LIBOR’s delayed sunset shines light on opportunities

Bloomberg Market Specialists Mengyuan Liu and Nick Burrough contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

It appears the pivotal London Interbank Offered Rate benchmarks will fade away a little more slowly than first expected.

On Nov. 30, the ICE Benchmark Administration outlined proposals for phasing out LIBOR, including ending one-week and two-month dollar LIBOR fixings along with all tenors for other currencies at the end of 2021. Other dollar LIBOR terms would end June 30, 2023, later than initially flagged. Meanwhile, regulators want big banks to move away from the benchmark as soon as they can.

“Regulators’ potential plans to delay the U.S.-dollar LIBOR phase-out to mid-2023 show that they are accepting the reality that if you go too fast, the market won’t be ready. Due to the Covid-19 pandemic, a lot of work in the LIBOR phase-out has been delayed,” John Tan, global head of financial markets regions at Standard Chartered Bank, told Bloomberg News.

The issue

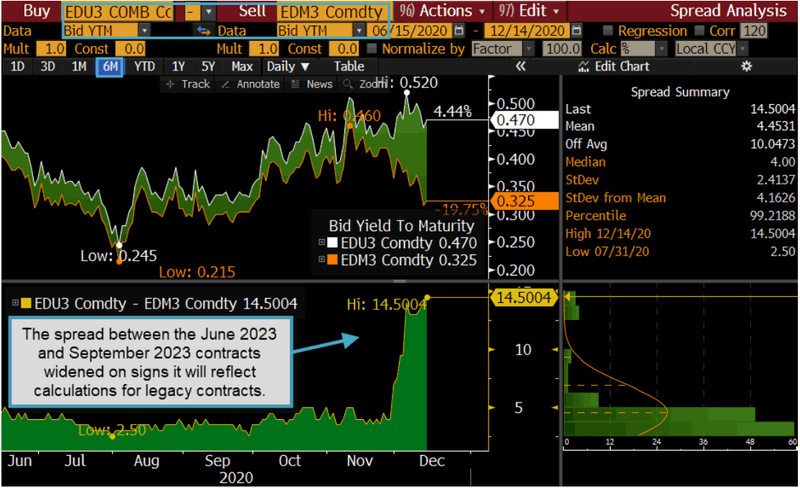

LIBOR’s eventual sunset will create trading opportunities for those who can closely monitor the transition to new benchmarks. For example, the spread between the June 2023 and September 2023 LIBOR three-month futures contracts widened from as low as 3.5 basis points to 14.5 basis points.

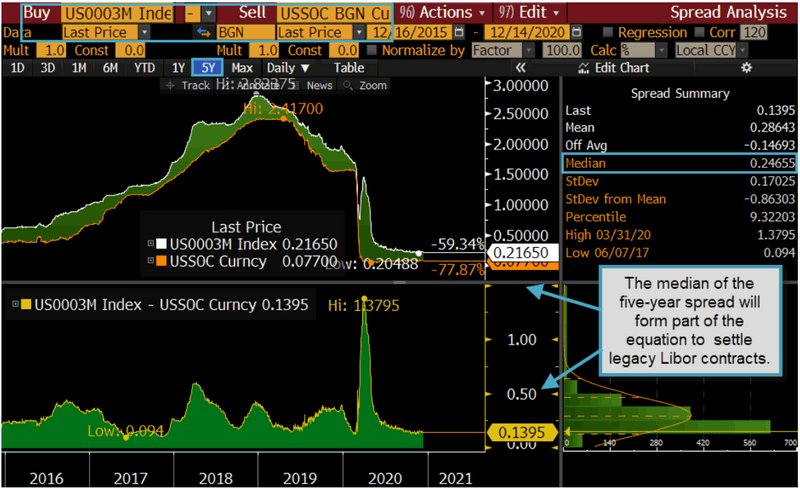

The reason for wider spreads is that when regulators finally decide dates for the transition, they will fix a spread for settling legacy contracts. Bloomberg Intelligence predicts pre-cessation announcements for LIBOR in the first quarter of 2021.

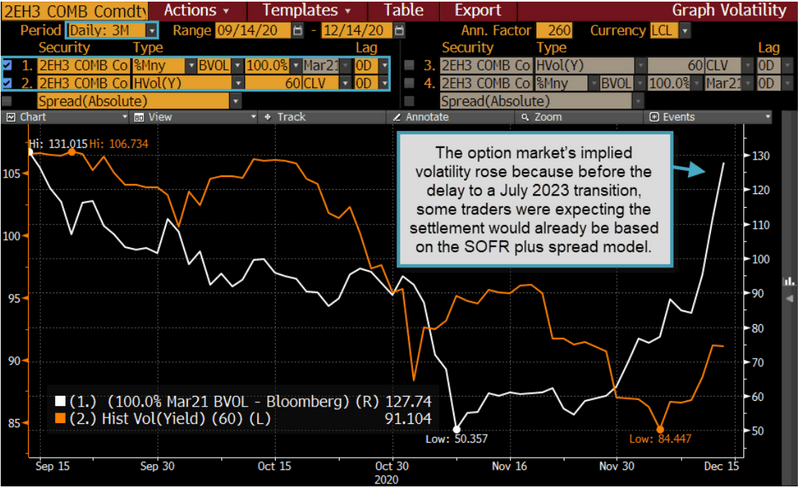

Unlike LIBOR, which reflects rates banks charge each other for loans, its leading successor – Secured Overnight Financing Rate (SOFR) – is derived from the lower overnight costs for repurchase agreements collateralized by Treasury securities. The method of calculating settlements for derivatives after those transition dates will involve SOFR, plus a fixed premium for LIBOR over SOFR. Before the announced delay, some traders were expecting the move to the more-predictable SOFR-plus-spread model to happen before the June 30, 2023 transition based on the options market’s implied volatility on contracts with underlying futures settling.

Use Bloomberg terminal’s functionality to track LIBOR and its replacements during the uncertain sunset to understand the range of different outcomes.

Tracking

Bloomberg’s Historical Spread tool can analyze the spread between LIBOR three-month futures contracts maturing before and after the new phase-out date.

Type “historical spread” in the command line and select HS – Spread Analysis. The shortcut is HS.

The Historical Spread tool can also track the five-year spot spread between LIBOR and the overnight indexed swap:

Type “3 month libor” in the Buy box and select US0003M Index, then type “usd swap ois” in the Sell box and select USSOC Curncy. Click the Data box for both and select Last Price and then Click 5Y in the periodicity bar.

The impact in the options market can be noted in the Historical Spread tool:

Type “eurodollar midcurve 2y mar23” and select 2EH3 Comdty, which is an option with the Eurodollar futures LIBOR rate for Mar 2023 as the underlying. Type “graph volatility” and select GV – Graph Volatility. The shortcut is “2EH3 Comdty GV.”

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.