Are you missing VWAP because of the auctions?

This article is by Gary Stone, Tom Kingsley and Gabriel Kan.

[bps_tooltip background=”black” id=”Gabriel Kan”]Gabriel Kan is a quantitative analyst in the algorithmic trading group of Bloomberg Tradebook. He is responsible for developing algorithmic trading strategies across global markets, with particular focus on the APAC region. Additionally, he analyzes market microstructure across Equities, Futures and FX, and reviews TCA. Gabriel holds a BS in Math and MS in Financial Engineering from the University of Michigan and a PhD in Operations Research from Columbia University.[/bps_tooltip][bps_tooltip background=”black” id=”Tom Kingsley”]Tom Kingsley is Regional Manager – APAC for Bloomberg Tradebook and is based in Singapore. Tom joined Tradebook in April of 2009 and has been focused on strengthening its relationships with its buy-side and sell-side partners in Asia as well as delivering our seamless 24/7 business model to the APAC region. Tom has more than 18 years of global sales and trading experience on both the buy-side and sell-side. He joined Tradebook from Magna Securities, where he was Sr. VP of Asian Markets and head of the sales trading desk. Prior to Magna, Tom spent 11 years as Principal and Director of Trading at Simms Capital, a multi-billion dollar global equity fund. Tom holds a Bachelors of Science in Mechanical Engineering from Florida Atlantic University and a Master’s in Business Administration from Rensselaer Polytechnic Institute.[/bps_tooltip][bps_tooltip background=”black” id=”GaryStone”]Gary Stone is the Chief Strategy Officer for Bloomberg Trading Solutions and a recognized expert on cross-asset market structure. In 2014, The Trade magazine named him one of the top 100 most influential professionals in the capital markets. Gary is currently serving a two year term on the U.S. Securities and Exchange Commission’s Equity Market Structure Advisory Committee. He is also affiliated with Bloomberg Tradebook LLC, Bloomberg’s global agency broker.[/bps_tooltip]This article is by [tooltip id=”GaryStone” title=”Gary Stone” background=”black”]Gary Stone is the Chief Strategy Officer for <a href=”http://www.bloomberg.com/trading-solutions/”><strong>Bloomberg Trading Solutions</strong></a> and a recognized expert on cross-asset market structure. In 2014, The Trade magazine named him one of the top 100 most influential professionals in the capital markets. Gary is currently serving a two year term on the U.S. Securities and Exchange Commission’s <a href=”https://www.sec.gov/spotlight/equity-market-structure-advisory-committee.shtml”>Equity Market Structure Advisory Committee</a>. He is also affiliated with Bloomberg Tradebook LLC, Bloomberg’s global agency broker.[/tooltip], [tooltip id=”Gabriel Kan” title=”Gabriel Kan” background=”black”]Gabriel Kan is a quantitative analyst in the algorithmic trading group of <a href=”http://www.bloombergtradebook.com/”><strong>Bloomberg Tradebook</strong></a>. He is responsible for developing algorithmic trading strategies across global markets, with particular focus on the APAC region. Additionally, he analyzes market microstructure across Equities, Futures and FX, and reviews TCA. Gabriel holds a BS in Math and MS in Financial Engineering from the University of Michigan and a PhD in Operations Research from Columbia University..[/tooltip] and [tooltip id=”Tom Kingsley” title=”Tom Kingsley” background=”black”]Tom Kingsley is Regional Manager – APAC for <a href=”http://www.bloombergtradebook.com/”><strong>Bloomberg Tradebook</strong></a> and is based in Singapore. Tom joined Tradebook in April of 2009 and has been focused on strengthening its relationships with its buy-side and sell-side partners in Asia as well as delivering our seamless 24/7 business model to the APAC region. Tom has more than 18 years of global sales and trading experience on both the buy-side and sell-side. He joined Tradebook from Magna Securities, where he was Sr. VP of Asian Markets and head of the sales trading desk. Prior to Magna, Tom spent 11 years as Principal and Director of Trading at Simms Capital, a multi-billion dollar global equity fund. Tom holds a Bachelors of Science in Mechanical Engineering from Florida Atlantic University and a Master’s in Business Administration from Rensselaer Polytechnic Institute.[/tooltip]

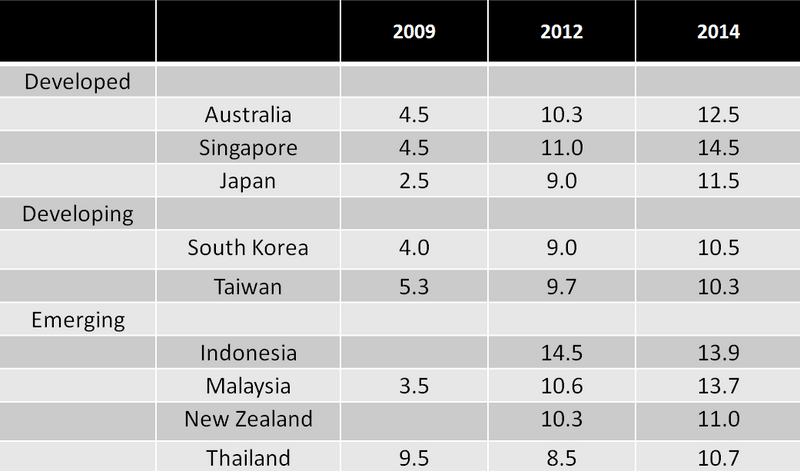

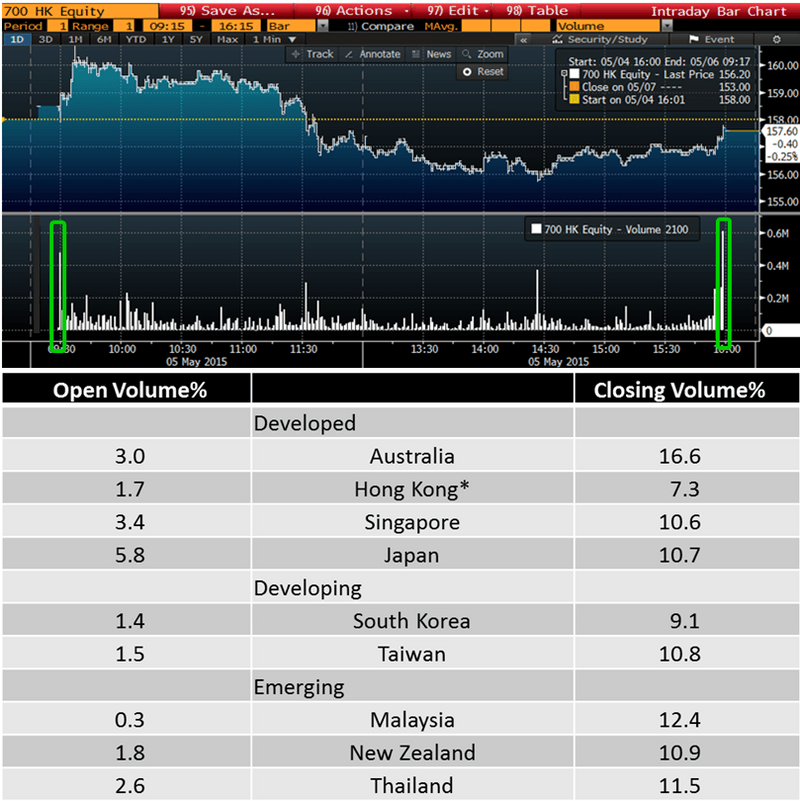

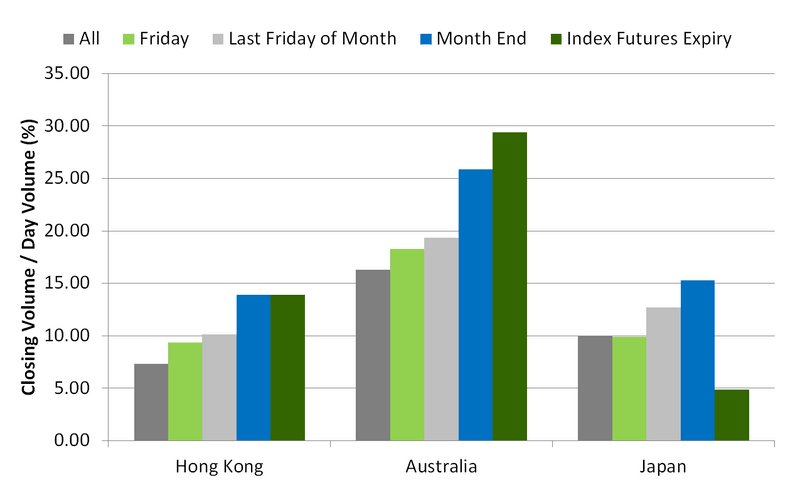

Asia equity auction volumes are growing. The data shows that closing auction volume has grown from approximately 4% in 2009 to almost 13% in 2014 (Figure 1). In fact, in Q1 2015, both the opening and closing auctions account for almost 16% of average daily volume (Figure 2). On special days—such as the last Friday of the month, month-end or index futures expiry auction—ADVs are even higher (Figure 3).

The growing importance of the auctions as a significant liquidity event has implications for portfolio managers, compliance and, of course, the equity trader.

Auctions may provide portfolio managers with an opportunity to enter or exit investments. For equity traders, benchmarked to the volume-weighted average price (VWAP) or those who are simply searching for liquidity, not participating in this volume and missing these auctions potentially puts their execution behind the eight ball. And, with more and more regulators globally consulting on the principles of best execution, compliance perhaps may need to start thinking of mentioning the auctions in their best execution policies and procedures.

*HK close volume is the last minute trading volume. Auction data period 2015 Q1.

* Close volume (last min volume in Hong Kong) as a percentage of day volume. Period Jan 2013 to April 2015

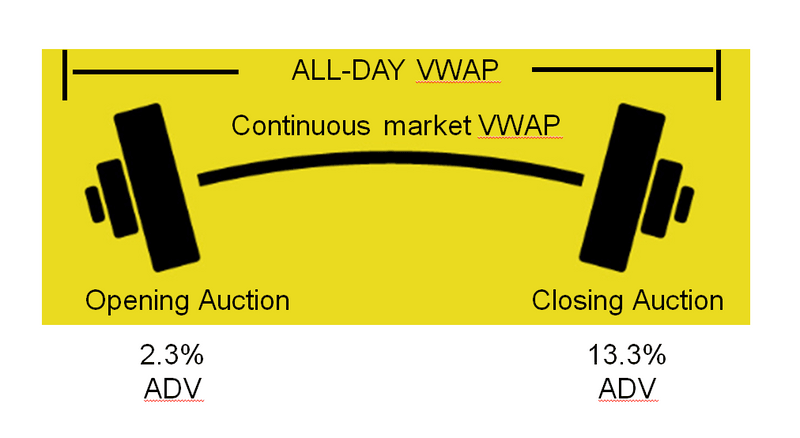

To quantify how far behind the eight ball by not participating in the auctions, we use the analogy of a barbell.

The barbell consists of two sets of weights, one on each side of the bar. The bar plus the barbells is the all-day VWAP. The weights to the left would be the “weight” of the opening auction; the weights to the right would be the “weight” of the closing auction. The bar would be the continuous market VWAP (Figure 4).

Thus, the difference in the average price between:

- The continuous market vs. the VWAP that includes the opening auction tells us the influence that the open auction has on the average;

- The continuous VWAP vs. the VWAP that includes the closing auction tells us the influence that the closing auction has; and

- The bar vs. the all-day-VWAP (the bar plus the weights) tells us the influence of the auctions in general.

What is the impact of my performance if I don’t participate in the auctions?

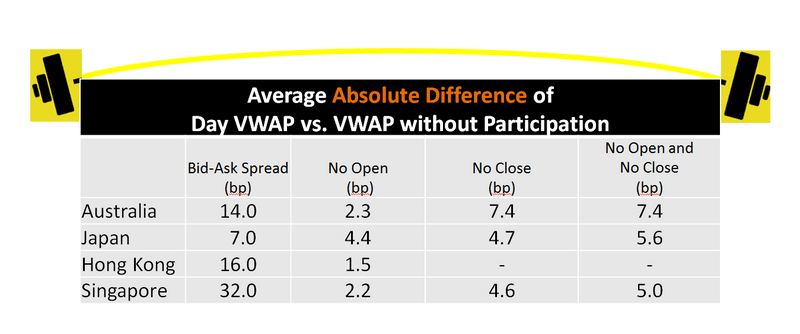

The closing auction has more volume, so it has a greater opportunity cost (potential impact on your execution). In Asia, it costs approximately 5 to 7 basis points (Figure 5). What does this mean?

The auctions provide an opportunity for the trader to add alpha from the desk

Let’s look at Japan. With a spread of 7bps, you are paying on a VWAP order 3.5bps. If you miss the auctions, you are paying 5.6bps—1.6x the VWAP performance spread. In other words, if you miss the auctions, on average, you pay more than the spread.

Clearly, the auctions represent a liquidity event that can have outsized influence on execution performance. Additionally, the auctions can also represent a significant liquidity opportunity that enables a portfolio manager to enter or exit an investment. You simply cannot ignore the auctions anymore.

The next question: How do you approach the auctions? What is the liquidity with a reasonable impact profile that is available to me? We will submit to you the “12 Percent Rule of Thumb.” Make 12% of your order (capping the size at 12% of the predicted closing auction volume) available to the auction. We will discuss the methodology and research behind the 12% next time.