Many global chemicals companies trail on carbon-transition goals

This analysis is by Bloomberg Intelligence Senior ESG Analyst Eric Kane. It appeared first on the Bloomberg Terminal.

New technologies, carbon capture needed

The chemicals industry accounts for 6% of global greenhouse gas emissions and will face increasing pressure to decarbonize, as we see it. The International Energy Agency estimates emissions from primary chemical production must decline 10% by 2030 to limit warming to 1.8 degrees Celsius, though decarbonization may depend on the development of new technologies and processes. Electrolytic hydrogen and bio-based feedstocks could replace fossil fuels, while carbon capture could provide both a key input and an emissions-reduction strategy.

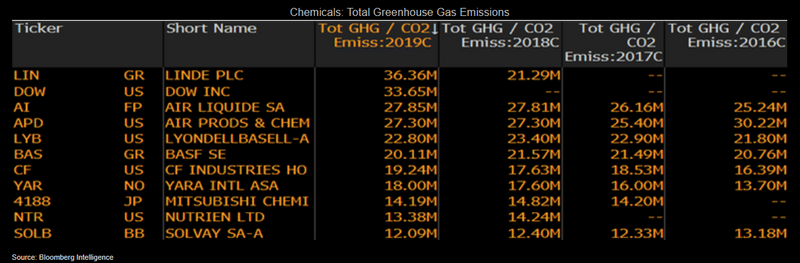

Industrial-gas companies, including Air Liquide, Air Products and Chemicals and Linde, emit the most in absolute terms, while agricultural-chemicals producers Yara and CF Industries are among the most intensive relative to sales.

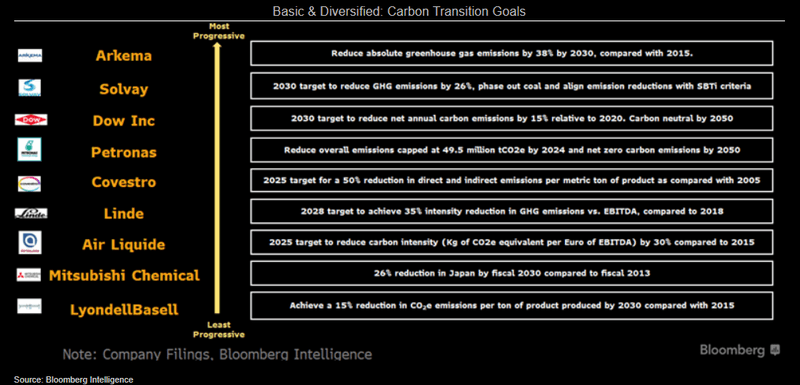

Solvay, Arkema, Dow and Petronas have the most ambitious carbon-reduction targets in basic and diversified chemicals. Solvay plans to reduce absolute CO2 emissions 26% by 2030 and to align efforts with the Science Based Targets initiative. The company uses a 50 euro-a-metric ton carbon price for its investments, and has pledged not to build new coal-powered plants and to phase out the use of coal in energy production wherever renewable alternatives exist by 2030. Dow and Petronas are alone with net-zero ambitions, by 2050. In the interim, Dow aims to source 750 megawatts of renewable energy capacity by 2025 and to reduce net carbon emissions by 5 million metric tons, or 15%, by 2030 from its 2020 baseline.

Agricultural chemicals trail sector on CO2 goals

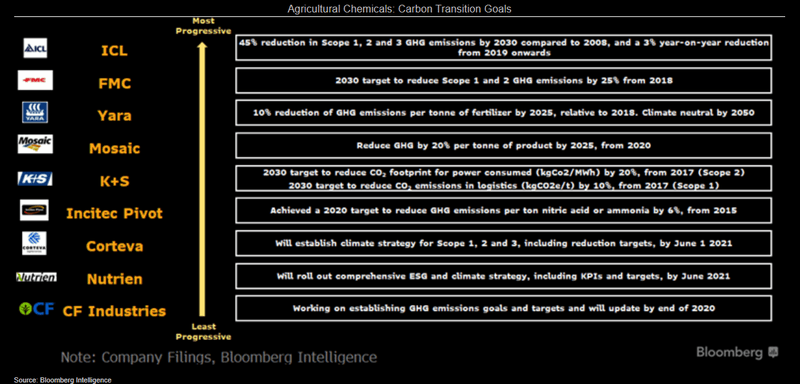

Just five of the 14 agricultural-chemicals companies we analyzed have greenhouse-gas-reduction targets, and none have committed to net-zero. ICL leads peers with plans to curb Scope 1-3 emissions 45% from 2008-30. The company is working to eliminate or reduce process emissions, including sulphur hexafluoride (SF6) and nitrous oxide (N2O), while increasing renewable-energy consumption by 20% year-over-year from 2019. Companies that don’t act are prone to regulatory risks. Mosaic reports that Saskatchewan’s plan to increase carbon-emissions costs to $50 a metric ton of CO2 by 2022 could cost the company over $10 million from regulated potash facilities.

Corteva, Nutrien and CF Industries merely say they’re developing climate strategies.

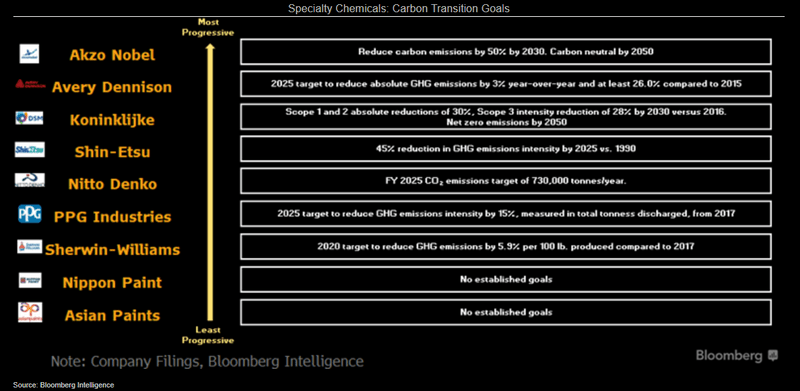

DSM’s CO2 plan comprehensive, Paris-aligned

Akzo Nobel has among the most ambitious CO2 reduction targets in the chemicals sector, seeking to eliminate 50% of emissions by 2030 and be carbon-neutral by 2050. However, Koninklijke DSM is the only one in specialty chemicals to include Scope 3 emissions along with net-zero ambitions. DSM plans to reduce its Scope 1 and 2 emissions by 30% and Scope 3 intensity by 28% from 2016-30. The company aims to reach net-zero by 2050. To achieve these goals, DSM will source 75% of its electricity from renewables by 2030, and continues to use a 50 euro-a-metric-ton price of carbon in evaluating key investments.

Nitto Denko, Nippon Paint and Shin-Etsu Chemical are likely to face pressure to accelerate CO2 reductions, as Japan has pledged to be carbon-neutral by 2050.

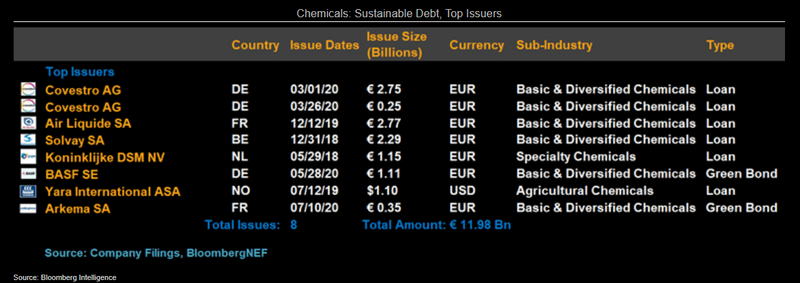

Chemicals’ sustainable-debt rise reflects CO2 focus

In the past three years, the chemicals industry has issued almost $14 billion in sustainability-linked loans, with a majority tying the cost of credit to CO2 reductions. In 2019, Air Liquide signed an amendment to its 2 billion-euro syndicated credit line that correlates its financial costs and three sustainability targets: carbon intensity, gender diversity and safety. In 2018, Solvay linked the cost of a 2 billion-euro revolver to its goal to reduce CO2 emissions by 1 million metric tons by 2025.

To date, less than 2% of the $555 billion in sustainable debt was issued to chemicals companies in 2020. Sustainability-linked loans comprise the biggest share for chemicals, as they can be used for general purpose, while green bonds link funds to specific investments.