Oil, ahoy! Track U.S. trade flows and plot vessel movements

Bloomberg Market Specialist, Bert Gilbert contributed to this article. It appeared first on the Bloomberg Terminal.

Background

Exports of U.S. liquefied petroleum gas exceeded exports of diesel, gasoline and crude in February, even as the quickest propane supply drawdown in almost a decade pushed up prices. As prices go higher still, exports may react and inch down.

The issue

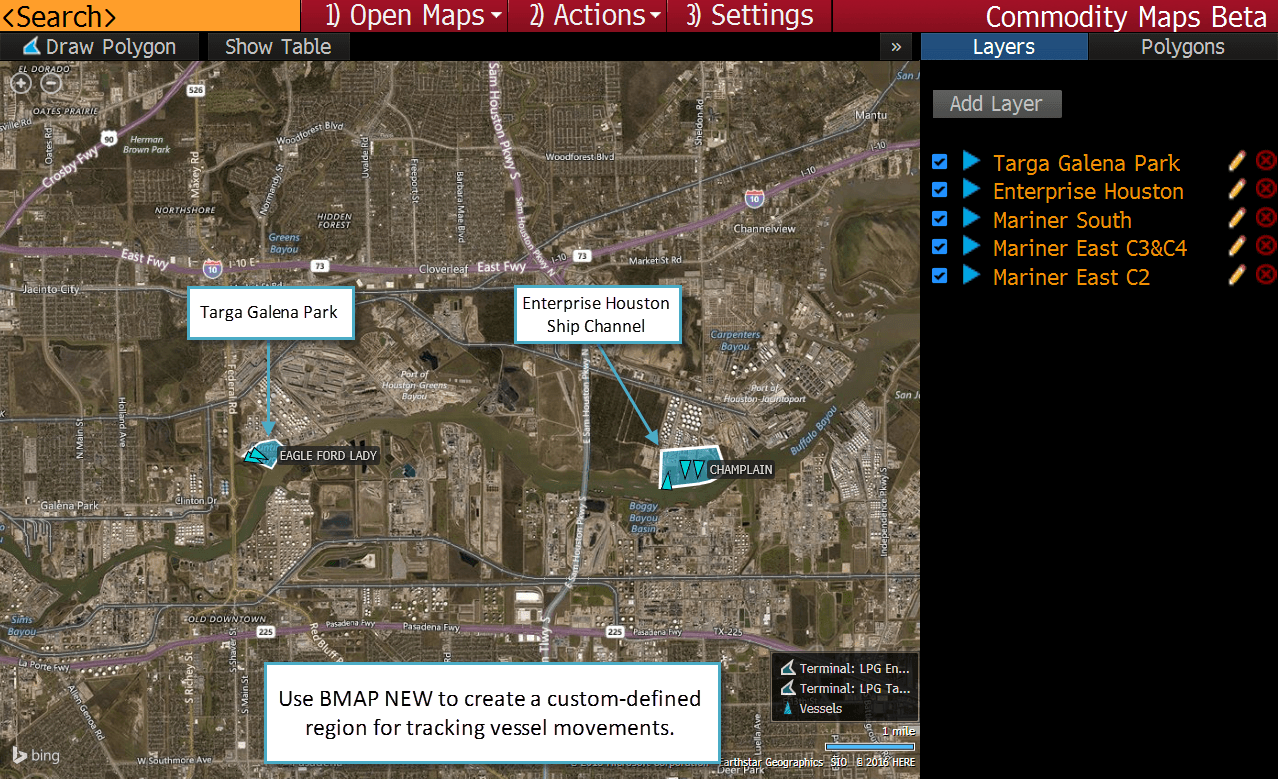

Propane, a natural gas liquid used for heating homes and making plastics, left the U.S. at the rate of 895,000 barrels per day in March. Houston is the largest LPG exporter in the country and is home to two of the nation’s largest export facilities, Targa Resources’ Galena Park terminal and Enterprise Products Partners’ recently expanded terminal on the Houston Ship Channel.

Enterprise’s new terminal can handle 500,000 barrels per day, and CEO Jim Teague remains bullish on the resource.

“Our terminal is over 90 percent subscribed through 2019, and we have contracts extending well into the 2020s,” Teague said, adding that some of those are Asian countries that previously depended on Middle Eastern propane. “We’ve signed two large contracts with Asian companies, one going to Japan and one South Korean company. These guys are looking to diversify their supply.”

Tracking LPG exports

Bloomberg functionality allows users to track the flow of oil products and assess projections of exports for energy commodities such as LPG.

Existing users can run AHOY <GO> to search US oil trade of flows for shipping vessels entering and leaving the country with cargo and BMAP NEW <GO> to generate maps that track the status of oil-related energy assets around the world.