Treasurer’s workflow: How a number can become strategy

This article is by Shan Anwar, Bloomberg Corporate Treasury Specialist. It originally appeared in Bloomberg Brief | Corporate Treasury.

Consultants have been known to tell treasury practitioners that they need a workflow that’s “standardized,” “controlled,” and “efficient.” As new buzzwords come into vogue, surely they’ll become part of this linguistic panacea. But what is a workflow, really? Consider a treasurer trying to gain visibility into their company’s cash holdings. This can be a manual process accomplished by logging into various bank portals or it can be automated.

Regardless, the result might be thought of as just a simple number, useful certainly for answering the question, “How much cash do I have?” Yet in the strategic sense, this process is the culmination of the cash lifecycle — and that’s where the workflow is pivotal.

Cash that has hit a bank account today may have been forecast some time ago as part of the company’s budget or financial planning and analysis (FP&A) process. Eventually, as the factory that manufactures the company’s product hums along, as the company’s salespeople achieve their targets, as the underlying business meets its objectives, the budget item becomes an invoice. That invoice is booked in the company’s enterprise resource planning (ERP) as revenue, against an accounts receivable item in some cases.

Workflows beget workflows. Perhaps the original forecast was in a foreign currency. Integrating a cash management workflow with risk management policies, the strategic treasurer will execute a hedge of the forecast, complying with his or her company’s risk management appetite. This hedge will be fair-valued each reporting period, compliant with IFRS or local GAAP rules. Hedge accounting, which matches a company’s risk management objectives with the company’s accounting results, may add another level of complexity to the workflow. Derivative hedges generate their own cash flow events upon settlement that need to be managed and planned for, creating a feedback loop that is the hallmark of a properly managed workflow.

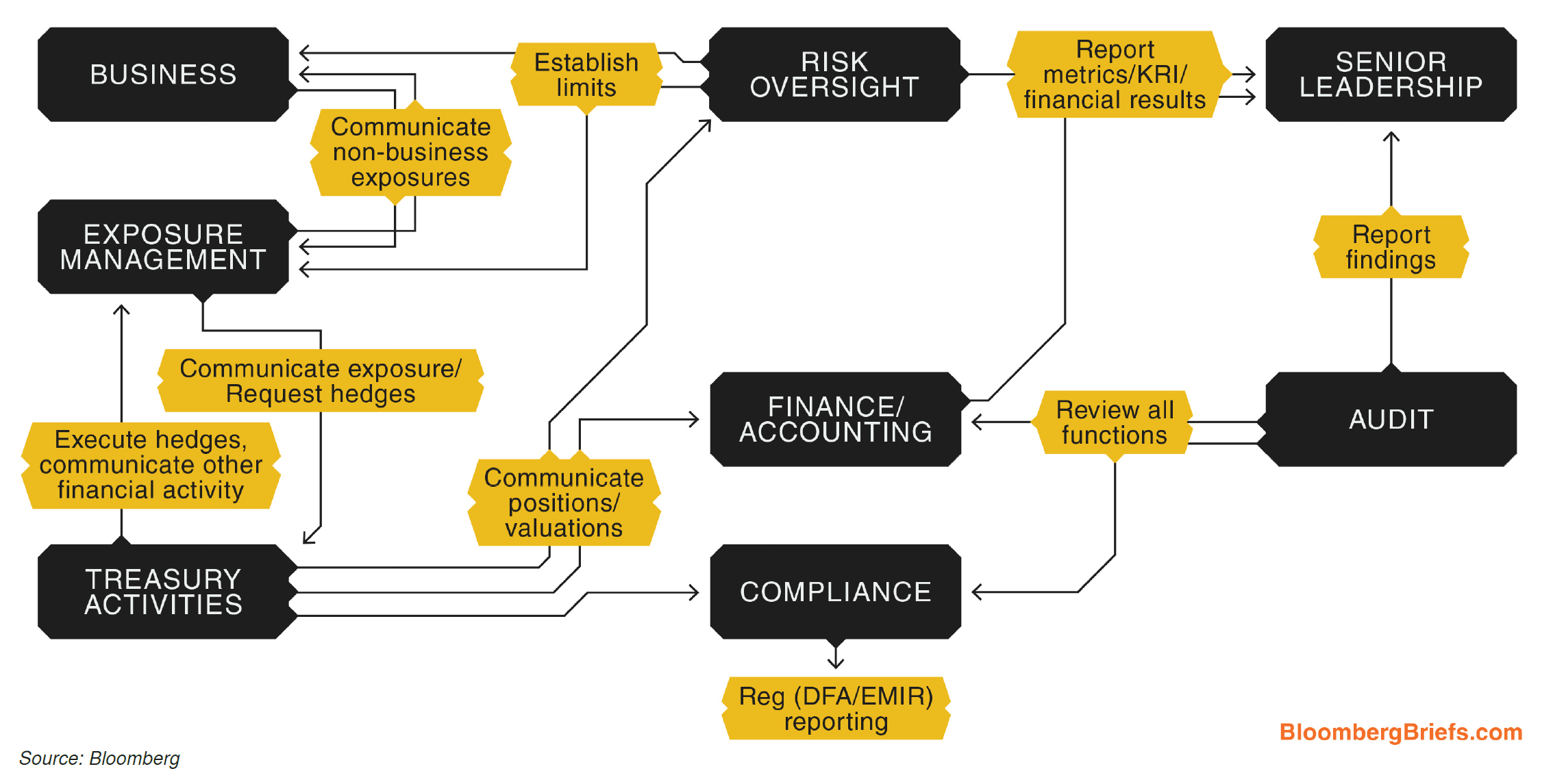

Senior management and independent audit functions will be involved with any treasurer’s workflow. Senior management helps set the tone, while audit’s core function as independent assurance helps treasury understand compliance issues before they become problems. The following diagram represents a best-in-class vision of the treasurer’s workflow, integrating all of these aspects.

In this vision, the cash that the company sees today is the end product of a long cycle of events. The treasurer is at both the beginning and the end of the workflow. By managing it properly, the treasurer can be a strategic partner as he or she decides what to do with the cash, whether it’s to be used for working capital, a strategic acquisition, simply paying down debt or parking in an investment.

Without a workflow, the treasurer simply reports a number on a bank statement. The deputy treasurer of one of the largest U.S. conglomerates said it best in a conversation with me. The treasurer chose a single-system platform for his treasury processes, forgoing the model of choosing a best-of-breed system for each aspect of the workflow. When asked why he went this route, he replied, “I want to make sure that the system I execute a trade in is the same system that accounts for it.”

Indeed, with a properly managed workflow, treasury is by definition standardized, controlled and efficient. You don’t need a consultant to tell you that.

Learn more about Bloomberg Brief | Corporate Treasury.