Behind the buzz of Paris Aligned Benchmarks

This article was written by Nadia Humphreys, Business Manager, Sustainable Finance Solutions at Bloomberg, Co-rapporteur on the Platform for Sustainable Finance of the European Commission.

Paris Aligned Benchmarks (PAB) were first introduced in 2019 as tools to accompany the transition to a low carbon economy by the Technical Expert Group of the European Commission. They are a group of indices aiming to reallocate capital towards a low carbon and climate resilient global economy.

The benefit of these benchmarks is that they provide investors with an appropriate tool to measure the decarbonizing efforts of their investment strategy. For example, if a fund claims to reduce carbon to limit the rise in global temperatures to well below 2°C, then an asset owner would expect to see that fund benchmark itself to an appropriate decarbonizing index as a meaningful point of comparison.

In essence, PABs help to increase transparency on investors’ alignment with meeting the ambitious climate scenarios and the rate of decarbonization needed to stay in line with the Paris Agreement.

What does it mean to be a PAB?

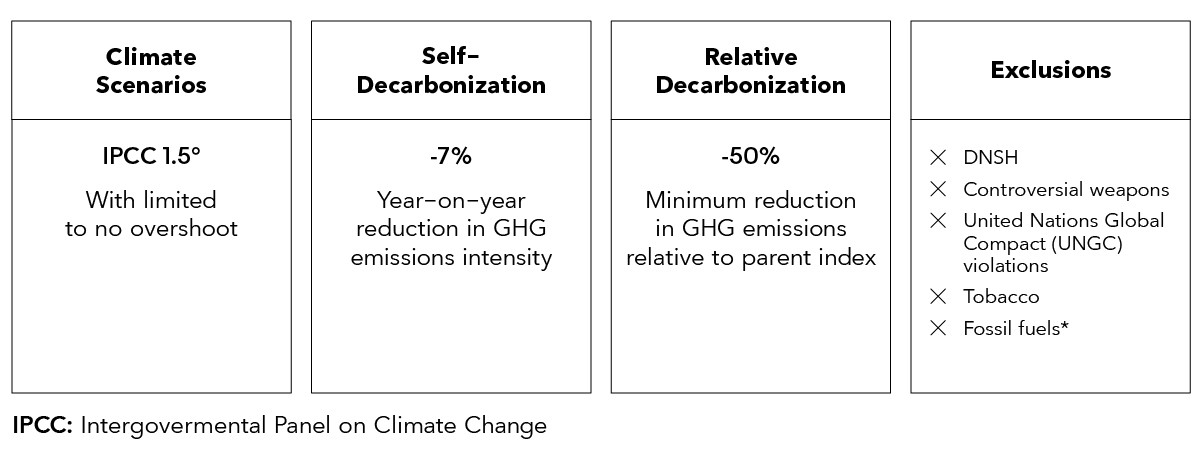

PABs require a 50% reduction in Greenhouse Gas (GHG) emissions compared to a fund’s parent index in year one and then a 7% year-on-year reduction of GHG emissions relative to the fund itself. There are also a number of exclusions, such as adhering to the EU Taxonomy’s “Do No Significant Harm” (DNSH) requirements. The following chart depicts the TEG’s minimum standard recommendations for EU Paris Aligned Benchmarks.

* Fossil Fuel Exposure – exclusions criteria:

1) companies that derive 1 % or more of their revenues from exploration, mining, extraction, distribution or refining of hard coal and lignite;

2) companies that derive 10 % or more of their revenues from the exploration, extraction, distribution or refining of oil fuels;

3) companies that derive 50 % or more of their revenues from the exploration, extraction, manufacturing or distribution of gaseous fuels;

4) companies that derive 50 % or more of their revenues from electricity generation with a GHG intensity of more than 100 g CO2 e/kWh.

What are the key features of a strong PAB?

1) Treatment of carbon data for non-reporting companies

Currently, many companies do not fully disclose their Scope 1, 2 or 3 carbon emissions data. In order to address this gap and account for an index’s carbon targets, benchmark providers will often turn to carbon estimates. However, when creating these carbon estimates, methodologies often use the mean or median point within a group of comparative companies as the basis to estimate non-reporting companies’ emissions.

According to Andreas Hoepner, a member of the Technical Expert Group who designed these Paris Aligned benchmarks, “Carbon emissions estimates can be biased by the better firms reporting their emissions and the worse firms staying silent.”

What this means is that the carbon estimate can look better than the actual carbon profile of a company with high carbon emissions. It can therefore be in the company’s interest to allow the estimate to prevail, which in turn discourages reporting of their actual carbon emissions.

Per the handbook that Andreas Hoepner helped author, he “recommends conducting corporate GHG data estimations based on the United Nation’s (1992) precautionary principle: If in doubt, err on the side of the planet not the side of the company. Applying the precautionary principle ensures that corporate GHG data is not underestimated and hence companies have incentives to commence or enhance reporting their GHG emissions.”

Carbon estimation should build a range of likely carbon profiles for a company based on production inputs, methods and output, as well as company size and location. Estimate models should then provide different percentiles in the probability distribution for each estimate for companies with similar practices. To apply the precautionary principle to a product like a PAB, carbon emissions should be over-estimated, ideally looking at over the 75th centile up to the 99th centile. This will help prevent bias and encourage companies to disclose their actual carbon emissions.

2) Do No Significant Harm (DNSH)

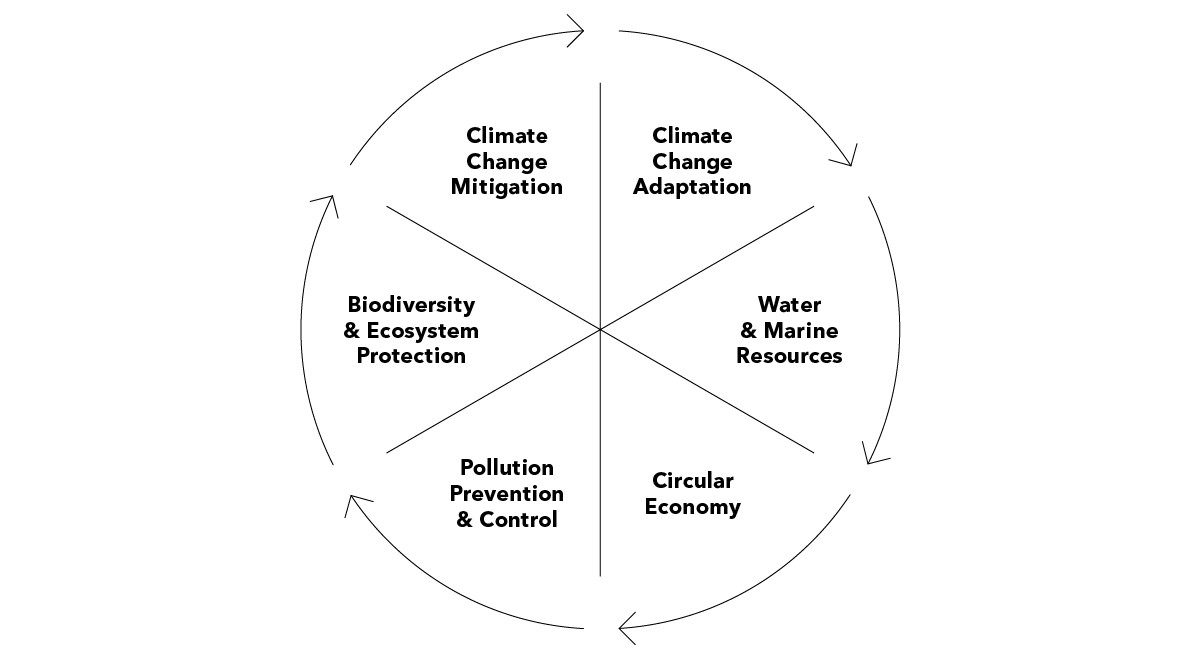

Another key feature of a strong PAB is accounting for the EU Taxonomy’s DNSH requirement. The EU Taxonomy has very strict requirements and stipulates that a company, which operates in an Taxonomy-eligible sector, must disclose that they do no significant harm to any of six environmental objectives: Climate Change Adaption, Water & Marine Resources, Circular Economy, Pollution Prevention & Control, Biodiversity & Ecosystem Protection and Climate Change Mitigation.

There are clear, sector-specific tests that need to be complied with to demonstrate DNSH. It’s important to note that this is not the same thing as a controversy data set, which indicates if an organization is subject to environmental fines or sanctions. The ask for DNSH is more detailed than this.

As mentioned earlier regarding carbon emissions data, a limitation for applying the DNSH test to a PAB is again the lack of corporate disclosure. In this case, if a company does not show evidence for passing the DNSH test, this should indicate harm under the precautionary principle. However, rather than take this blanket exclusion approach, a more practical solution is to show a tilt on how compliant a company is with the EU Taxonomy’s detailed regulatory requirements. This, in turn, would encourage better disclosure.

3) Limited tracking error

Ultimately an investor is still looking for financial returns, and so tracking the same sector diversification and financial performance with as little error as possible is important. PABs can certainly have many further ESG or climate-based use cases, but often simpler is better. A fund that tracks well to the parent index but still delivers Paris Aligned carbon performance is the nirvana.

To learn more about Bloomberg’s Sustainable Finance Solutions, please click here.