IFRS 9 bridges the gap between accounting and risk management

This article is by Eva De Leon, Product Manager for Hedge Accounting Solutions at Bloomberg L.P. It appeared first on TMI.

For years, accounting and risk management have not always been fully in sync. Limitations in the prevailing accounting standard meant that firms were not always able to accurately reflect their risk management activities in financial statements. While the emphasis of accounting was the forensics of company finances, risk management was traditionally focused on the prospective future. IFRS 9 will help to clarify the role and outcome of risk management in the accounting output.

IFRS 9’s impact will be in encouraging clarity and providing a common language that finance, treasury, risk functions and the CFO can use to better communicate financial performance to investors.

Key changes introduced to achieve closer alignment

The global financial crisis exposed many problems with IFRS 9’s predecessor, IAS 39. It was viewed as complex, challenging to implement, inflexible and confusing to investors in its treatment and reporting of risk management. The crisis also highlighted the deficiencies of the incurred loss impairment model, whereby a provision is booked after a loss event has happened, resulting in delayed credit-loss recognition. This was commonly referred to as “too little, too late”. Companies often found themselves unable to achieve hedge accounting for common hedging strategies, resulting in financial statements not necessarily reflecting the true status of risk management application.

IFRS 9 sees a general shift from a prescriptive to a principle-based approach, changes to the way financial assets are classified and measured based on their nature and how they are managed, changes to the impairment model based on expected rather than incurred credit losses, and a move to hedge accounting guidelines that are less rigid.

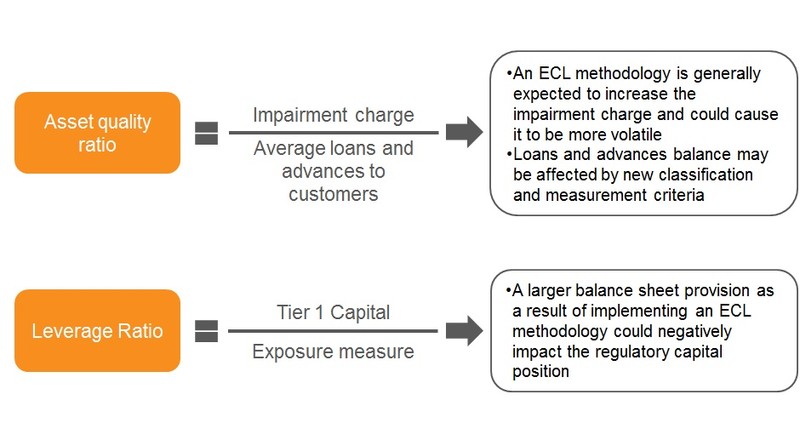

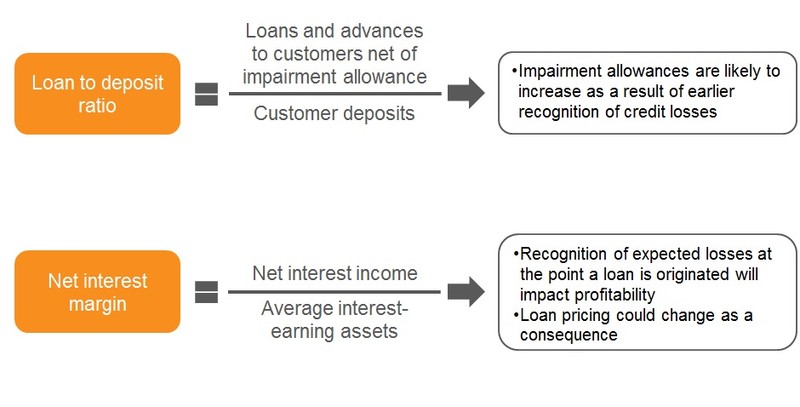

Adopting the new expected credit loss (ECL) model will require companies to consider multiple, probability weighted scenarios and macroeconomic factors in order to apply a forward looking approach. Credit losses will be recognized earlier, from the point a loan is issued, and will be based on the expectation of losses over the life of the instrument. Credit risk modelling is likely to be a key feature in the assessment of credit risk and the subsequent tracking of credit risk. Equally as important, ECL calculations will require significant management judgment, which must be supported by enhanced disclosure of asset quality, provisioning policies and performance ratios.

The need for increased judgment and disclosure is an opportunity for CFOs to expound on their reasoning and strategy because it creates a need for more discernment and explanation of assumptions. These changes create an opportunity for treasurers and CFOs to open the dialogue with investors about how risk is managed in a company.

More hedging strategies are likely to qualify for hedge accounting application under IFRS 9, which will result in less income-statement volatility and permit new strategies. The changes will allow stakeholders to see more meaningful information. The hedge accounting model will also permit greater flexibility by introducing and expanding on concepts such as rebalancing, aggregate exposure, layers and net positions. Hedge accounting can show exactly what is being hedged to provide a clear view of risk management across the firm. These should be welcome changes for most companies that manage their risk well.

The changes introduced by IFRS 9 will, however, bring fresh challenges to investors. The numbers generated under IFRS 9 may look quite different so significantly more disclosures are needed to help investors understand the risks a company faces. CFOs and treasurers will play a key role in actively managing the communication around how best to disclose them.

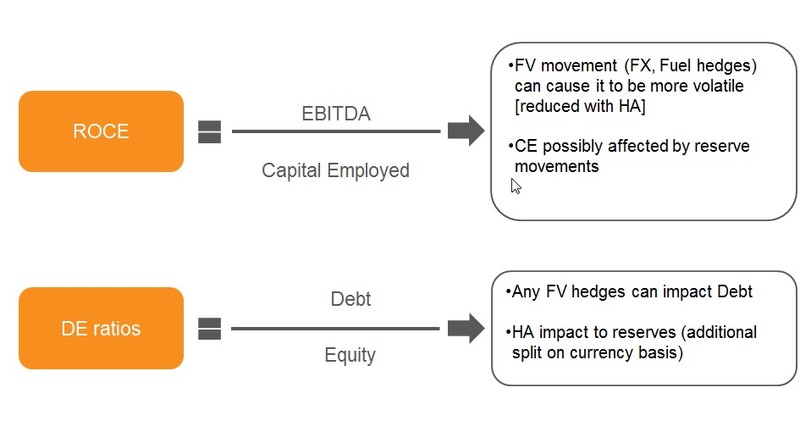

Some of the key performance indicators that could be impacted under IFRS 9, for both a corporation and a financial institution, can be seen on the charts below. Consider an airline and the return on capital employed: EBITDA is sensitive to fair value movement from FX or fuel hedges. This volatility can be reduced with hedge accounting; while capital employed could be affected by reserve movements from hedge accounting or the transition to ECL.

The first financial reporting period or two in particular will require extra care to ensure differences that exist because of IFRS 9’s accounting changes are fully explained.

Firms should seek to develop standard approaches that can be written into software and automated as quickly as possible.

IFRS 9 builds a bridge between accounting and risk management, but that’s just the beginning. Ensuring a coherent and joined up message is conveyed to users of financial statements, that reflects the risks a firm faces and the actions taken to mitigate them, is the next challenge.

Bloomberg enables organizations to simplify and automate the complex challenges presented by IFRS 9 with robust and defensible data. To learn more about our data solutions for IFRS 9 visit bloomberg.com/IFRS9.

About TMI: Treasury Management International (TMI), in print and online, showcases topical, pragmatic solutions and strategic insights on treasury, cash management, FX and other issues affecting treasury and financial professionals today, along with treasury and finance news, education and opinion. With real-life treasury management experiences and case studies at its core, TMI provides valuable material for all practitioners – from experienced treasurers and CFOs to those new to the profession.