Higher asset sensitivity at regional banks

This analysis is by Bloomberg Intelligence Senior Industry Analyst Herman Chan. It appeared first on the Bloomberg Terminal.

Regional banks’ ample liquidity means they may not have to wait for a short-term-rate move to capitalize on the interest-rate backdrop through 2023, with our analysis of 2Q run-rate data showing Signature, Comerica and M&T’s pretax pre-provision revenue could rise 5-7% on a quarterly basis. With four rate hikes expected through 2023, the group is well positioned.

Curve steepening spurs banks to buy securities

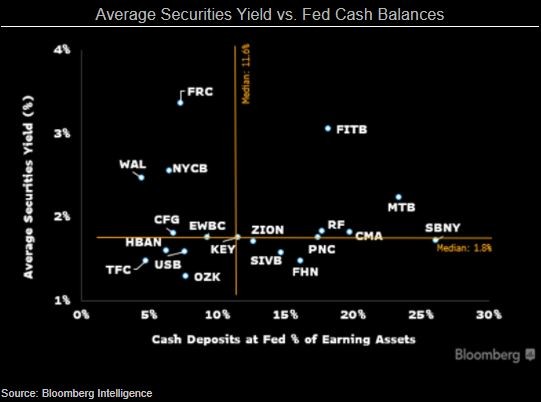

With the yield curve steepening, regional banks could add securities and pick up some interest income. Normally, banks find rising short-term rates to be more beneficial than yield-curve steepening, but in this operating environment with plenty of excess liquidity, higher long-term rates could also prove helpful. Regionals hold a median 12% of earning assets in cash vs. 2% pre-pandemic. Signature, M&T and Comerica have more dry powder. Assuming a quarter of cash is deployed at a 2% investment yield, predicated on additional steepening, these three banks could respectively improve pretax pre-provision income by 7%, 5% and 5% vs. a median 2% for the group.

Investment at current rates could already boost securities yields for some. Truist, First Horizon and OZK all posted yields below 1.5% in 2Q.

Well positioned for upside once rates rise

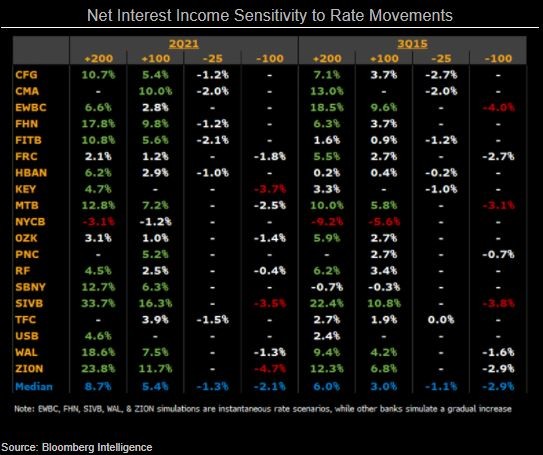

Regional banks are better positioned to capitalize on higher short-term interest rates than they were in the prior rising-rate environment that started in late 2015. Balance-sheet dynamics are different now, as banks are flush with deposits and much more cash on their ledgers. With low loan-to-deposit ratios, banks may be able to suppress deposit betas, or pricing reactivity to a rising fed funds rate. Banks such as Fifth Third and M&T have more earning assets tied to cash, the redeployment of which garners greater upside in a period of higher rates.

As of 2Q, regionals expect a median 5.4% pickup in net interest income following a 100-bp increase in rates, vs. 3% at 3Q15, with SVB and First Horizon exhibiting higher degrees of rate sensitivity. Signature has flipped its rate posture due to growth in floating-rate loans.

Market, fed signaling initial rate hike in 2022

Banks may not have to wait much longer for short-term rates to rise. The markets are pricing in a Federal Reserve rate hike by 2022, echoing the FOMC’s most recent dot plot signaling, and are assuming somewhat higher rate expectations than prior to the release of the Fed’s rate projections. The current implied policy rate anticipates about three hikes by 2023.

Regional banks with more floating-rate loans would benefit the most in an eventual scenario were rates are climbing. We highlight SVB and Comerica as most sensitive to short-term rates. However, the broad industry is positioned to benefit due to the abundance of cash, while low deposit costs may endure amid ample available funding and the Fed’s continued quantitative easing.