Behind stock price movement IV: Classification of stocks based on bid-ask spread

This blog is the fourth and last installment outlining our Stock Price Movement Journal of Trading paper published by our quantitative research team.

In the previous parts of this blog post series, we introduced a model that explains stock price movements based on market imbalances. This model reveals interesting characteristics of stocks. For some stocks the quote imbalance is the dominant factor that dictates the price movement, and for others the trade imbalance is more significant.

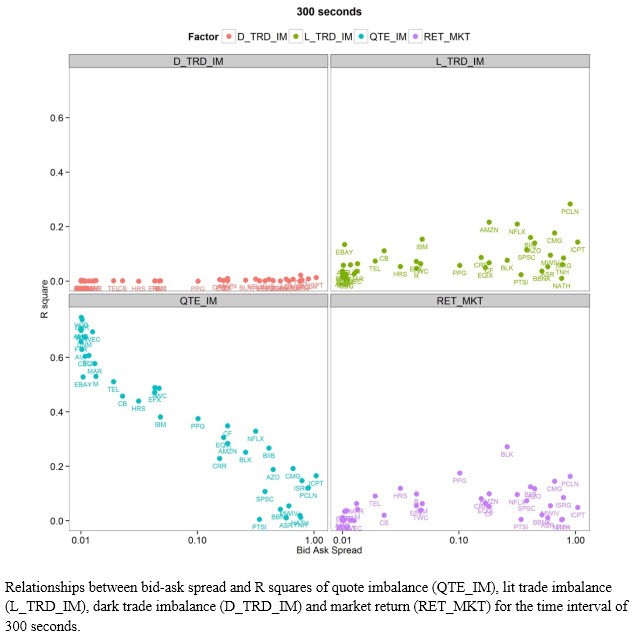

What determines this classification between quote-driven and trade-driven stocks? The determining factor turns out to be the bid-ask spread. As illustrated in the figure below, as spread widens, the quote imbalance loses its explanatory power (indicated by R2) and the trade imbalance gains its. Narrow-spread stocks are quote-driven and wide-spread stocks are trade-driven.

We speculate two possible explanations.

- For wider-spread stocks, liquidity takers pay higher transaction costs, and therefore must be more prudent. Consequently, trades of such stocks would be interpreted by the market as containing more information.

- In order to avoid higher spread costs, more trades occur within the spread via hidden order types or in dark pools. These trading activities are captured by the trade imbalance, not the quote imbalance. Thus the quote imbalance explains less of price variation.

In summary, our study indicates that the majority of short-term stock price movements can be explained in terms market imbalances. We also find that stocks can be classified as either quote-driven or trade-driven and that the determining factor of this classification is the bid-ask spread. These are interesting results to traders and algorithm designers who attempt to control their footprints in the marketplace.