This analysis is by Bloomberg Intelligence Senior Industry Analysts Sharnie Wong and Francis Chan. It appeared first on the Bloomberg Terminal.

Popularization of the digital yuan could be a tailwind for future globalization of China’s currency. China may launch digital yuan pilot zones with its trading partners, which could in turn help lift the yuan’s status as a global settlement currency. Meanwhile, further de-dollarization may also spur yuan usage.

Higher yuan share in the SDR basket may help

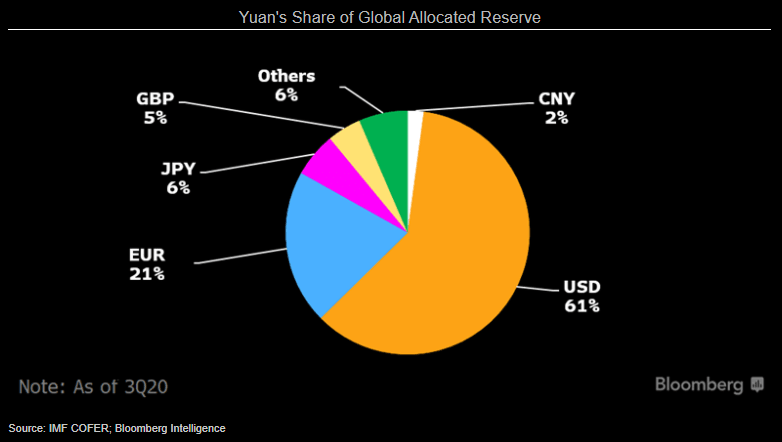

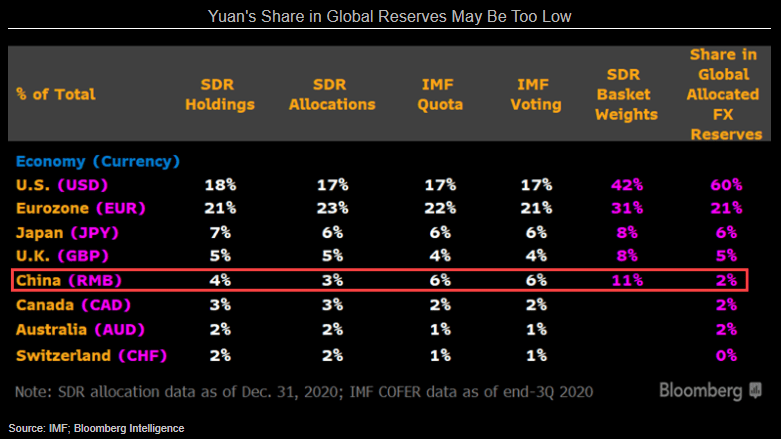

The yuan may be assigned a higher share of over 12% at the next five-year review of the five-currency SDR basket, scheduled to be determined by Sept. 30 by the IMF. This number is more comparable to China’s share of global total trade, and may lift demand for yuan reserves. The new basket weights would also reflect the relatively higher importance of the yuan in the world’s financial systems amid the higher share of yuan among global FX reserves and rising demand for China bonds. In fact, the yuan’s current share in global FX reserves at 2% may still be too low, compared with other major currencies, given the yuan’s SDR-basket share of 10.9% and China’s IMF quota at 6.4% (see exhibit).

SDR is a reserve asset that can be redeemed at any other central bank for one of the five basket currencies.

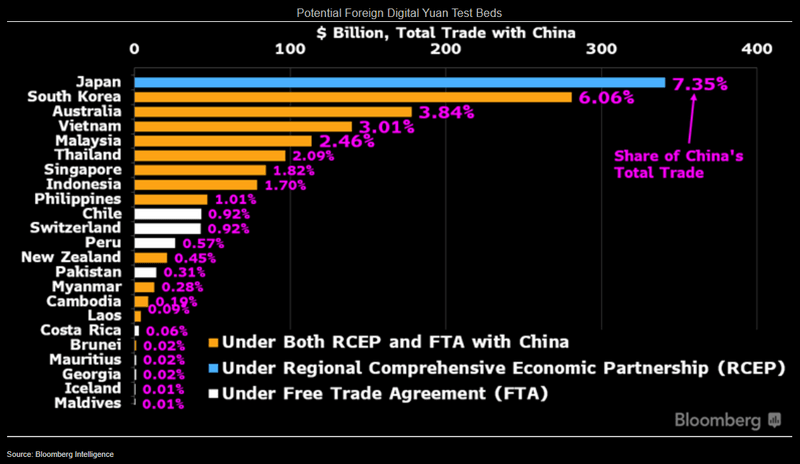

China may favor trade allies for digital yuan pilots

China may prioritize economies it has trade deals with for digital yuan pilot projects, such as members of the Regional Comprehensive Economic Partnership or countries it has free trade agreements with. This may also help promote the yuan as a global settlement currency. The digital yuan may be used for consumption initially, with final consumption expenditure at 54.3% of its GDP in 2020, but could be utilized in trading goods and investment later.

A digital yuan could first circulate in designated areas that fit China’s opening-up policy, with controls to preserve financial stability. For example, it could circulate within China’s Greater Bay Area and free-trade zones, then overseas in offshore yuan-settlement centers and Belt and Road Initiative economies.

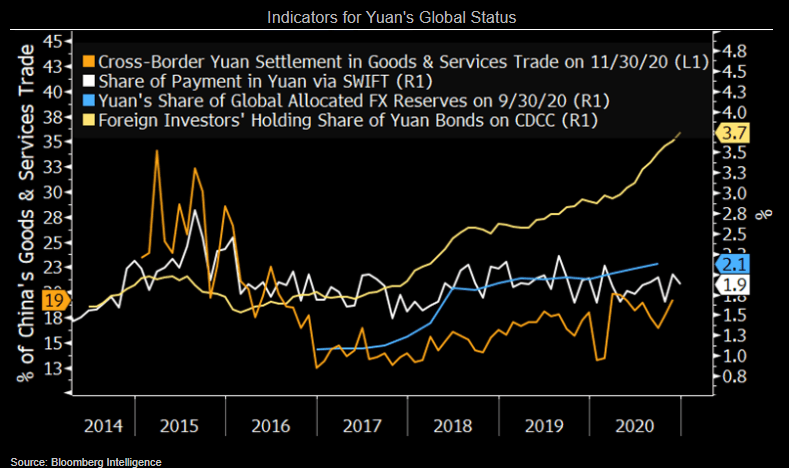

Yuan’s ascent has been slow since 2015

Yuan globalization has been slow since the last FX reform and its SDR-basket inclusion in 2015. In fact the yuan has regressed as a settlement currency, with its share of China’s cross-border trade settlement still below 20% most of the time over the last five years. As a payment currency, its share among international payments via SWIFT was still below 2% as of end December, being the fifth most-used currency. Meanwhile, even if its role as a reserve currency has been growing, it is still far behind the dollar. While the yuan’s share among global FX reserves rose to a record 2.1% as of end 3Q, this is still way below the dollar’s 60.5% share. Similarly, overseas investors only held over 3% of yuan bonds, lower than the near 30% share in the case of the U.S.

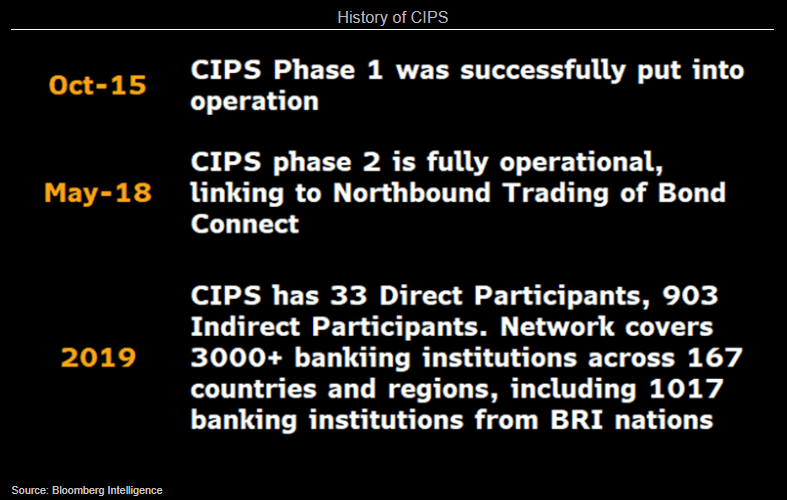

China’s CIPS first step towards internationalization of yuan

CIPS is China’s equivalent of the SWIFT system. It facilitates yuan settlement and clearing between member banks across borders. It allows members to settle goods and services trade settlement, direct investment, financing and remittances in on-shore and offshore yuan, bypassing the SWIFT system. Russia has developed a similar system, the SPFS, which it’s planning to integrate with the Chinese system. CIPS has facilitated a increase in trade settlement in yuan, especially with respect to the oil trade. Europe as a similar SPV system created specifically to bypass U.S. Iran sanctions, and can be expanded to include other countries.

These systems were developed in response to U.S. sanction policies, which pose a threat to many nations with regard to financial settlements.

Yuan could benefit from de-dollarization

The yuan’s reserve currency status could rise further as the world further de-dollarizes, and its share among reserve currencies may reach 5% by the end of 2025 — implying a demand of over $300 billion worth of yuan. Yuan share could grow on rising demand for Chinese assets, with China government bonds’ yield advantage over their SDR counterparts. U.S. trade policy could lead to more de-dollarization, especially in the Middle East and Russia.

The yuan may overtake the pound and the yen as the world’s third-largest reserve currency over the next decade. At the end of 3Q20, its share of global allocated foreign exchange reserves was 2.1%, the highest since the IMF started singling out the yuan’s share in 4Q16. This remains the smallest share out of the five SDR currencies.