Farm, Food, and Fuel Summit: Upstream earnings pressured

This analysis is by Bloomberg Intelligence Senior Industry Analysts Jennifer Bartashus and Jason F. Miner. It appeared first on the Bloomberg Terminal.

The 2024 outlook for corn and soybean prices remains under downward pressure, as experts at BI’s Farm, Food and Fuel summit emphasized that large crops loom over still-occupied bins. Farmers will likely dip into savings to plant, despite negative margins. Amid greater macroeconomic risk, debt costs add pressure.

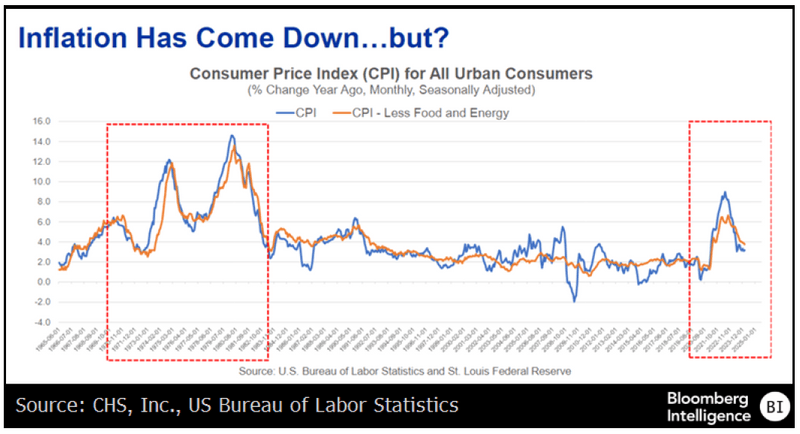

Agriculture risks include untamed inflation

The risk of more inflation was among our key takeaways from comments by CHS’ Director of Global Research Ken Zuckerberg. Farm budgets face the risk of a further squeeze if interest-rate cuts are delayed. Farm debt exceeds cash receipts, according to the USDA — a relationship last seen after the 2012 drought. Pressure for an increase in long-term interest rates is coming from an array of credit risks, including US government debt-to-GDP approaching its post-World War II peak.

Despite optimism over potential biofuels-driven demand, a cycle of declining crop prices and falling farm incomes is adding pressure for (ever larger) US farms to innovate. We found significant, if gradual, potential in Zuckerberg’s assertion that agriculture has been less transformed by digital technologies than any other $1 trillion industry.

Inflation Cycles Historically Not Brief

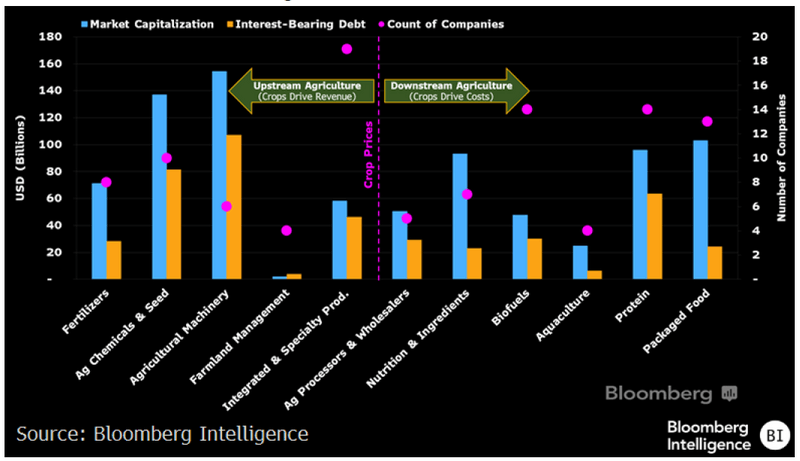

Bigger, cheaper crops pressure upstream margins most

Lower crop prices are driving farmers to push back on costs. This creates earnings pressure upstream, as a margin drag from lower prices overwhelms better volume for fertilizer leaders including Nutrien, Yara and Mosaic, alongside chemicals and seed leaders like Corteva, Bayer and BASF. In 4Q, median Ebitda margin fell 480 bps across the BI Agriculture Upstream peer group, as trailing 12-month Ebitda dropped 15%.

In contrast, cheaper, more-ample crops mean less margin pressure for companies in the BI Agriculture Downstream peer group. Here, Ebitda margins were down just 40 bps in 4Q. Consensus revenue growth for this group is a median 4.4% in 2024 vs. a 0.6% decline in the upstream cohort. Downstream, consensus suggests large players — including JBS, Wilmar, Tyson and Marfrig — may eke out mild growth.

$1.3 Trillion Agriculture Investment Universe

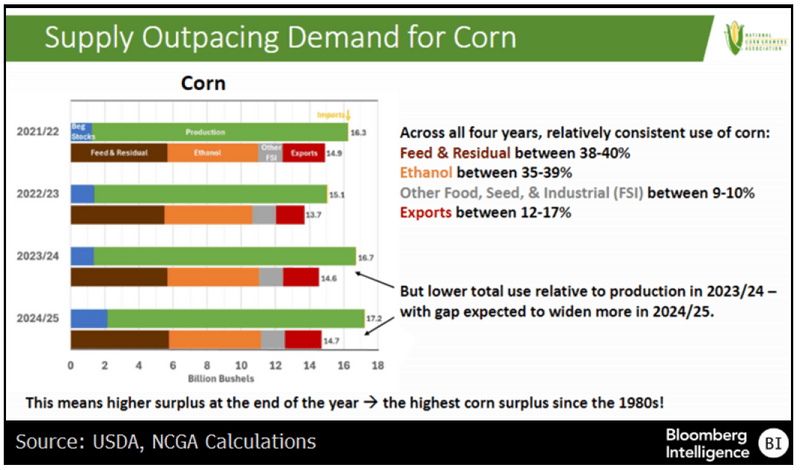

Corn supply surplus may extend price, margin squeeze

A greater likelihood that the US corn surplus will rise — putting a drag on prices — was underscored by Krista Swanson, the National Corn Growers Association (NCGA) lead economist. The group’s calculations show that US corn yields have increased for 90 years. If extended, that may leave 2024-25 with the biggest corn surplus since 1987, and stocks-to-use the highest since 1995. Weakness across key markets has left the composition of demand stable. With local growth slower, exports must partially plug the gap. Yet growing competition from Brazil and a strong dollar are challenges.

Even as these pressures support a negative outlook for corn margins, and yield growth could push stocks-to-use into the high teens this decade, Swanson emphasized multiple agronomic factors limit a pullback from corn planting.

Stocks-to-Use & Price History

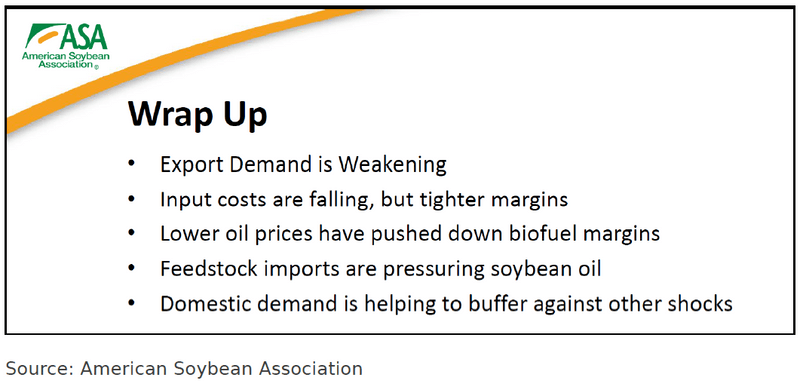

Robust soybean output; fuel opportunity races export risk

Weak demand in China, a strong dollar and record South America soy production are among the challenges to prices and US exports we gleaned from comments by Scott Gerlt, chief economist of the American Soybean Association. More renewable-diesel use, aided by carbon credits, is boosting US soybean-oil use and should offset the export decline. Yet lower oil prices and worries about a surge in alternative low-carbon feedstocks are challenging soybean-oil value. Though input costs are off of recent highs, weaker soy-oil prices are keeping US soybean crush margins tight.

On the soybean supply side, US farmers face regulatory issues, which may curb options in 2025. The limited availability of herbicides may increase production costs and reduce environmental benefits if farmers return to more tillage to control weeds.

Oilseeds Outlook

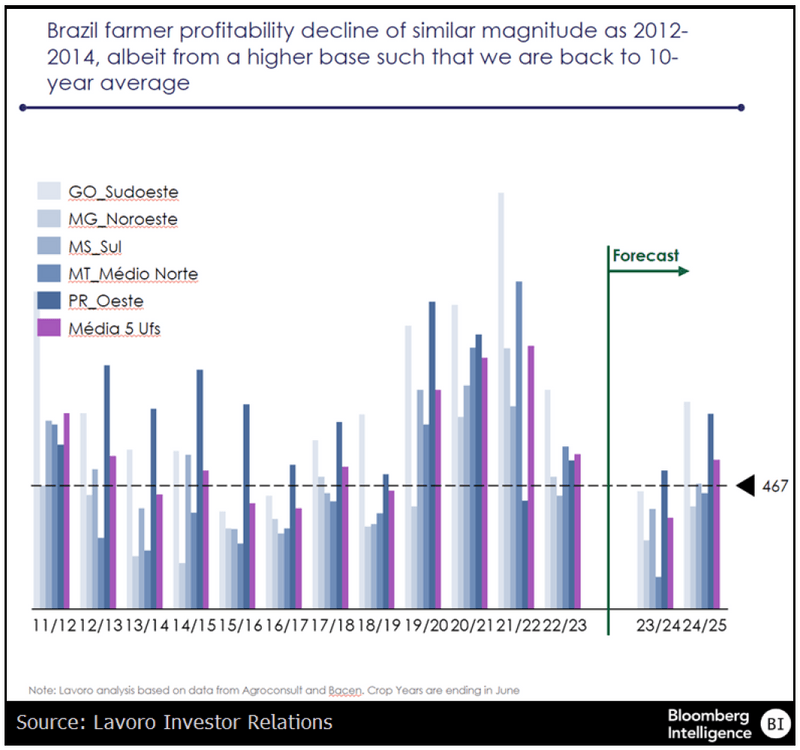

Bottom in Brazil farm incomes afoot

Despite lower crop prices, profit margins for Brazil’s farmers have been helped by easing input costs. Farm profits, which have fallen in all major regions, look likely to recover toward 10-year averages over the next year. This was a key takeaway from comments by Ruy Cunha, CEO of Lavoro, the largest retailer of farm inputs in Latin America, at our 2024 Farm, Food & Fuel conference. Crop-protection product prices have fallen 36-47% vs. last year, and fertilizer prices have also returned to pre-pandemic levels.

Falling prices created pressure on balance sheets in 2023 for some participants in Brazil, who had built up inventories following Russia’s invasion of Ukraine. With inventories returning to normal, we believe 2024 conditions support a resumption of steady growth in Brazil’s farm sector.

Brazil Farm Income Outlook