This analysis is by Bloomberg Intelligence Senior Analyst Matthew Kanterman and Bloomberg Intelligence Associate Analyst Tiffany Tam. It appeared first on the Bloomberg Terminal.

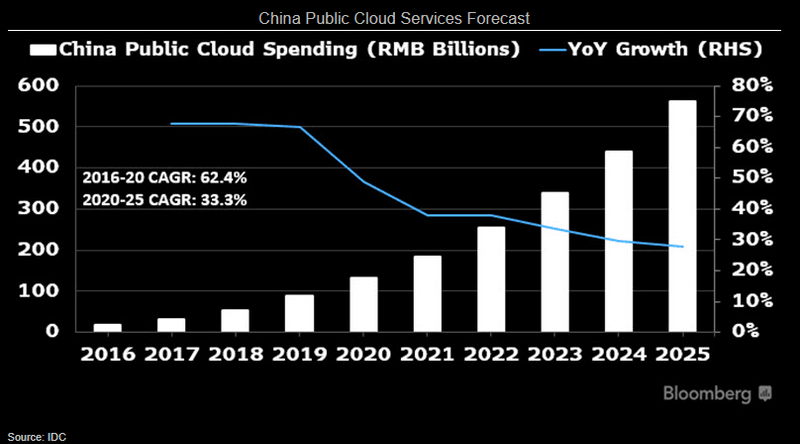

China’s public cloud services market may expand rapidly over the next several years, fueled by accelerating adoption of digital technologies post-pandemic. The public cloud market in China is forecast to expand at a 33.3% average annual growth rate from 2020-25, reaching 562 billion yuan ($87 billion) by 2025, according to IDC. Infrastructure-as-a-service offerings may continue to drive the market, fueling sales gains of 4x or more for Alibaba, Tencent and Huawei through 2025, while rising platform-as-a-service sales may pad their profits. Local software vendors such as Yonyou and Kingdee may outpace gains of foreign software-as-a-service providers.

Infrastructure driving China cloud to $87 billion post-pandemic

Public cloud infrastructure services may lead the expansion of China’s public cloud market to 562 billion yuan ($87 billion) by 2025, 4x the size of the sector in 2020, according to IDC forecasts, paving a massive growth opportunity for leaders Alibaba, Tencent, China Telecom and Huawei. China lags the U.S. in overall cloud adoption but a focus on cloud software development could help narrow the gap.

China cloud on $87 billion trajectory

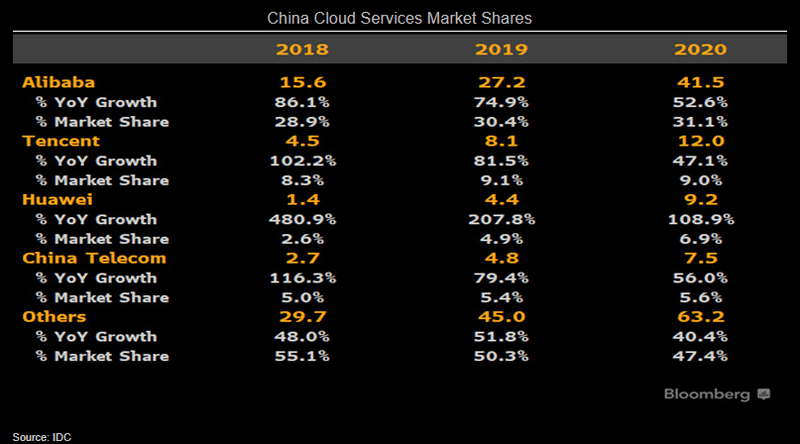

The increasing adoption of digital technologies in China post-pandemic will help fuel the country’s public cloud-services market over the next few years. The market for public cloud services in China is forecast to expand at a 33.3% average annual growth rate from 2020-25, reaching 562 billion yuan ($87 billion) by 2025, according to IDC. Market leaders Alibaba, Tencent, Huawei and China Telecom may benefit the most from the markets’ expansion, building off of their combined 52.6% 2020 market share.

For most enterprises, public cloud provides a lower total cost of ownership of their IT assets, greater scalability, more agility and little to no maintenance. In cloud infrastructure, enterprises can focus on building higher-value applications and leave the lower-end infrastructure work to cloud providers.

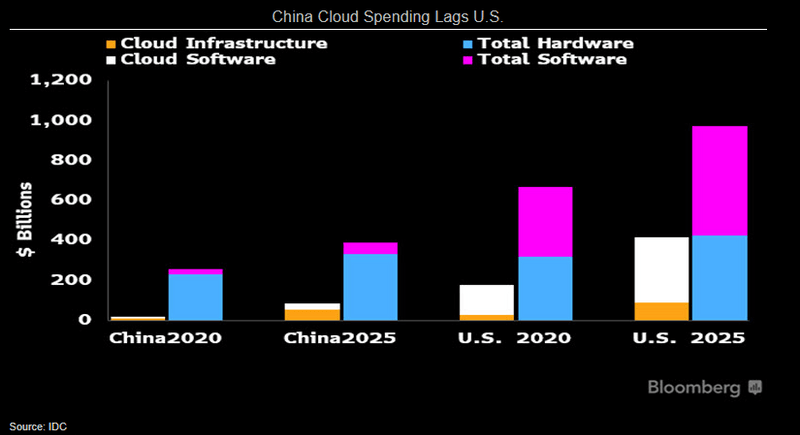

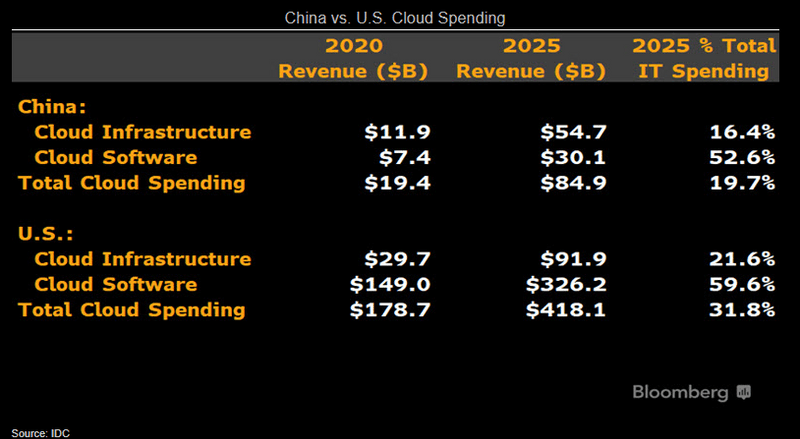

Cloud spending lags U.S. at 7% of total

The share of cloud spending as a percent of total expenditure on information technology in China lags the U.S. by a significant amount, despite the two being the largest countries by IT spending, reflecting a far less developed software industry in China and a later boom in cloud infrastructure services. Spending on public cloud services in China may rise to 19.7% of total IT expenditures in 2025 vs. just 6.8% in 2020, according to IDC. In the U.S., the ratio may climb to 31.8% in 2025 after hitting 18.4% in 2025.

Growth in China cloud services has historically been driven by new workloads for Internet and other industries, but increasingly the migration of legacy workloads to the cloud by government and other enterprise customers may aid growth and also begin to cannibalize hardware spending.

IaaS dominates China cloud, unlike U.S.

China’s far-less developed enterprise software sector means that public cloud infrastructure services are likely to lead the expansion of the domestic cloud industry for the next several years, in stark contrast to the U.S. where software dominates. Infrastructure services are forecast to rise to 64.5% of total China public cloud spending in 2025 vs. 61.6% in 2020, while in the U.S., infrastructure is forecast to account for just 22% of cloud spend in 2025 vs. 16.6% in 2020, according to IDC.

Cloud software champions in the U.S. such as Salesforce were early adopters of the multitenant cloud software model, enabling them to become massive players over the last two decades. China lacks clear leadership in this market, which may present an opportunity for IaaS leaders like Alibaba and Tencent to lead SaaS development.

Alibaba maintains China cloud dominance

Alibaba may maintain its leading position in China’s public cloud market while rivals including Tencent, Huawei and China Telecom seek to catch up. Alibaba’s total cloud revenue market share in China increased to 31.1% in 2020 vs. 28.9% in 2018, with sales rising to 41.5 billion yuan, according to IDC. Rivals including Tencent, Huawei and China Telecom have grown faster the last few years off a smaller base but we expect the leaders to continue to consolidate their market share at the top, especially infrastructure services, which leads the market’s growth and that segment lends itself to high economies of scale.

Foreign cloud vendors such as Amazon, Microsoft, Oracle and Salesforce may keep winning business for multinational corporations who do business in China but may lose share of domestic customer spending over time.