Global LNG outlook 2021-25 overview

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

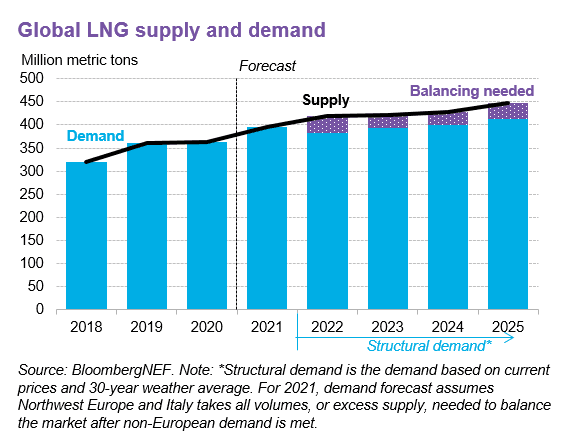

The global LNG market is likely to be oversupplied until 2025. Supply growth exceeds the increase in LNG demand, with a new wave of projects expected to be commissioned over the next five years. Europe will continue to be a key balancing market, but demand from Asia could respond to prices and other factors.

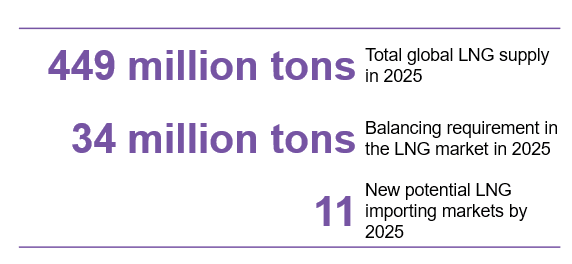

- Global LNG supply could reach 449 million tons by 2025, up 23% from 2020, driven by the U.S. and Russia. LNG project backfills or expansions are sustaining output in Australia, Middle East and Africa.

- The U.S. could see its liquefaction capacity rise by more than half, overtaking Australia by 2024. Qatar will regain its top position after its expansion project is complete. Mauritania/Senegal, Mozambique, Canada and Mexico, will be among the newest LNG exporters.

- Structural global LNG demand could rise 14% by 2025 from 2020, resulting in a 26 to 34 million tons a year call on balancing markets over 2022-25, of which Europe would be the biggest driver. China, South and Southeast Asia will be the key growth regions. Demand in traditional markets of Japan, Korea, Taiwan will largely be stagnant.

- Pakistan, Bangladesh and Thailand would be the top three growth markets in emerging Asia over the next five years. New gas plants and falling domestic supplies will increase the need to import LNG. Eleven new markets could see their first LNG imports by 2025.

- Pressure is mounting on the gas industry to lower emissions. Key gas markets and industry players are exploring carbon capture and storage, hydrogen and carbon offsets to reduce their emissions profile. With the energy transition accelerating, the outlook for LNG demand beyond 2030 is uncertain. As a result, the outlook for final investment decisions of new supply projects is equally unclear.