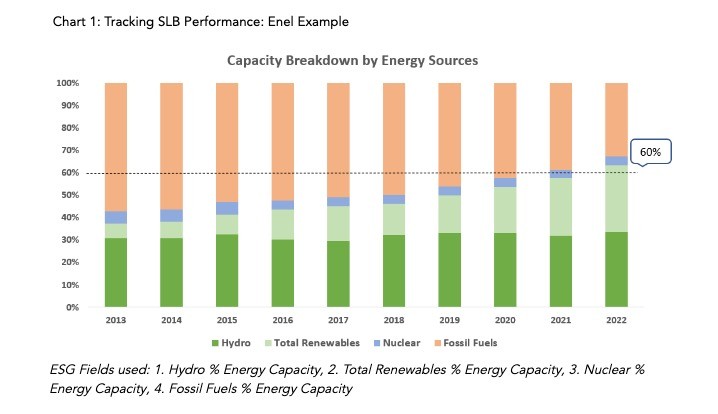

Bloomberg clients can also link Bloomberg’s Sustainable Debt data to our ESG company-reported data, which covers 15,000 companies, to track the performance and transparency of a company’s ESG objective. Chart 1 shows how Enel, an Italian energy company, is on track to have more than the 60% of renewable capacity required for it to not trigger a penalty on its 2027 SLB.

Theme: Sustainability Debt

Roles: Fixed-Income Portfolio Managers, Risk Managers, ESG Analysts

Bloomberg Datasets: Sustainable Debt, Sustainable Debt (Per Security), Company ESG Reported

2. ESG backtesting: unveiling industry insights and overcoming criticisms

With the proliferation of ESG data reported globally today, it can be difficult to understand which metrics are financially material to which sectors. To cut through the noise, a robust, transparent scoring model can help investors understand which ESG factors are impacting financial performance. When evaluating ESG scores, it’s critical to understand the inputs and methodology underpinning those scores for defensible investment decisions.

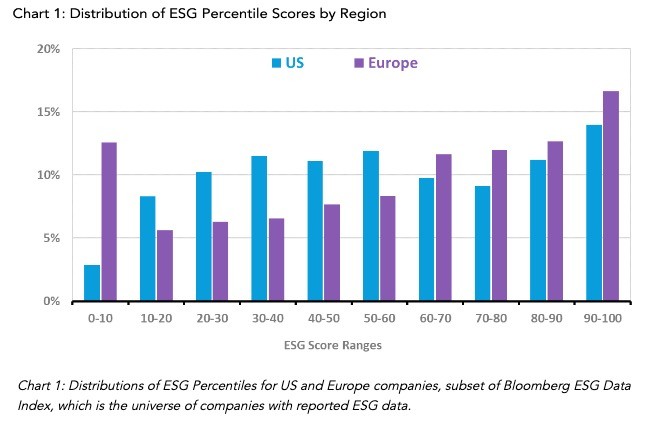

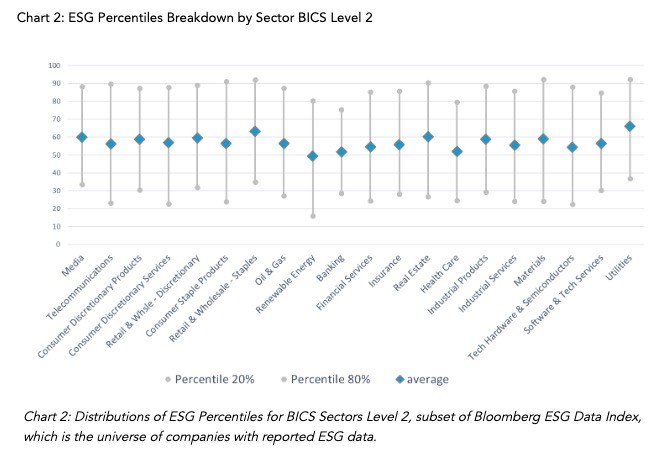

Bloomberg provides data-driven and fully transparent ESG scores as well as percentiles for 14,000+ companies. Bloomberg’s scores are based on company-reported data and do not use proxies to supplement a lack of data governance. It is clear to users what data has been disclosed by the company, what hasn’t, and how well a company performs on disclosure. Charts 1 and 2 illustrate the diversity of companies’ ESG performance across regions and sectors.

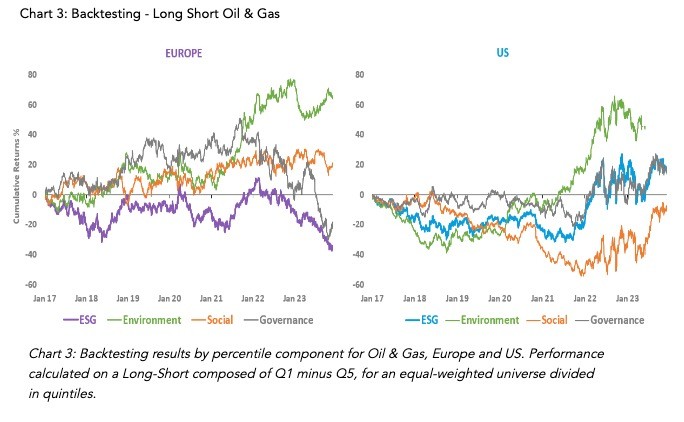

Backtesting ESG scores and their components provides insight into market performance, such as the positive correlation between environmental practices and financial rewards as seen in chart 3 for the Oil & Gas sector.

Monitoring how markets react to ESG criteria can also help investors integrate ESG alongside traditional financial criteria for more informed decision-making when screening companies.

For more insights on ESG backtesting check out this blog post. To learn more about all of Bloomberg’s ESG solutions, please visit our website.

Theme: ESG

Roles: ESG Portfolio Managers, ESG Analysts

Bloomberg Dataset: ESG Scores and Transparency

3. European ESG Template: getting transparency into sustainable practices

For fund investors, ESG considerations are becoming more prevalent and there’s a growing need for transparent and standardized ESG reporting. The European ESG Template (EET) has emerged as a pivotal tool, providing a comprehensive framework for fund managers to disclose their ESG performance. By offering a consistent and comparable set of data, the EET is not just a regulatory requirement but also a powerful, standardized reference for investors. It additionally acts as a support for wealth managers in their MiFID II investor protection compliance.

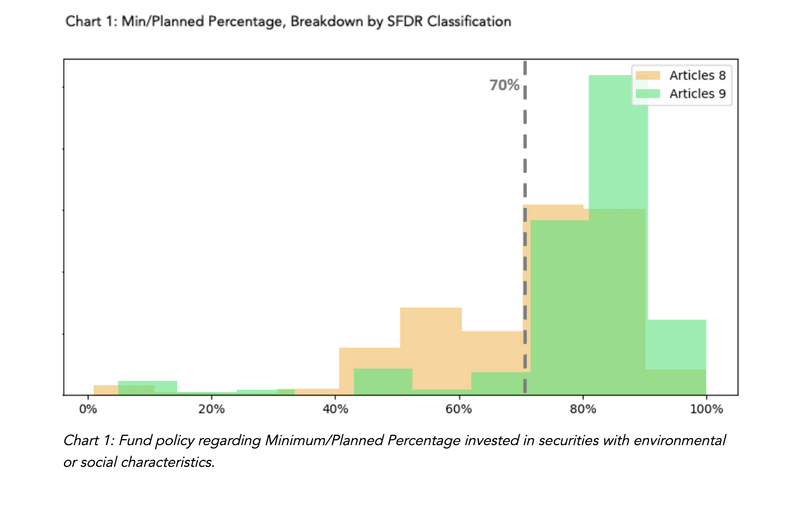

An example question investors can answer with EET data is: What sustainability policies does a fund have in place? As shown in chart 1, most Article 9 funds intend to invest at least 70% in securities with environmental or social characteristics.

It is worth noting that compared to Article 8 funds, which should promote environmental or social characteristics and have good governance practices, Article 9 funds should make a positive impact on society or the environment through sustainable investment and have a non-financial objective at the core of their offering.

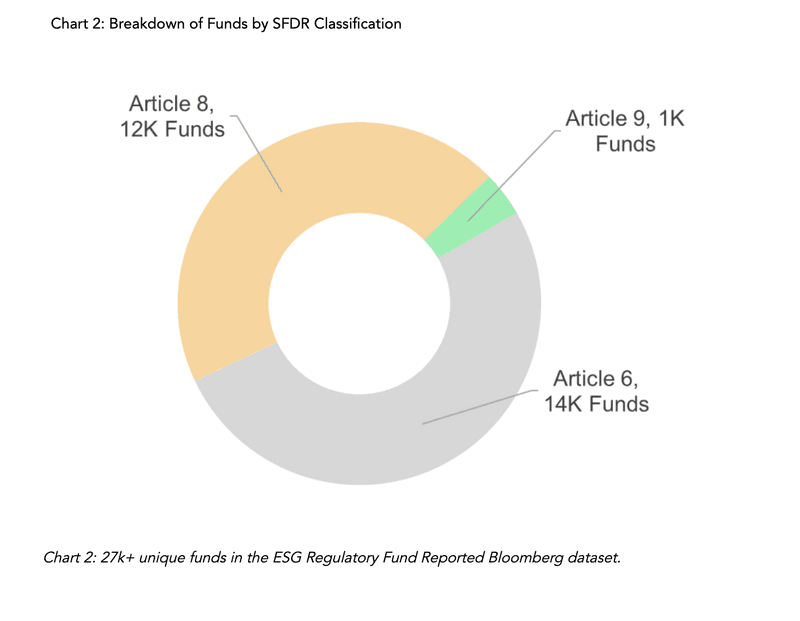

This question, and many more, can be answered using Bloomberg’s ESG Regulatory Fund Reported data which covers more 27,000 unique funds with more than 350 data fields, as shown in chart 2. This comprehensive dataset gives investors a detailed understanding of funds’ policies as well as their execution when it comes to ESG investing.

Theme: ESG

Roles: Fund Analysts, ESG Analysts, Portfolio Managers, Consultants

Bloomberg Dataset: ESG Regulatory Fund Reported

4. Updated GHG model estimates: financed emissions

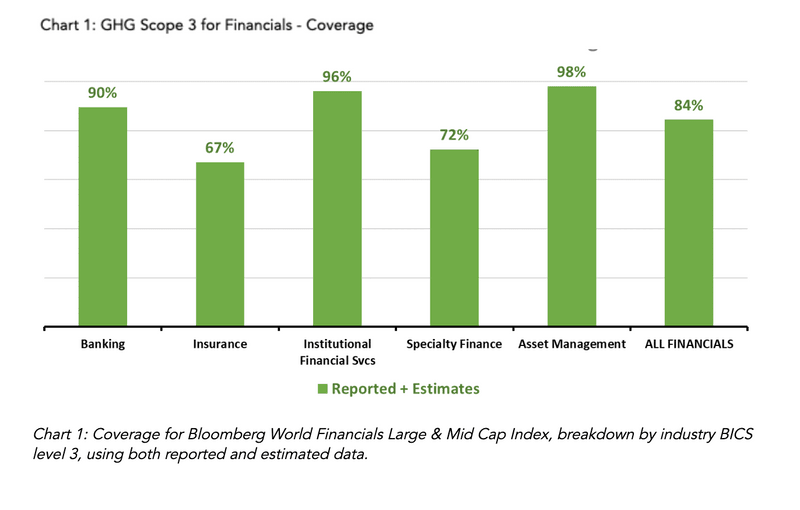

Bloomberg uses a model to estimate financed emissions using a bottom-up approach and following the guidelines issued by the Partnership for Carbon Accounting Financials’ (PCAF). This model leverages Bloomberg extensive data on financial companies’ loan book, long-term investments and holdings data.

The model output populates Scope 3 GHG estimates for financial companies and also updates two new data fields that break down financed emissions into two buckets: financed emissions resulting from a company’s loan book and long-term investments; and financed emissions resulting from a company’s assets under management.

Chart 1 shows Bloomberg’s coverage of GHG Scope 3 financed emissions by industry.

Theme: GHG Scope 3 – Financed Emissions

Roles: ESG Analysts, Portfolio Managers, Risk Managers

Bloomberg Dataset: Carbon Emissions

Interested to learn more about our data offering? Bloomberg’s Enterprise Data business transforms the way customers extract value from data by providing the most comprehensive coverage and highest data quality in the industry.

Bloomberg’s OneData approach makes all of the data easily discoverable on data.bloomberg.com, via Data License, instantly usable and delivered via APIs on the Cloud, to a customer’s hosting provider or data center. Our data management solutions aggregate, organize, and link your data to make it accessible through a diverse set of delivery mechanisms.