How to hedge your bond portfolio against falling rates

Bloomberg Market Specialist Siddharth Iyer contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Money managers around the world are looking to profit from falling interest rates, while at the same time reducing their exposure to credit risk as economies slow and the coronavirus roils markets.

Indian money managers are a prime example. Reserve Bank of India Governor Shaktikanta Das said that the central bank will consider options including a rate cut and supporting the market through liquidity measures if necessary. “There is definitely a strong reason for coordinated policy action, because coronavirus has now turned out to be a global problem,” Das said. “So when the problem is global, naturally the response and the need for coordinated action is so much more.”

The falling interest rate environment means fund managers in India and elsewhere need to stress test their portfolios for specific interest rate movements and rebalance to hedge against duration risk.

The issue

For years, money managers have gorged on long-maturity bonds because of dovish monetary bets by central banks, the relentless demand for safe assets from investors and strong convictions that inflation will remain low. That behavior has led to portfolios with high duration risk, or sensitivity to interest-rate changes.

Money managers can hedge that duration risk by shorting bonds or using futures — options and other derivatives to target a lower duration than what the portfolio currently has. The downside to hedging is that the yield from the hedged portfolio could be slightly less because of the costs of the hedge.

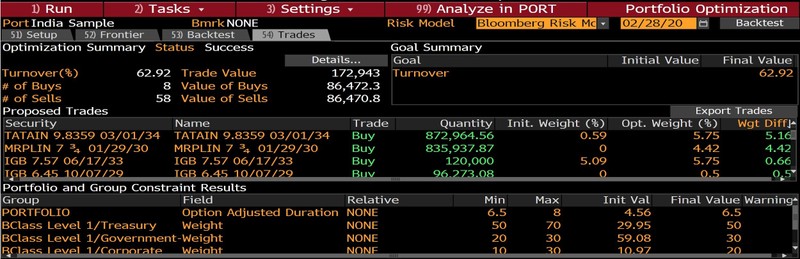

The Bloomberg Terminal links two powerful filtering tools that more efficiently to help hedge duration risk. The Fixed Income Worksheet screens a group of bonds for factors, including low default risk, while the Portfolio & Risk Analytics tool can optimize the portfolio’s characteristics, such as duration and turnover.

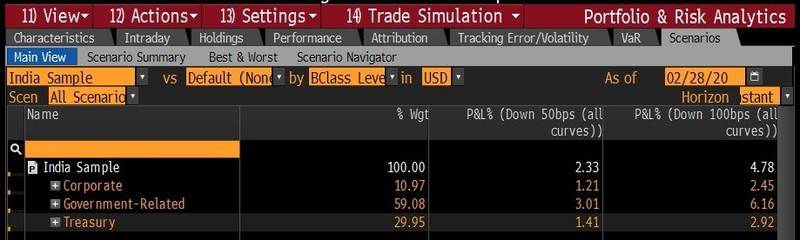

This type of analysis becomes even more important in an environment where interest rates continue to drop. For example, take a look at the possible scenario of a 50 basis point or 100 basis point drop in interest rates on February 28.

Tracking

The Portfolio & Risk Analytics tool recommends trades to meet a portfolio’s stated goals for turnover, duration, asset mix and size.

Run PORT <GO> to access the portfolio analytics platform.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.