This article was written by Eduardo Pereira, Global SIMM Product Manager and Harry Lipman, Global Derivatives Product Manager at Bloomberg.

With the next phases of Uncleared Margin Rules (UMR) implementation in sight, firms in scope are actively entering planning mode and evaluating their options on the road to compliance. In this article, we explore some of the anticipated impacts and shed light on optimization strategies firms can apply. We also explore Bloomberg’s solution to help firms gain transparency on their requirements, including MARS SIMM, which provides pre-trade analytics. This blog is the first of a series of analysis on UMR and related risk topics, including XVA impact.

Uncleared Margin Rules (UMR) refresher

In March 2015, the Basel Committee on Banking Supervision (BCBS) and the International Organization of Securities Commissions (IOSCO) published the final policy framework that established the minimum standards for margin requirements for non-centrally cleared derivatives.

As firms come to grips with this new regulatory framework, the wide-ranging impacts on both buy side and sell side firms have come to light. As implementation proceeds, pre-trade analytics will play a critical role as firms choose their paths through the UMR framework.

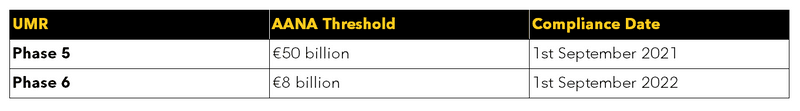

Phases 5 & 6 in sight

The implementation of the final two phases of the Uncleared Margin Rules is now imminent. And for many impacted firms, remaining below the EUR 50 million initial margin threshold will be critical. By exceeding that threshold, firms might indeed incur significant costs and cumbersome legal and custodial requirements, as highlighted by the Basel Committee and IOSCO in a March 2019 statement.

Table 1: UMR AANA (Average Annual Notional Amount) thresholds and corresponding phase-in dates

For a majority of firms in scope for phases 5 and 6, their calculated Initial Margin (IM) posting requirements for some, or all, of their counterparties will not have reached the prescribed 50MM USD threshold. Such institutions will consequently be looking to avoid going above, both by analyzing the impact of new trades across their existing netting sets and rebalancing their portfolios across counterparties when appropriate. If they were to in fact breach this threshold, they would then focus on how to calculate IM.

A work in progress

Phase 1 implementation dates back to September 2016, meaning IM requirements is no news to large institutions. However, with implementation hurdles now behind, many impacted firms have shifted their focus from simply calculating IM to determining how to best minimize their IM capital charges on a pre-trade basis.

Depending on their trading counterparts and the netting set they hold with each, the incremental IM charge firms face for a new trade can indeed vary significantly. In some cases, it could even result in a negative IM charge, freeing up even more capital. By doing so, such institutions are able to lower their capital constraints and focus this free capital on additional revenue-generating activities.

Optimization strategies using Bloomberg

To help clients, whether already in scope or with upcoming implementation in sight, understand the impact of trading new derivatives in their portfolio-level SIMM calculation, Bloomberg has developed a set of new pre-trade analytics as part of its Bloomberg’s Multi-Asset Risk System (MARS). This offering allows front-office users to run pre-trade initial margin calculations across multiple CSAs and to identify the counterparty with which the lowest incremental IM would be incurred.

Here, we explore a practical sell-side (“Local Bank”) use case where the impact of Incremental Initial Margin is analyzed using MARS SIMM. In the first case, the Local Bank is not in scope for the UMR rules, while in the second case, the trade is subject to UMR, as the Local Bank is above the AANA threshold.

- Local Bank provides a loan to a corporate institution where floating interest rate (IR) is floored.

- To hedge the IR risk of the loan, the corporate entity swaps IR payments into fixed payments via a IR Cap structure.

As per the current regulatory framework, the Local Bank is not in scope for the UMR rules.

- The Local Bank then seeks to hedge the cap structure with other potential Tier 1 dealers. To do so, it considers two dealers (Counterparty A) and (Counterparty B).

- The cap structure cannot be cleared, therefore it is subject to a bilateral agreement.

This trade is subject to UMR, as the Local Bank is above the AANA threshold. The Local Bank now faces the following dilemma: which dealer to choose for this incremental trade?

Figure 1: Example trade (A) – Long position on a EUR 100 million cap using SWPM on Bloomberg Terminal

Counterparty A: Directional portfolio. Receiver swaps + Long Cap position (-23,633.97 EUR delta).

Counterparty B: Portfolio where delta off-sets through payer/receiver swaps. Combination of Payer/Receiver swaps.

Counterparty C: Portfolio containing Quanto Cap derivatives as well as a position in a EUR Payer IRS.

In this hypothetical exercise, we will focus on Counterparties A and B.

Figure 2: MARS – Positions tab – Trade distribution per netting set

Using the position tab of MARS, above, the Local Bank can examine the impact of adding trade EUR 100 million interest rate cap on EUR003M Index [Deal ID: SLRS1M96] to its Tier 1 dealer community. We again focus on Counterparty A and B, as seen in the IM results tab generated below.

Figure 3: MARS SIMM – Initial margin results

Figure 4: Post analysis SIMM levels

Key observations

- As seen in Figures 3 and 4 using the MARS SIMM IM results tab, the following insights can be gained with regard to the impact of dealing with either counterparty:

A: decrease in Incremental Initial Margin on the order of USD 1,029,663.73

B: an increase of USD 482,183.39 - Post Analysis SIMM levels still show USD 10,051,578 and USD 7,496,160.88 for Bank A and B respectively, below the regulatory 50MM Initial Margin Threshold

- By simply choosing the optimal counterparty to trade with, we observe a differential of 1.5 million USD at stake, i.e., you can either take back 1 million from the IM Capital Charge, or you can pay an additional 500,000

- Rates risk predominant across two netting sets, providing the ability to identify the attribution of delta, curvature, and vega across six ISDA risk classes

This study comes to show that the incorporation of pre-trade analytics into the decision-making process is essential to allow for trade optimization, in turn freeing up capital to be deployed in revenue-generating activities. By simply analyzing the Initial Margin Incremental impact across netting sets, firms can indeed trade in ways that would generate the minimum incremental Initial Margin, helping them remain below their chosen threshold.

MARS SIMM offers trading desks and portfolio managers with a holistic solution to gain the transparency they need to make optimal decisions, all while meeting the strict IM requirements set out by UMR rules. To find out more, speak to a specialist today by contacting us below.