This analysis is by Bloomberg Intelligence Senior Industry Analysts Jennifer Bartashus and Jason F. Miner. It appeared first on the Bloomberg Terminal.

US pork and poultry providers (Hormel, Tyson, Pilgrim’s Pride) may see slight production gains in 2024, while beef (JBS, Tyson) might contend with reductions since cattle herds aren’t being built back up as fast, BI’s Farm, Food and Fuel Summit this month revealed. Alternative proteins (Beyond Meat, Oatly) remain a small yet crucial element for feeding the global population, too.

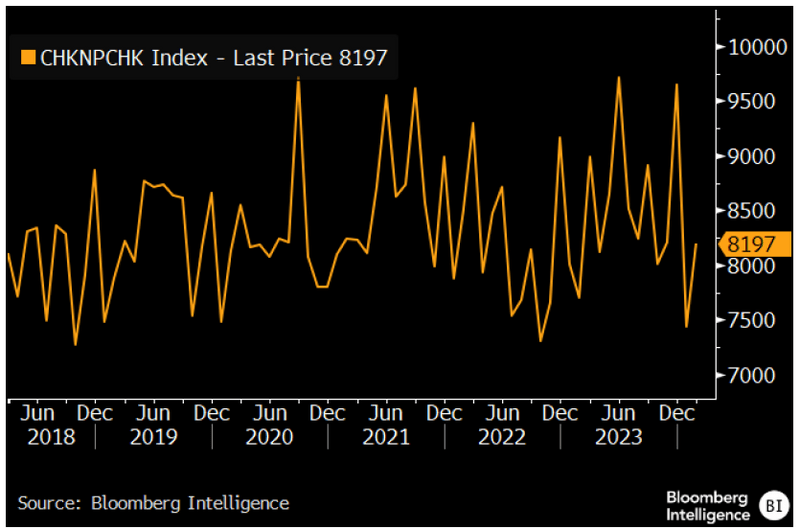

Poultry hatch rates, plant closings in focus

Poultry production is poised to remain fairly stable through 2024, though margin improvement is key for producers and processors like Tyson, Pilgrim’s Pride and JBS. Soybean- and corn-price declines are lowering feed costs, which can aid margin expansion. Yet to maintain bird size and quality consistency, the composition of feed can’t change much. Doing so could have a negative impact on animal health and growth. Though better, hatch rates are below historical levels, affecting production costs and overall supply. Warmer temperatures should reduce the instance of the highly pathogenic avian flu, but the table-egg market has lost more than 3.8 million laying hens and pullets since April 1.

Processing-plant consolidation continues, though automation investment could help propel greater productivity in existing assets.

Pullet Chicks for Hatchery Supply

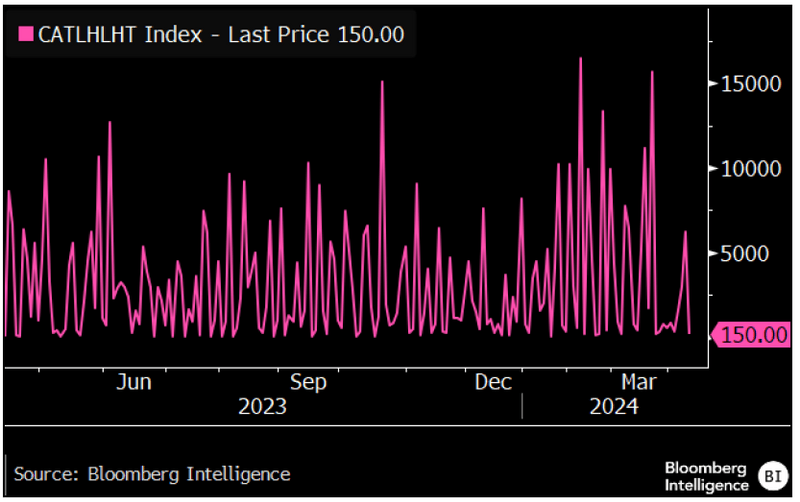

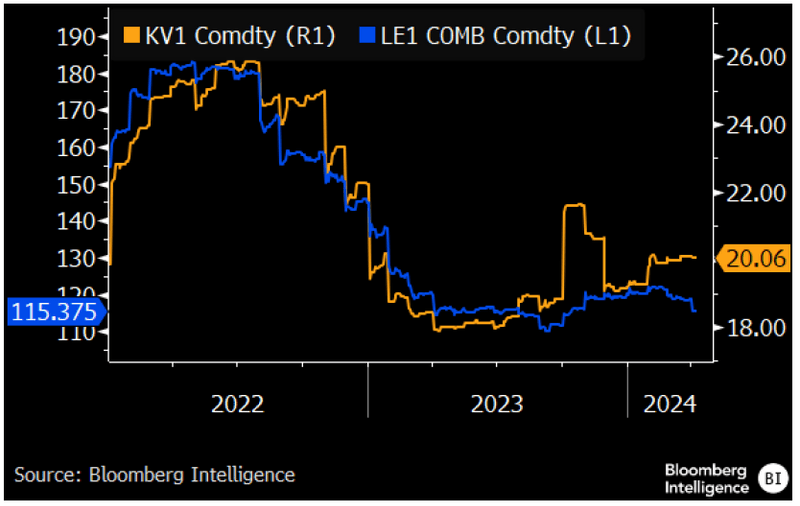

Pork, beef still recovering from herd lows

Beef supply is likely to stay constrained through 2024-25, as we’ve yet to see a significant uptick in heifer retention, among the best leading indicators of supply. Other factors — weather, hay supply and interest rates — aren’t spurring investment for building herds. This implies retail prices could remain high, affecting consumer demand and JBS and Tyson.

Commercial pork production may be modestly higher. The industry is grappling with the ramifications of California’s Proposition 12 (producers must give sows at least 24 square feet of space per animal) and other similar state-led initiatives. This could affect demand and might limit commodity price appreciation, dampening the profit outlook for producers and processors like Hormel. Lower feed and transportation costs may help unlock some margin expansion.

USDA Live Cattle Slaughtered Heifer

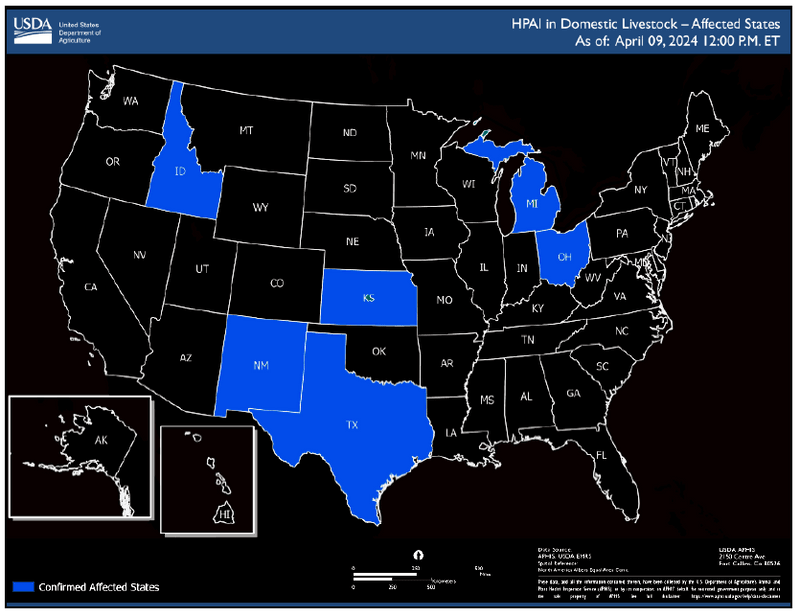

Dairy cows better able to withstand disease

Bird flu — or highly pathogenic avian influenza (HPAI) — has spread from wild fowl to dairy cows in at least six states. Unlike HPAI’s high mortality rate in poultry, the disease in dairy cattle typically results in symptoms that last 7-10 days, including a large drop in milk production (10-30 pounds per cow), appetite loss and low-grade fever. Milk from affected animals is being diverted or destroyed, so an aggressive spread of the disease could disrupt short-term supplies. This could ultimately boost retail prices as well as inputs for packaged-food companies that use milk as a key ingredient.

Risks to human health and the safety of commercial milk should be low since products are pasteurized before entering the market.

Confirmed Cases of HPAI in Domestic Livestock

Food producers, retailers could feel supply pinch

Packaged-food companies with milk exposure could see input costs rise if HPAI spreads widely through dairy cattle. Initially reported in Texas, cases have now been confirmed in New Mexico, Kansas, Idaho, Ohio and Michigan. The top five milk producers — California, Wisconsin, Idaho, Texas and New York — accounted for 50% of US annual milk supply in 2022, according to USDA ERS data. Milk futures haven’t moved much on the still-small outbreak.

Companies with higher exposure to milk costs include confectionery companies Hershey and Mondelez; those that produce soft dairy (sour cream, cream cheese and yogurt), like General Mills and Kraft Heinz; and companies that rely on milk as a consumer-added ingredient, such as cereals from WK Kellogg and Post.

Generic 1st Milk Class IV, Nonfat Dry Milk Futures

Alternative proteins down but not out

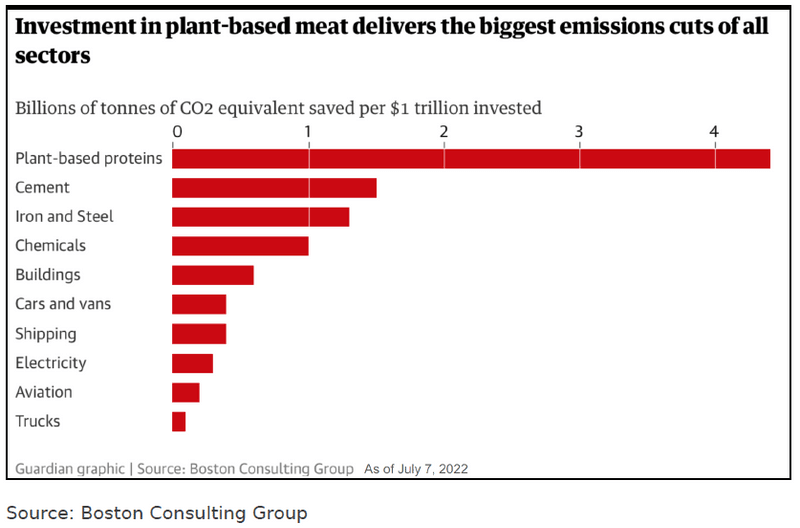

Retail sales of alternative protein products — particularly plant-based meats — have contracted the past two years, yet the long-term outlook remains positive. Diversification of protein types has been embraced by Cargill, JBS, Tyson and others. Alternative protein will supplement global meat production for years to come in multiple forms, from plant-based meats and dairy to fortified protein powder. Opportunities exist across the entire food-value chain to significantly reduce greenhouse gas emissions.

Less accessibility to capital infusions has likely been good for the sector. It’s weeded out poor products and forced founders to rethink strategies and develop robust business plans that include a clear path to profitability.

CO2 Saved Per $1 Trillion Invested