Demystifying the Sustainable Finance Disclosure Regulation

This article was written by Nadia Humphreys, Business Manager for Sustainable Finance solutions at Bloomberg.

Asset managers are still trying to get a handle on the multitude of ESG-based regulations coming out of Europe. The European Supervisory Authorities (ESAs) have proposed technical standards on what will need to be disclosed under the Sustainable Finance Disclosure Regulation (SFDR). We wanted to utilize our perspective and expertise to dispel some commonly held misconceptions, while explaining which information needs to be disclosed, and when, to ensure compliance.

What does the SFDR aim to achieve?

SFDR is part of a broader package of legislative tools designed to reorient capital towards more sustainable businesses. The main objective is to ensure that financial market participants are able to finance growth in a sustainable manner over the long term while combating so-called ‘greenwashing:’ in which the environmental claims made by an investment could be untrue. A key part of this regulation is also linked to transparency, explaining how the manager takes adverse impacts on sustainability into account. There are both entity and product level requirements.

Who is in scope for it?

Financial market participants (FMP) are defined as investment firms, such as asset managers who offer portfolio management services, pension providers, and insurance-based investors, as well as qualifying venture capital and social entrepreneurship activities. In-scope financial products will include investment and mutual funds, insurance-based investment products, private and occupational pensions, and both insurance and investment advice. If any of these products make sustainable investments, the manager should disclose how those investments are compliant with the ‘do no significant harm’ principle laid out in the regulation.1

The reporting framework for principle adverse impact (PAI) at entity level will initially take the shape of a “comply or explain” requirement, moving to “comply” from 30 June 2021 for large financial market participants (those with more than 500 employees). If not, it will have to state that the product or entity does not consider sustainability risks. A firm that claims its products have sustainable characteristics or objectives will also need to make a product level disclosure in accordance with the technical standards.

What do those in scope need to do?

Initial focus should be on the entity or manager level requirements. It is worth stressing that whilst the ESAs have delivered their Regulatory Technical Standards (RTS), this is still subject to the official European bodies signing off.

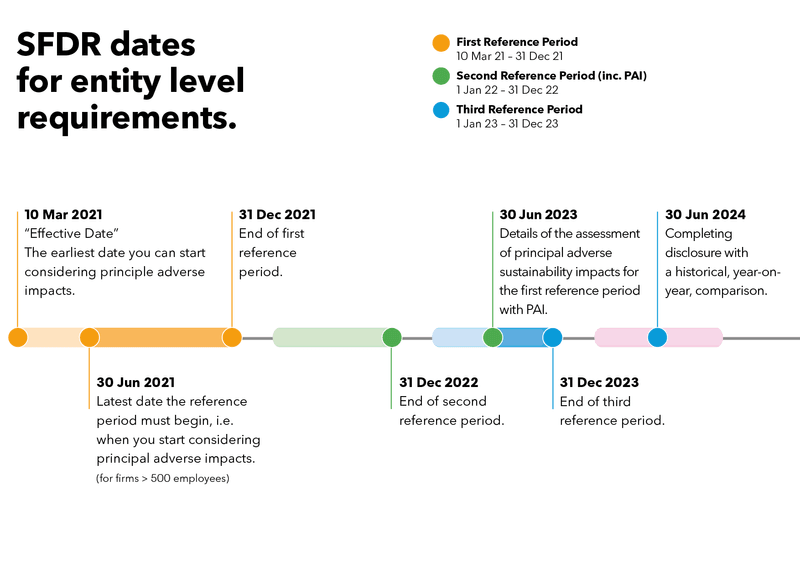

There are a few key dates that become relevant concerning this regulation:

- The date when a financial market participant first considers the principal adverse impacts

- The period from that first date, until December 31 of that year

- Subsequent disclosure from June 30 the next year, and annually thereafter

An FMP which considers the PAI of its investment decisions must disclose the appropriate information from the date is starts considering these impacts. The entity-level disclosure of principal adverse impacts will apply from March 10, 2021 with an update to websites referencing the relevant policies according to the high level framework set out in Article 4 SFDR. The additional detail specified by the entity-level ‘principal adverse sustainability impacts statement’ set out in Annex I of the RTS will be phased in from January 1, 2023. The first disclosure under the RTS, from January 2023, should contain information in the “Summary,” “Description of policies to assess principal adverse sustainability impacts,” any “engagement policies” not related to reduction in impacts during the reference period, and “adherence to international standards” sections.

Despite the European Commission having deferred the application date of the RTS to 1 January 2023, the additional PAI data specified in Annex I of the RTS is still expected be reported in June 2023, with respect to the reference period in 2022. Where an FMP publishes the principal adverse sustainability impacts statement for the first time, the RTS does not need disclosure of any information for a previous reference period.

On June 30, 2024 (year n+3), the FMP would also have to complete the “historical comparison” section of the Annex, comparing the first reference period (year n+1) with the second reference period, which would be 1 January – 31 December of year n+2.

How does this work in practice?

By June 30, 2023, that FMP must complement that disclosure with details related to a choice from 20 suggested data points, noting that 18 are mandatory in table 1 and 2 indicators can be selected from a choice of the remaining 46 social and environmental data points in tables 2 and 3, plus any others than the FMP deems relevant to their investment decisions. This report will cover investments made during January 1, 2022 – December 31, 2022.

Volume of data

As Sustainable Regulation in Europe starts to take shape, what is clear to all is the quantity and quality of ESG data that needs to be consumed, and not just into a reporting framework. These regulations are designed to embed sustainability into decision making. This is not just a compliance check box exercise. With regard to SFDR the adverse impacts of products need to be clearly communicated to the end-investor and broad claims on ‘ESG integration’ will no longer be sufficient.

Notes: 1. Article 2(17) of the SFDR consistent with the content, methodologies, and presentation of indicators in relation to adverse impacts referred to in Article 4(6) and (7) SFDR.

Speak with an ESG specialist for more information on Bloomberg’s SFDR solutions.