Create a smart beta strategy with your own factors

This article was written by Everett Perry, Ethan Ganz and Alper Atamturk. It appeared first on the Bloomberg Terminal.

Background

What is smart beta?

“It’s like taking Peter Lynch’s brain and putting it into R2D2,” says Eric Balchunas, a senior ETF analyst for Bloomberg Intelligence.

Smart beta is no joke. These strategies now represent more than 20% of the exchange-traded funds market, having grown beyond $1 trillion from about $200 billion in 2012. That growth reflects another shift: a move away from discretionary, fundamental investing driven by experience and gut toward more systematic, rules-based approaches that aim to exploit behavioral biases rather than fall victim to them.

With the proliferation of systematic investing strategies like smart beta, many investors are left wondering how they can position themselves as we move into a new year, new administration and a possible new financial regime. Whether a tech-fueled growth rally continues in 2021 or is overshadowed by a resurgence in cyclical and value stocks, investors need access to tools that allow them to quickly assess the landscape and make potential adjustments to strategy and positioning.

The issue

Many firms have small armies of Ph.D.s researching alpha signals and factor rotation, but Bloomberg tools can let you see what’s worked, in what market environments and under what economic conditions. Terminal functionality allows you to assess the risk-return relationship of individual factors, explore how they’ve interacted with indicators such as interest rates and test specific strategies through time. Once you’ve adequately researched and found your target factor or theme, how do you build a strategy from the ground up?

The workflow

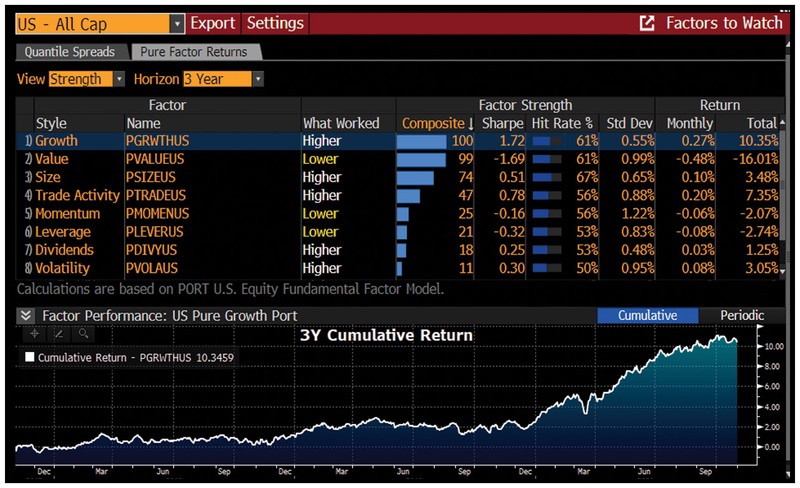

Bloomberg’s Factors to Watch function lets you analyze a deep list of smart beta factors and observe their performance and past predictive strength. The screen displays and ranks analytics for factor quantile spreads and pure factor portfolios. Pure factor portfolios use statistical methods to isolate precisely one unit of a factor, with zero exposure to others, to track its performance and risk over time.

You can build a smart beta strategy with Bloomberg functionality in three steps.

Step 1. Find a pure factor to focus on.

Let’s dive deeper into growth, which has been in the spotlight during the pandemic. The economic landscape has supported growth in recent years. Corporate tax cuts in 2017, for one thing, temporarily ratcheted up earnings growth for U.S. companies. In addition, the current low-rate regime has helped fuel a risk-on appetite for high growth from an investor’s point of view.

To start, run FTW <GO> and click on the Pure Factor Returns tab, then change the View drop-down to Strength and the horizon to 3 Year. The Factors to Watch function shows that the growth factor outperformed all other factors over a 3-year period. The growth factor also tops the list as strongest in terms of Sharpe ratio, information coefficient and return, according to data aggregated by the Factors to Watch function.

Step 2. Select your smart beta strategy.

Sticking with the growth factor, if you feel that supportive conditions will persist and factor regime change isn’t imminent, how can you implement a growth strategy? First, you need to find metrics to gauge growth. To build a growth strategy portfolio, use the optimizer in Bloomberg’s Portfolio & Risk Analytics (PORT) function. Portfolio optimization draws on Nobel laureate Harry Markowitz’s work; his modern portfolio theory posits that an optimal portfolio can be constructed based on the expected returns and volatility of securities. Applying this basic framework to real-world portfolio goals, universes, constraints and trade-offs creates a sophisticated model of securities — and how much of each — to trade based on specific rules and specifications.

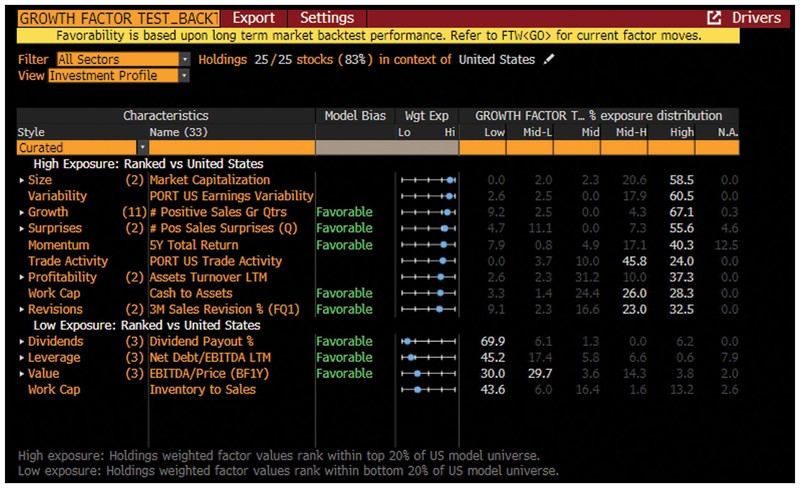

Create a cash portfolio by going to PRTU <GO> and clicking on the Create button. Enter a name such as Growth Factor Test, select Equity as the asset class, click Create. Run PORT <GO> and use the drop-down in the upper left to select the portfolio. Let’s set the Bloomberg 1000 as the benchmark. Now that you have a portfolio of cash and a benchmark, click on the Trade Simulation button and select Launch Optimizer. You can set up a rules-based optimization task to create a long-only equity portfolio that will maximize exposure to the growth factor while minimizing risk.

Step 3. Test your smart beta strategy.

Let’s backtest the strategy to make sure a long-only portfolio performs similarly to the factors we observed in FTW. Click on the Backtest button in the PORT Optimizer. Set up a 36-month backtest and hit Run. Once it’s run, you will see each rebalance date on the displayed chart. You can see how all of your goals and constraints have changed over time as well as click into any date to see proposed trades.

Click on the Analyze in PORT button to examine the portfolio’s performance further. In this case, the function shows that the U.S. Growth factor portfolio outperformed the benchmark by about 25% over three years. Select the PORT Attribution tab to confirm that alpha generation in the backtest was indeed driven by exposure to the Growth factor.

Tracking

You can load your saved optimized portfolio (or any public fund or index) in DRIV <GO> to see an exhaustive list of active factor exposures that could drive future risk and return. You may detect exposures you didn’t realize you had.

For more information on this or other functionality on the Bloomberg Professional Service, click the button below to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.