Pair trading: It’s complicated – Part II

Pair and cross-asset algorithms seek market neutrality by using correlation as a key factor to managing multi-security executions. In our previous post, “Pair Trading: It’s Complicated – Part I,” we differentiated the parameters of cross-asset algorithms from standard single-stock or list algorithms. We will now explore the inner-workings of these pair algorithms in more detail.

To do better than the current market: buy lower in one leg, and/or sell the other leg higher, the algorithm needs to do better than just sending market orders in both securities. Put simply, a Buy market order executes at the opposite side ask price, or a Sell market order executes on the bid price (Figure 1). Execution can be improved by trading from their respective sides (buy on the bid, or sell at ask) to somewhere between the bid/ask spread (Figure 2).

Pair and Cross-Asset strategies are contingent orders. Meaning, certain parameters must exist for the individual security and between each security, for the algorithm to execute. The first parameter of a pair algorithm is the relative price value between two or more securities. This relative price value is the trigger that starts the pair algorithm working. However, a pair algorithm needs to do better than just sending single orders to the market, the algorithm also needs to:

- Execute inside the bid/ask spread for each order,

- Sequentially execute two or more orders that capture or improve the relative price execution between each security, and

- Execute the required number of shares for each leg on a pro-rata basis

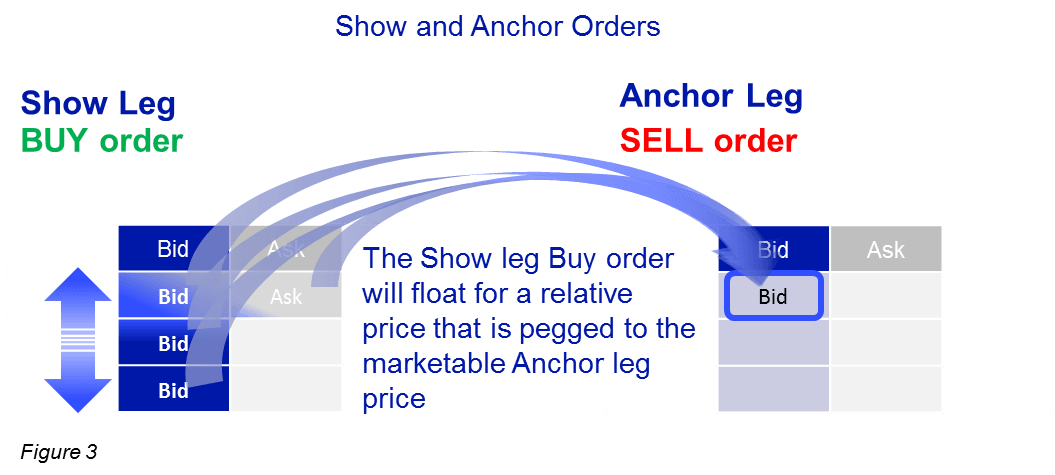

We can illustrate by using the show leg and anchor leg concept of pair algorithms.

A show leg is the first order sent at a price defined by the relationship between the two securities, and the marketable anchor price. A sequence of events would be:

- The Show leg Buy order will post on the bid side, or pay the ask to get filled

- After the Show leg Buy order is filled, then the Anchor leg Sell order is sent to be filled

- Repeat

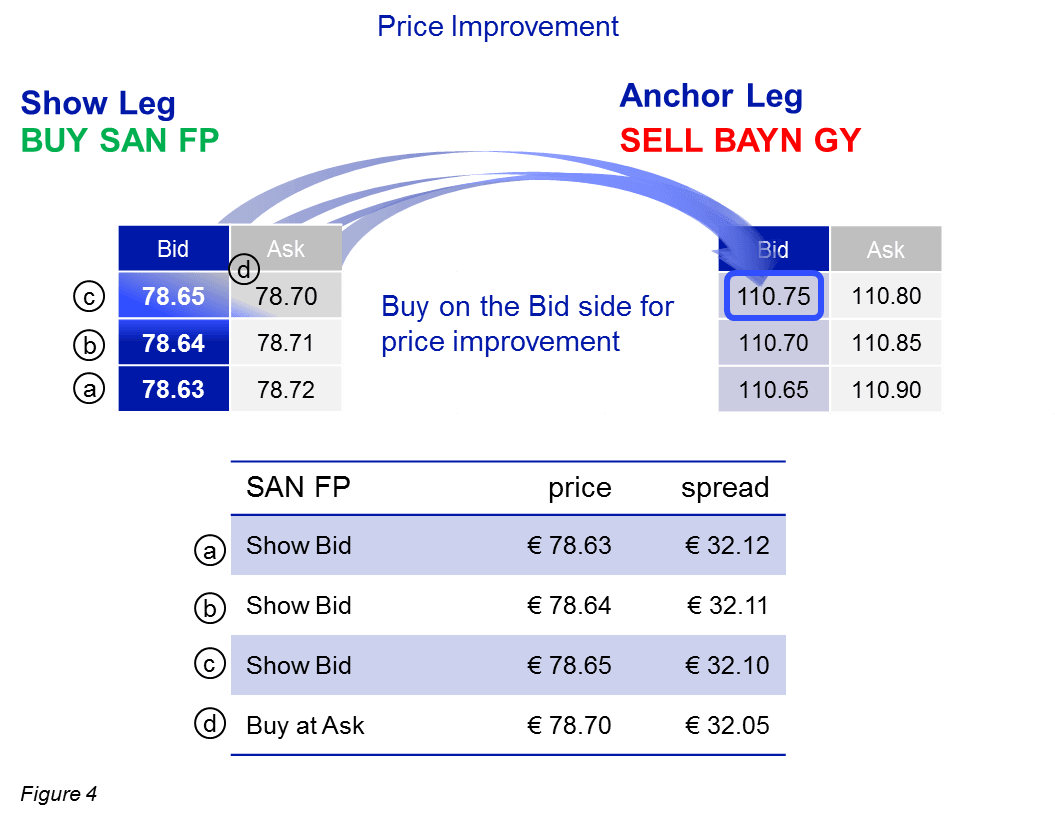

Let’s take an example (Figure 4): Buying Sanofi [SAN FP] and Selling Bayer AG [BAYN GY]. The spread that we would like to capture between the two securities is €32.05 or better (BAYN GY price – SAN FP price = €32.05).

Given the displayed BAYN GY Bid price of €110.75 for the Sell Anchor leg, we can pay up to €78.70 for SAN FP (€110.75 – €78.70 = €32.05). The algorithm could start with a passive Buy order for €78.63(a) in SAN FP, then move up each price level (b, c), until ultimately paying €78.70(d) that would still capture the €32.05 spread we wanted. Starting the Show leg on the passive side allows for price improvement in the execution.

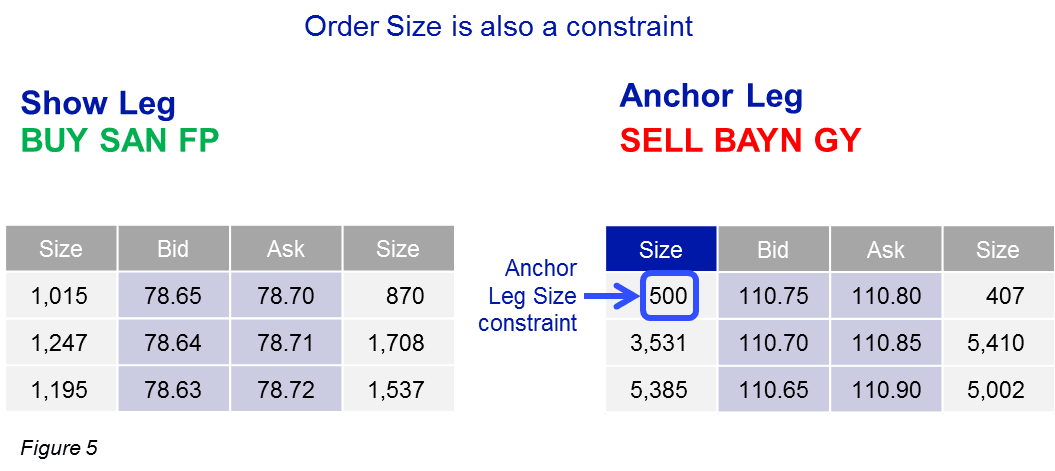

Size is another important parameter for pair algorithms (Figure 5). To be able to execute a relative value trade, volume must be available for each security. Let’s assume we want to execute the same number of shares for SAN FP and BAYN GY. If there are only 500 shares displayed on the bid side for BAYN GY (Anchor Leg), then the algorithm will only post an order to Buy 500 shares of SAN FP with the Show Leg.

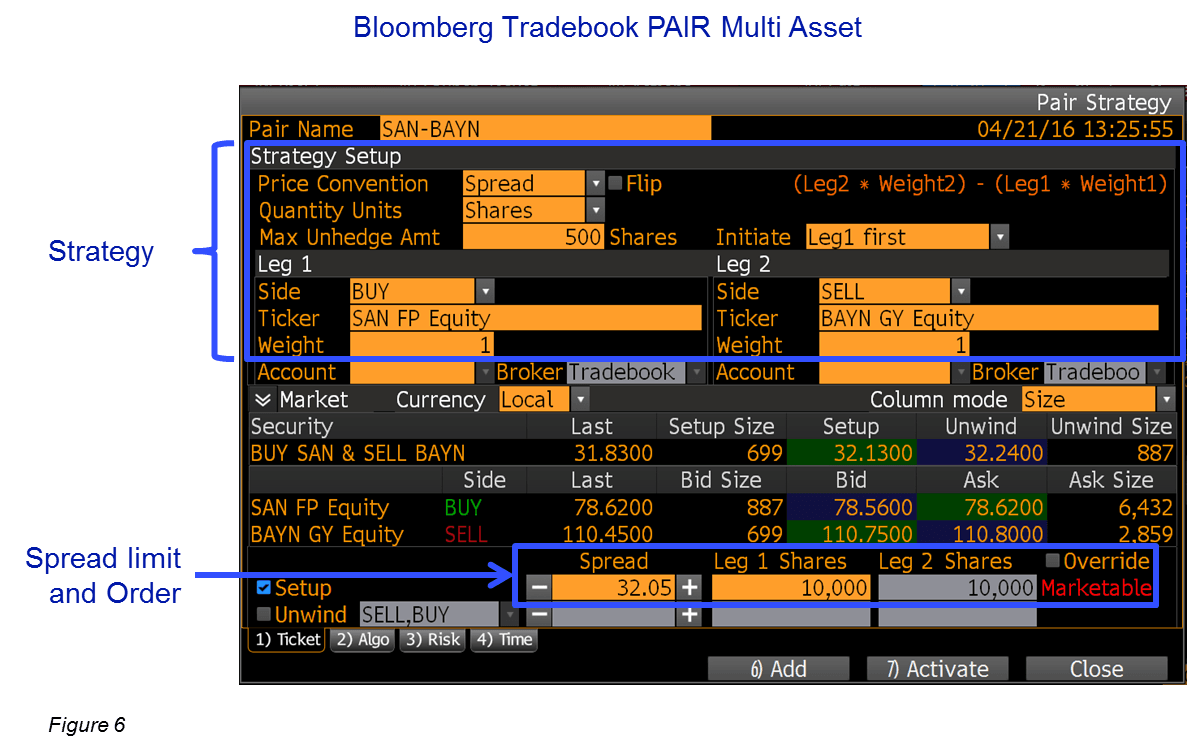

Traders using the Bloomberg Tradebook PAIR Multi-Asset platform (Figure 6) can execute these strategies and control the parameters we have described. After defining the strategy and entering the order details, the trader then applies their spread limit and order size controls to activate the strategy.

In our next installment of this series, we will provide the comprehensive electronic solutions available to integrate the Bloomberg Tradebook PAIR Multi Asset platform with your EMS and OMS workflows.