Nuclear fusion market could achieve a $40 trillion valuation

This analysis is by Bloomberg Intelligence Thematic Strategist Mike Dennis. It appeared first on the Bloomberg Terminal.

Achievement of net energy — where energy produced exceeds the energy used — via nuclear fusion is nearing and would be momentous for the $15 trillion global energy market and GDP. Extrapolation of game-changer tech multiples like Tesla implies a potential $40 trillion in valuation. Chevron and ENI are among those chasing this clean energy breakthrough, with several expecting success within five years.

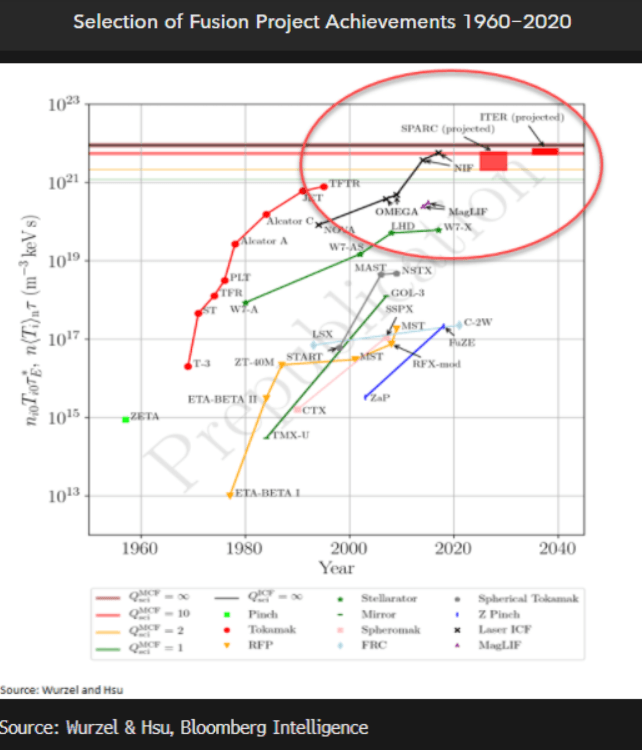

Fusion proven, now a complex engineering problem

A $1.8 billion investment in startup Commonwealth Fusion Systems, backed by Italian oil major ENI and tied to MIT, shows the heightened interest in fusion, and private investment should speed progress. At least $4 billion has been invested in 35 projects focused on solving the engineering challenge of maintaining the fusion reaction. Fusion reactors are expected to achieve net energy within five years, according to Bob Mumgaard, Commonwealth’s CEO. Several projects are close to that energy break-even. In 2021 the U.S. government-funded National Ignition Facility reported a Q (energy output) of 0.7, excluding the cost of running facilities and cooling.

Fusion projects approach the problem of trying to avoid loss of energy — and with it, plasma — from fusion via various technologies such as lasers, magnets and compression.

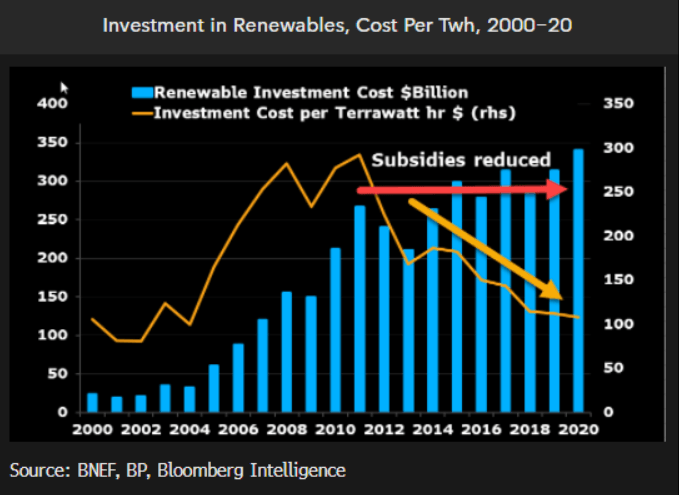

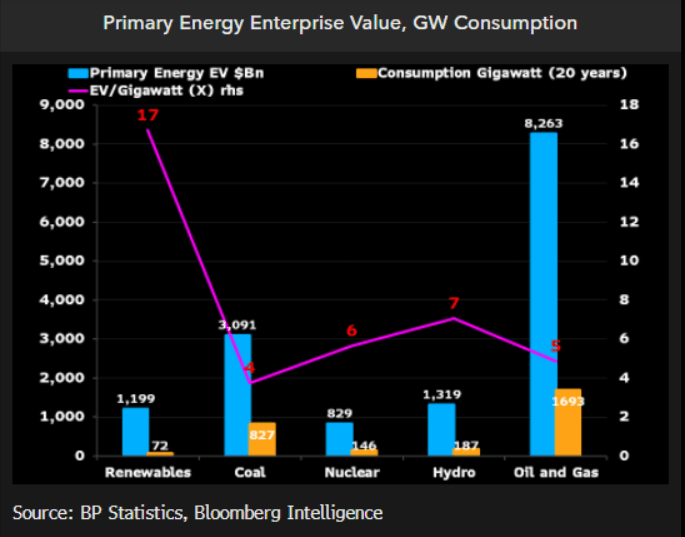

$1 trillion in nuclear fusion vs. expensive renewables

The enterprise value of global energy is about $15 trillion, we calculate, and viable fusion could not only reverse the deceleration in world energy productivity gains since 1970s (as extracting energy got more expensive), but also claim a superior valuation for the efficiency leap. If $1 trillion of the $9.5 trillion in renewables investment planned over the next 20 years, based on IEA data, was invested in fusion projects, they might achieve their goals to deliver electricity to the grid by 2030. The cost of an ARC fusion reactor is a fraction of that of renewables, ENI estimates.

Since 2000, $5.1 trillion has been spent on renewables and related infrastructure, yet its share of production grew to just 5.7% as of 2020, based on BP data. Cuts in government subsidies in 2011 curbed investment to about $275 billion a year.

Renewables can’t solve falling productivity

If global renewable electricity prices follow a similar trend to Europe — a rise of 4% with every 1% increase in renewable energy mix — scaling neither wind nor solar is going to boost productivity or stop global real GDP growth from slowing, as it has been since the 1970s with oil and gas becoming less productive. Add the current high oil and gas prices and energy becomes more prohibitive to growth, which combined with reduced funding for fossil fuels, leaving stranded energy assets, places a huge demand on undervalued nuclear or an opportunity for fusion investment.

The implied enterprise value multiple to gigawatt usage over 20 years gives oil, gas and coal single-digit multiples vs. renewables’ huge 17x multiple, one that cheaper fusion could exceed, given it would undoubtedly replace all primary energy.

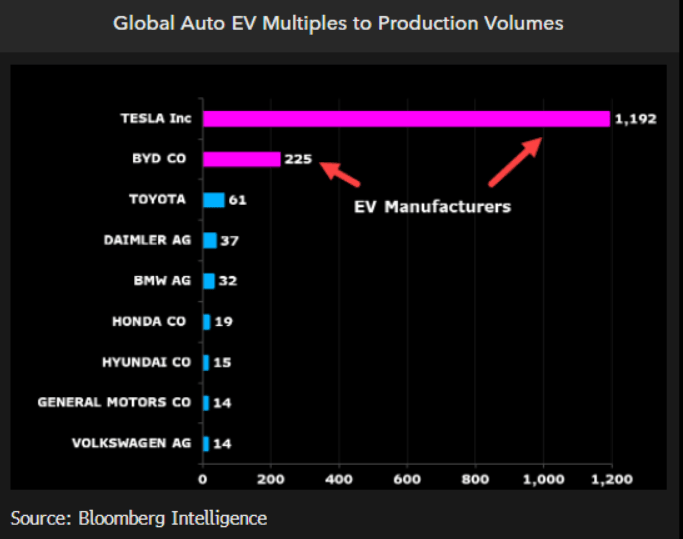

Nuclear fusion could outdo Tesla’s stretched multiple

Energy is at the center of all economic activity. The efficiency afforded by fusion — low input cost and the promise of endless energy produced — suggests that viable commercial nuclear fusion is a development off the Richter scale of modern advancements. Tesla might offer the closest modern market valuation for such a leap in technology, though the ramifications of fusion far exceed that of electric vehicles. Applying Tesla’s valuation — 2021 EV multiple of 1,192x annual unit production (1% global share) — and assuming fusion supplants 1% of the global energy gigawatt output would imply a $40 trillion valuation on fusion. This could completely change the valuation of the energy market, despite limited actual initial fusion power contributing to the global grid.