This article is by FX Market Specialist Matt Gorelik. It appeared first in Bloomberg Briefs | Corporate Treasury.

Corporations with revenues and expenses in foreign currencies have often grappled with the dilemma of whether to hedge each exposure, and if so, how much of it.

This is further compounded by the fact that some foreign exchange exposures carry a significant hedging cost if they are to be offset. Frequently, little analysis goes into the risk of each individual exposure, and particularly to its contribution relative to the company’s overall FX exposures. Rule of thumb approaches such as hedging all exposures partially, or only hedging exposures where forward points are favorable, miss the mark on minimizing the company’s overall currency risk by failing to consider how each hedged exposure is correlated with other exposures.

Instead, the risk management best practice is to assess the company’s total currency risk using a portfolio Value-at-Risk (VaR) analysis and determine a unique set of hedging ratios that minimize the company’s FX VaR for a specific level of total hedging cost.

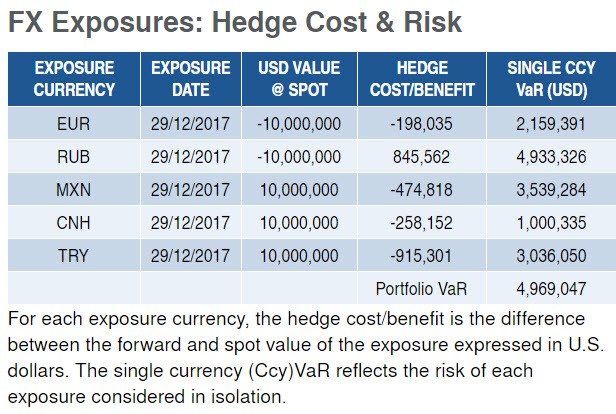

For example, consider a U.S. dollar functional technology company that incurs R&D expenses in euros and Russian rubles and sells into Mexico, China and Turkey, generating revenue in the local currencies. Since these currencies have non-zero correlation with one another, the total FX risk is less than the sum of the individual currency risks, as defined by a Value-at-Risk (VaR) measure.

Given the interest rate differential that exists between the functional currency and the exposure currencies, all exposures (save for the ruble) carry a significant cost of hedging. The company would like to reduce its current $4.9 million in FX VaR, but unless the company is prepared to incur about $1 million of hedging costs, hedging all FX risk in its entirety may be out of the question.

It may be tempting to only hedge the ruble exposure since it earns positive carry. However, doing so would actually increase total FX VaR to $5.9 million since the ruble exposure acts as a natural hedge against the other emerging market currencies with which it is correlated.

How should the company go about finding the optimal hedge ratios for a given level of total FX VaR in a way that minimizes total hedging costs?

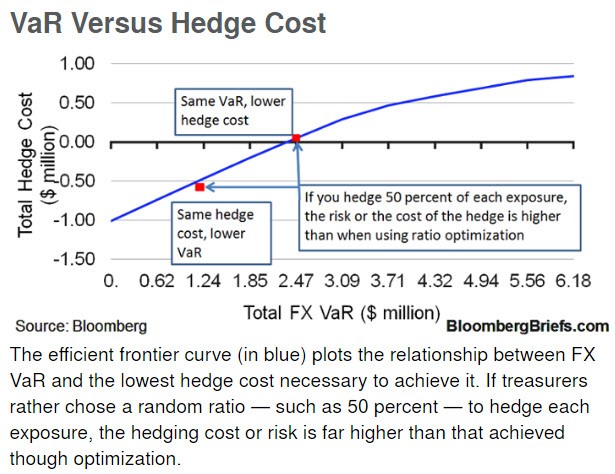

We can address this by first constructing and plotting an efficient frontier where each point on the chart depicts a level of total FX VaR and the optimal hedging cost necessary to achieve it.

Further, each point on the curve is associated with a set of hedging ratios for the exposure currencies which result in the FX VaR and optimal hedging cost combination. For example, if the company wants to halve its fully unhedged FX VaR to approximately $2.47 million, the optimal hedging benefit to achieve this level of VaR is $0.05 million and the corresponding hedge ratios are 22 percent for the euro, 100 percent for the ruble, 100 percent for the Mexican peso, zero percent for the Chinese renminbi and 30 percent for the Turkish lira.

Now let’s consider the situation if the company wanted to accomplish the same goal of reducing FX VaR by half without doing an optimization analysis, but instead hedging each exposure with a ratio of 50 percent. While it would succeed in reducing FX VaR by half, the resulting total hedge cost would be approximately $0.5 million.

If we plot this scenario on the efficient frontier chart, it would reside below the curve which means that this set of hedging ratios is inefficient. By hedging 50 percent of each exposure, you achieve the same VaR but at a higher hedging cost.

By optimizing the hedge ratios we could either reduce the FX VaR further down to $1.1 million while keeping hedging cost constant at $0.5 million, or convert the hedging cost into a hedging benefit of $0.05 million while keeping total FX VaR at $2.47 million. To sum up, by conducting a hedge ratio optimization exercise, the treasury department could minimize the company’s FX risk while minding the bottom line.

Learn more about Bloomberg Briefs | Corporate Treasury.