ESG disclosures gain traction in APAC

This article was written by Kimihiko Takamatsu, ESG Data Specialist at Bloomberg.

Environmental, social and governance criteria is growing in popularity among investors worldwide, and in the Asia-Pacific region specifically, over the past decade.

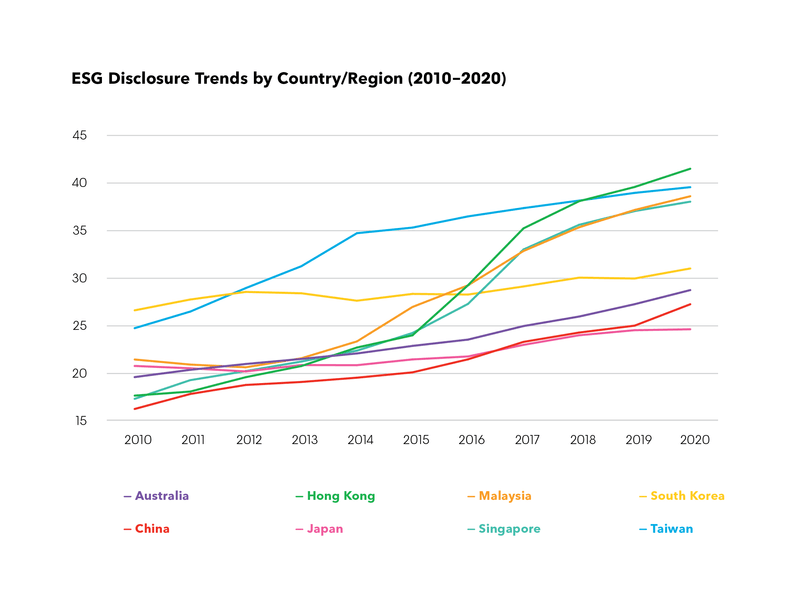

Disclosure of ESG data has increased in all countries and regions in APAC over the past 10 years. Hong Kong has seen the most growth from the average ESG Disclosure Score of 17 in 2010 to over 40 in 2020, leading other markets in the APAC region.

The APAC region has seen drastic regulatory changes over the past decade, and now most markets have some form of a governance-related code on a comply or explain basis. Some countries, such as China, are making it mandatory.

Momentum from APAC is part of the reason Bloomberg Intelligence estimates that global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management.

ESG investing varies widely by theme and country

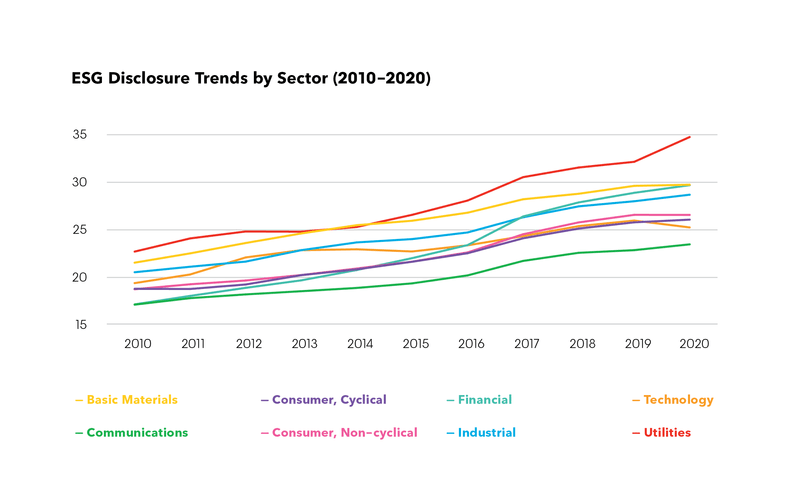

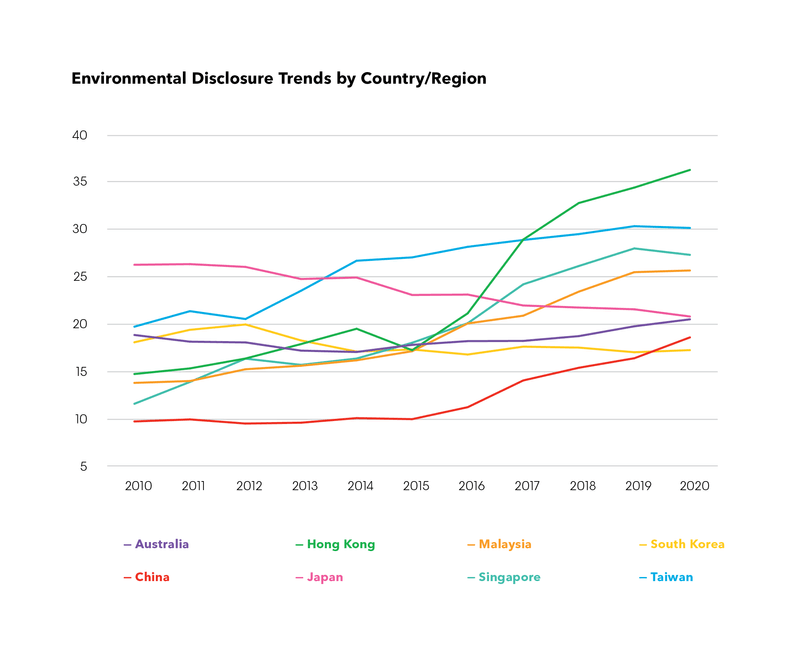

While there is little variance between countries by the sector breakdown, if we break down into the respective E, S, and G themes, notable trends can be observed. For example, disclosure of environmental data has noticeably increased in Hong Kong since 2016, after a policy change upgraded the mandates of the ESG Reporting Guide from voluntary to “Comply or Explain” basis.

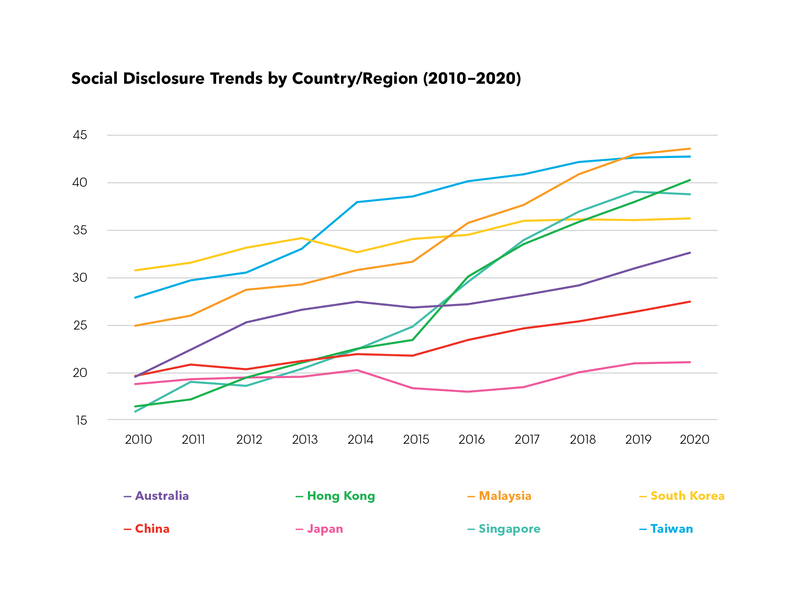

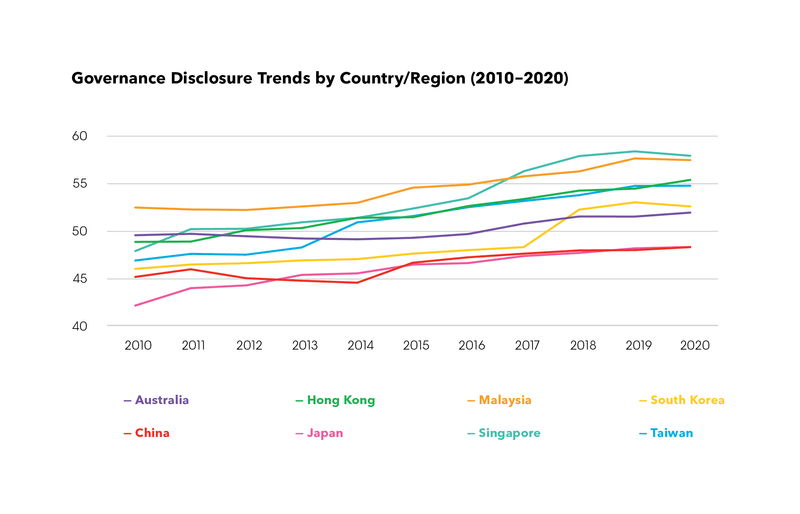

Unlike governance data, which is a mandatory disclosure item in most countries, a company’s commitment to reporting environmental and social data seems to be impacted by the regulatory landscape where the company is located. For example, social data in particular has a wide divergence in the level of disclosure between countries, with Japan lagging behind other APAC countries. This can be tied to the low appetite among Japanese companies to disclose safety-related data, which may affect the company’s reputation negatively.

Type “ESG” in the command line and choose BI ESG – Bloomberg Intelligence: Environmental, Social and Governance Analysis from autocomplete. Click on ESG Scores in the Data Library section of the sidebar. The shortcut is BI BESGG ESSCORE.

ESG guidelines are evolving in Asia

While most APAC countries have implemented governance-related reporting guidelines, some countries have introduced more thematic guidelines focusing on specific topics of ESG.

Most notably, Hong Kong and China introduced reporting guidelines concerning green finance and green bonds in 2018 as the issuance of sustainable bonds have soared in Chinese markets in recent years. China has taken over Japan and Korea as the largest ESG bond issuer in Asia this year, driven by a green issuance surge of 230.3% year-on-year to $60.5 billion. In May 2021, People’s Bank of China released guidelines for green lending, incentivizing borrowers towards financing environmental projects.

Meanwhile, Japan, Hong Kong, and Taiwan have incorporated the Task Force on Climate-Related Financial Disclosures in their recommended disclosure items.

ESG investing has proven itself durable amid the pandemic volatility, particularly in China. As the demand for green investments grows in APAC and elsewhere, investors and governments will look for more sophisticated and transparent ESG criteria and metrics. The past decade of disclosures may herald more ESG data and transparency to come.

For more information on ESG data, governance, or other functionality on the Bloomberg Professional Service, request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.