This article is written by Lisa Lee. It appeared first on the Bloomberg Terminal.

The $700 billion CLO market will soon be able to purchase junk bonds and potentially other, riskier securities alongside leveraged loans after U.S. regulators eased constraints on some of their biggest investors.

The Federal Reserve, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. approved changes to the Volcker Rule last week that expand the types of securities that banks can invest in, paving the way for CLOs to once again include bonds in their pools of assets. What’s more, the moves could possibly allow them to buy equity and equity-like securities, according to some initial interpretations of the new regulations.

The changes hearken back to the pre-crisis days for collateralized loan obligations, which previously had more latitude to decide what assets they bundled and sold into securities of varying risk and return. In 2015, Volcker Rule provisions limiting Wall Street banks from investing in so-called covered funds essentially did away with that leeway. Beginning Oct. 1, those restrictions are expected to change, allowing CLOs to have bond buckets of up to 5% of their assets without being considered covered funds.

“I welcome the bond bucket coming back,” said Lauren Basmadjian, a senior portfolio manager at Carlyle Group Inc. There’s more opportunity to profit with a bond “because they have stronger call protection. Bonds have more upside than a loan. You could build 10 points profit by using a bond bucket.”

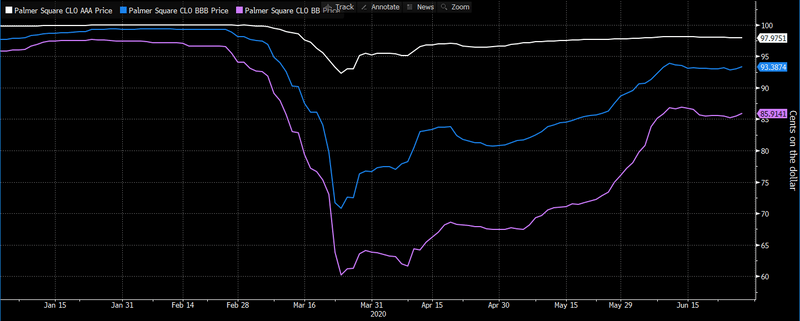

CLOs tranches of every credit quality are rebounding after plunging in March

The changes come at a time when CLOs are under heightened scrutiny amid a surge in downgrades among the leveraged loans that they buy. New vehicles are already being loaded with a higher share of lower-rated assets, while a significant number of deals are failing key performance tests that could force them to shut off payments to holders of the riskiest and highest-returning part of the CLO structure — the equity portion.

While a bond bucket could help juice returns, unsecured high-yield notes typically have lower recovery rates than the higher priority leveraged loans CLOs traditionally invest in, and are therefore generally considered riskier investments. Moreover, bonds are fixed-rate securities, while CLOs are floating-rate, creating an asset-liability mismatch.

Still, most CLO watchers say the added risk of a 5% bond bucket is marginal.

Bigger changes

While the new buckets can only hold debt securities, some industry insiders are already noting that other regulatory changes approved last Thursday could potentially allow collateral managers to purchase other types of assets.

They’re zeroing in on modifications to what the oversight agencies consider an ownership interest in CLOs when they’re deemed covered funds.

Under the old rules, banks were deemed to have ownership stakes even if they only held debt tranches. That’s because the senior bonds granted them the right to remove managers. It was this ownership interest in covered funds that was barred under Volcker Rule provisions.

Now, the right to replace managers under certain conditions may no longer be considered an ownership stake, according to the federal regulatory agencies that oversaw the revisions. Market watchers are still interpreting the extent of the changes.

“If a bank isn’t considered to hold ownership interest, banks could invest in CLO debt tranches regardless of whether they are considered a covered fund,” Wells Fargo & Co. analysts led by Dave Preston wrote in a report to clients Friday.

Safe harbor

That would allow CLOs to exceed the 5% bond threshold, potentially ramping up the risk of the structures in the process.

They could also buy assets like convertible debt, warrants and equity stakes in troubled companies, giving them more flexibility to participate in restructurings amid a wave of corporate bankruptcies.

“Even if you are a covered fund, you have a safe harbor that would allow banks to invest in CLOs that have bond buckets in excess of 5% and other securities such as those in restructuring situations like warrants and equity,” said Deborah Festa, a partner at law firm Milbank LLP. “It’s really a question of what the market will support. The jury is out on whether investors will allow managers greater flexibility.”

In recent months new CLOs have begun incorporating springing bond buckets into their deal terms in anticipation of the rule changes. But for the most part, older CLOs will need to amend underlying documents to take advantage of the regulatory shift.

“Not all managers will be in a position to buy bonds,” said Dagmara Michalczuk, a portfolio manager at Tetragon Credit Partners. “Some managers with strong bond capabilities may look to amend existing CLOs.”