Weekly freight rates provide insight into container segment

This analysis is by Bloomberg Intelligence Senior Analyst Lee A Klaskow and Bloomberg Intelligence Associate Analyst Adam Roszkowski. It appeared first on the Bloomberg Terminal.

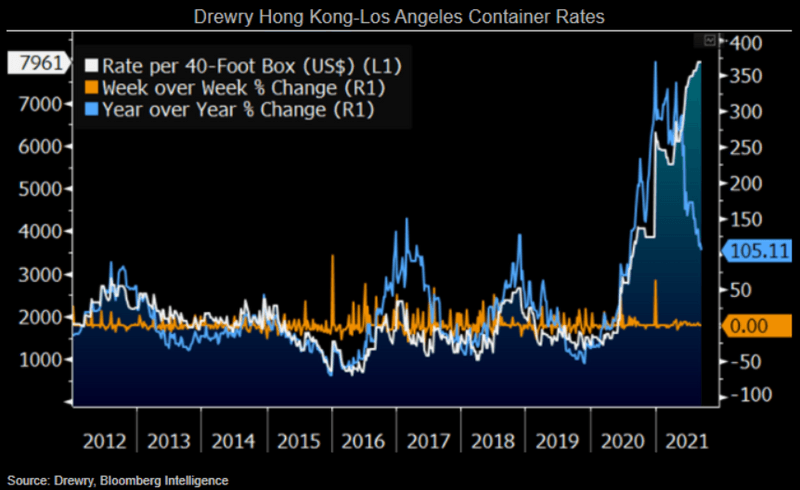

The Drewry Hong Kong-Los Angeles 40-foot container rate benchmark is published on Wednesdays and WCI freight rates on Thursdays, providing insight into spot rates. The China Export Containerized Index and New ConTex Index offer liner-rate visibility. Container Trades Statistics delivers monthly data on volume and the container price index.

Peak prep, supply chain snags set to keep liner rates propped up

The Drewry Hong Kong-Los Angeles container-rate benchmark held firm at a record-high $7,961 per 40-foot container for the third straight week through Sept. 15. Unprecedented conditions stem from pandemic-fueled supply-chain dislocations, capacity constraints and port congestion. Moderate deceleration in U.S. import growth over the past several weeks appears more a product of the loss of effective capacity vs. demand weakness. Peak season preparation, restocking and any further supply chain snags akin to recent virus-related terminal closings or storms will likely keep rates well above historic averages.

Spot-rate volatility influences profitability for liner operators including Mitsui OSK, Maersk, Zim and Orient Overseas, and for railroads. Truckers, freight forwarders and intermodal marketers are also affected.

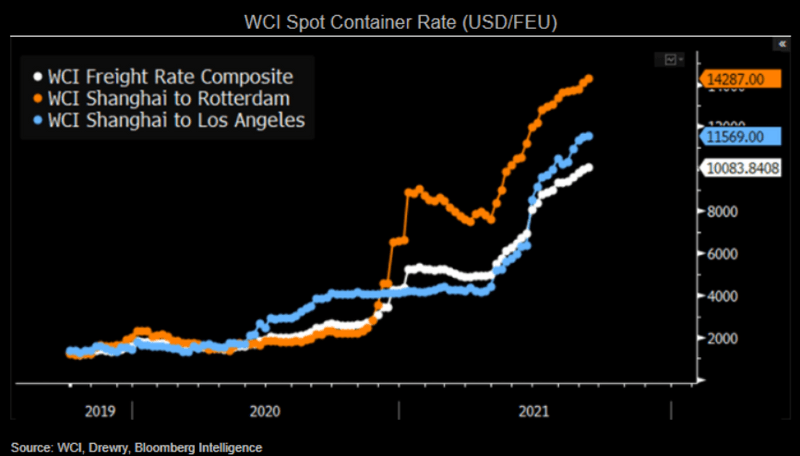

Liner rates sail further past $10,000 as peak demand kicks in

Spot rates for 40-foot containers rose 2.9% sequentially in the week ended Sept. 16, based on World Container Index data. This marks another record and the 22nd weekly increase as the index reached a staggering $10,375. Rates are up 281% this year, driven by exports from China to Europe and North America. The unprecedented backdrop is being fueled by the combination of restocking demand, port congestion and capacity constraints. Rates should find support near term from supply-chain disruptions and peak-season demand.

Maersk’s third annual guidance upgrade on Sept. 16 supports our view that consensus earnings expectations aren’t factoring in the strength and duration of the rate environment, which we believe could support historically high levels through 1H22. The WCI is based on data assessed by Drewry.

Upcoming peak may spur liner volume growth, capacity still tight

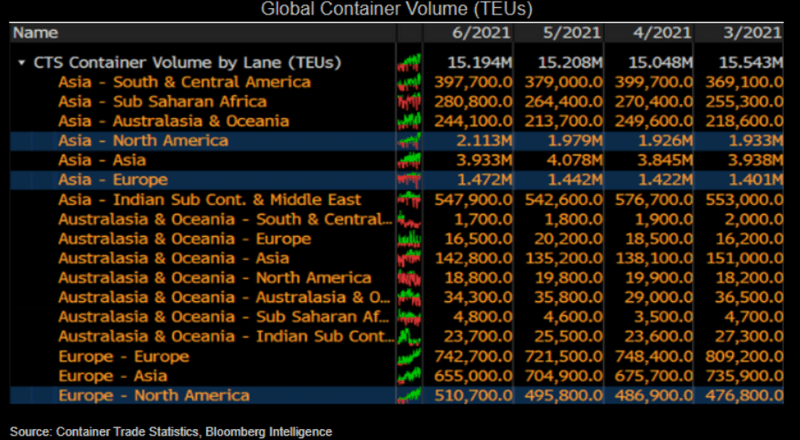

Restocking and better macroeconomic conditions elevated global container volumes 11% in June, with key Trans-Pacific lanes gaining 7% vs. May, hitting their highest level in eight years. Volumes could firm up amid a strong 2H peak season outlook, with retailers and importers looking to secure space early amid ongoing box shortages. Backlogs led by Yantian’s port closure fueled a 56% rise in global rates, with Asia-Europe prices surging 264% and Trans-Pacific up 133%. We believe port congestion and supply chain bottlenecks may linger in the near term as new Covid-19 flare-ups and weather-related woes in Asia may hinder ports operations.

Contracts fixed at high rates and for longer periods are tailwinds to liners’ earnings. Maersk, Cosco, Orient Overseas, Mitsui OSK, CMA CGM, Hapag and NYK are among the largest operators.