Why Asia is leading the fintech revolution

This was written by Bloomberg News. It first appeared on the Bloomberg Terminal.

To find the red-hot center of the fintech boom, you’d look for a growing base of consumers, a burgeoning financial infrastructure, a swell in monetary transactions, and the presence of some of the world’s largest tech companies. You’d look toward the East. Here, Bloomberg Intelligence explains why Asia is at the vanguard of the fintech revolution and what’s next for industry there.

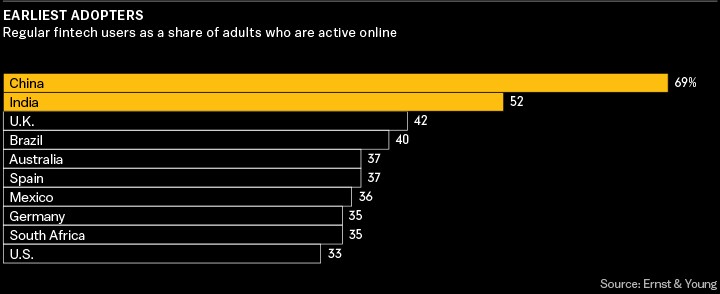

Early fintech adopters

Asia is leading the way in consumer adoption of financial technology products. In China and India, the most populous nations in the world, more than half of adult consumers active online said they regularly use fintech services, according to a 2017 survey conducted by Ernst & Young.

Fintech businesses are particularly adept at reaching “tech-literate yet financially underserved” markets, the company says. China and India are both growing quickly, but they lack some of the financial services that appeal to a rising middle class.

More than 4 out of 5 respondents in China said they have used at least one fintech service for mobile money transfer and payments, and more than half reported using one for savings and investments. In India, 47 percent of respondents said they have used a fintech insurance product.

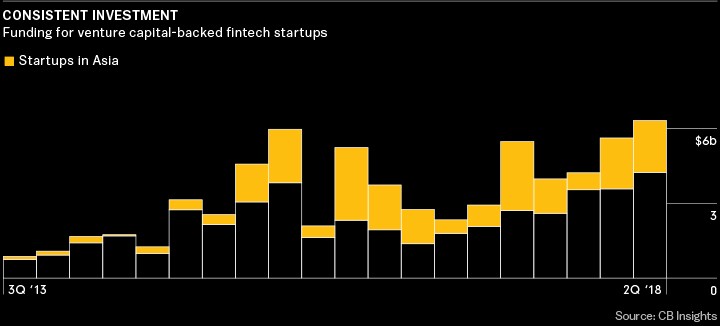

Follow the money

Funding for fintech startups has continued to rise in 2018, with both private equity and strategic investors staying active. In the first half of the year, almost $12 billion flowed into venture capital-backed fintechs, and more than a third of it went to companies based in Asia, according to CB Insights, a research company that tracks investment deals and volume. (That excludes a mega-round of $14 billion raised for Ant Financial Services Group, the China-based giant partially owned by Alibaba Group Holding Ltd.) In the second quarter alone, there were 132 fintech funding deals in Asia, up from 91 deals in the same period last year. More than half were seed or Series A rounds.

Where the unicorns graze

At the end of June, there were 29 fintech unicorns — venture capital-backed private companies with valuations of at least $1 billion, according to CB Insights. Six were in Asia, including China’s Tuandaiwang, Tongdun Technology, 51Xinyongka, and Lu.com, as well as India’s Policybazaar and Paytm. The U.S. is home to 18, including Stripe and Robinhood.

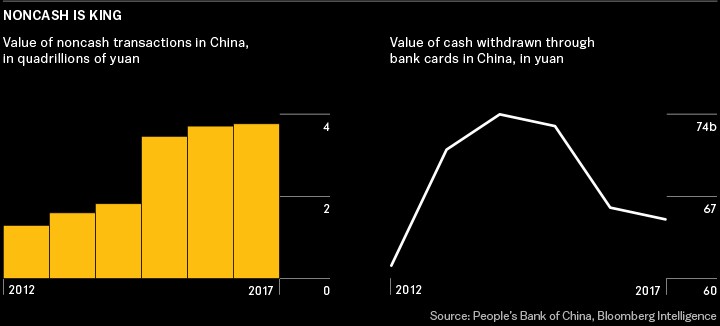

Moving towards a cashless economy

In China, several trends are under way that benefit fintechs. The growth of money transfers through third-party payment systems and of digital transactions is helping the nation go cashless. Cash transactions are declining, as shown by

a drop in withdrawals through bank cards in 2017.

Mobile payments such as QR code transactions are widely used for shopping, restaurants, travel, and medical services. The value of third-party transactions through mobile is forecast to rise from 120 trillion yuan ($17.4 billion) in 2017 to 354

trillion yuan in 2020, according to IResearch.

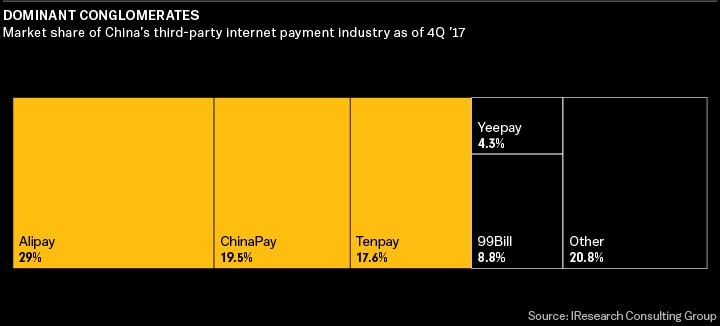

Online payment dominated by a big three

China’s largest fintech players account for the majority of online payment volume. The big three — Ant Financial’s Alipay, Tencent Holding Ltd.’s Tenpay, and ChinaPay — had a combined market share of 66 percent in the fourth quarter of 2017.

Tenpay, which includes WeChat Pay, has increased its share on the strength of its messaging app, as well as its QQ Wallet and red packet products, which allow users to make mobile payments and send gifts, respectively. ChinaPay benefited from the

network of its owner, UnionPay, the country’s official bank card association.

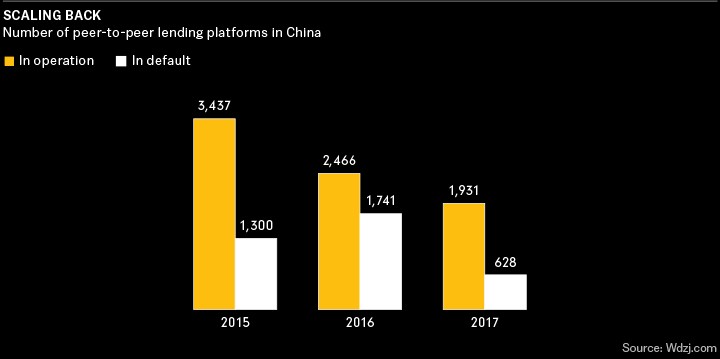

Lending platforms face hurdles

After peer-to-peer lending platform defaults hit a peak of 1,741 in 2016, officials took regulatory action that’s weighed on industry growth. The national loan balance was 903 billion yuan in August, a decrease of 19 percent year-over-year, according to consultant Wdzj.com. That’s down from growth of 101 percent in 2016 and 292 percent in 2015.

More than half of active P2P sites could go dark because of noncompliance with new online lending rules, which limit the use of asset-backed securities and constrain lenders’ ability to source funding from financial institutions. The prospect of more

curbs for online lending and associated businesses, including a possible purge of online micro-lenders, has weighed on their share prices. That sets the stage for industry consolidation.

Established P2P companies such as Ping An’s Lufax, U.S.-listed Yirendai, and PPDAI Group are likely to lead the way with their ample funding and strong management, allowing them to draw businesses despite the industry shakeup. Fading returns are also chipping away at loan growth momentum in China. The average P2P loan return fell to 10 percent in August from 17.5 percent four years ago amid a low-rate environment. Meanwhile, average loan duration grew to 14.6 months in August, from nine months a year earlier.

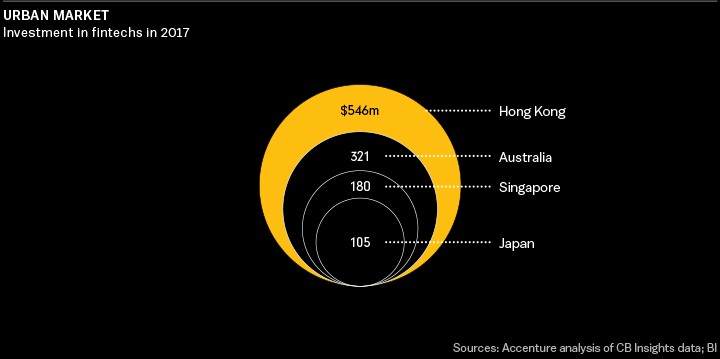

A small magnet for new fintech investment

Hong Kong’s fintech investments more than doubled in 2016 and 2017, thanks to supportive government policies, a nurturing ecosystem, and China’s regulatory tightening. Investments reached $546 million last year, up from $216 million in 2016.

The jump was driven in part by $220 million in venture capital funding for WeLab, a mobile lending platform, according to CB Insights.

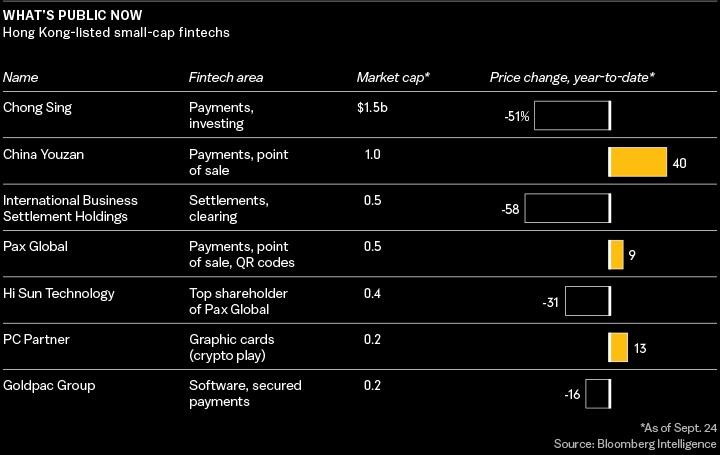

Waiting for the IPO boom

While private investment has been on the rise, few fintechs have tapped into the Hong Kong public market. Fintechs are scarce on the Hong Kong bourse. Most that BI tracks are small caps specializing in online payments; their performances this

year have been mixed. Graphics-card maker PC Partner Ltd. offers exposure to crypto mining. Mining cards contribute 15 percent of the company’s sales.

If the government builds it, will fintech come?

Hong Kong’s government provides project funding, incubation programs, and tax incentives to court and cater to fintechs. The Smart City project includes plans to increase fintech usage, expand the local talent pool, and encourage entrepreneurship. And the government will fund a new technology park to promote cooperation on fintech ventures in Hong Kong and Shenzhen, the nearby mainland technology hub.

Hong Kong is already among the world’s freest economies, with light regulations on fintech ventures. The city’s proximity to China provides a big market. Startups have easy access to top investors, accelerators, and partners.

China’s crypto overflow

The fintech pool in Hong Kong could get a boost from Chinese cryptocurrency startups, as well as other ventures seeking funding through initial coin offerings. After China halted crypto exchanges and ICOs last year, many have come to the city in pursuit of funding and business development. Gatecoin and ANX International are Hong Kong’s exchanges for digital tokens. BlueMeg, Likecoin, and TrustME are among prominent startups in the application of blockchain technology.

Look for more crypto and blockchain ventures of Chinese origin to head to Hong Kong for venture capital and coin funding.

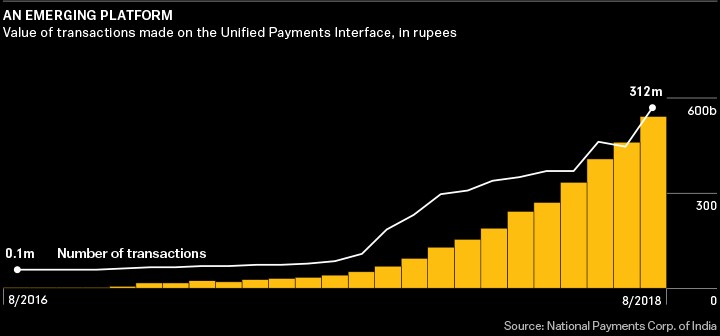

A new payment network ramps up transactions

The Unified Payments Interface, an Indian platform that lets parties exchange money in an instant, has joined traditional banks with newer apps and widened the consumer base for digital payments. Two years old, the UPI has already drawn Google, which says its India payment app has been downloaded more than 50 million times, and Facebook Inc., which began beta testing its WhatsApp payment service this year. There are 115 lenders on the system, up from 21 at its introduction. Transactions reached 542 billion rupees ($7.5 billion) in August, up from 31 million rupees in August 2016.

An upgrade to power payments

The UPI has made person-to-person transactions faster and easier. Now an upgraded version of the network, known as UPI 2.0, promises to bring the same ease of operation to the person-to-merchant payments space. Here are a few examples of transaction innovations at work:

- PhonePe POS Powered by Bluetooth and resembling a simple calculator, this device delivers payment processing to merchants of all sizes. All a user has to do is bring her smartphone close to it and click to pay. There’s no need for an internet connection.

- Google Audio QR Embedded in the Google Pay app, this technology lets users transfer money across devices using ultrasonic frequencies—and without exchanging personal or banking details.

- Paytm QR codes Since India’s demonetization in 2016, Paytm’s scannable QR codes have become almost ubiquitous amongvendors.

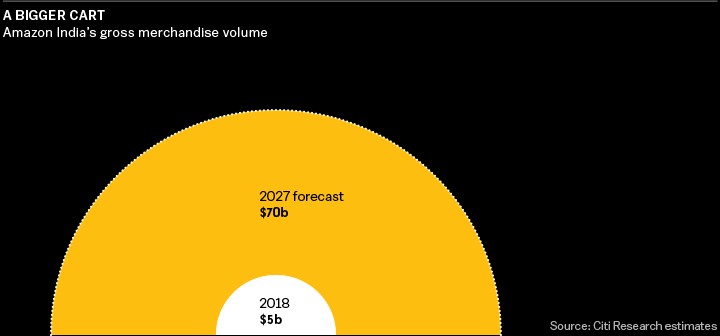

Amazon sniffs an opportunity

Amazon.com Inc.’s focus on financial services has broadened to include India. The company has made several investments in Indian fintech businesses—including in those focused on lending and insurance—and has increased investment in Amazon Pay’s Indian operation. Demonetization of the Indian currency increased demand for online payment options, creating more opportunity for Amazon.

Amazon already has about 150 million users in India and is a market leader in Indian e-commerce, rivaling Walmart Inc.’s Flipkart Pvt. and Paytm Mall. Amazon’s presence in the country should continue to grow. Indian e-commerce is expected to expand to $72 billion by 2022, up from $33 billion in 2018, according to EMarketer Inc. That increase would represent a compound annual growth rate of more than 20 percent.