Short stock? How to save on equity borrow costs in the options market

Statistical arbitrage, merger arbitrage and just plain “hater” strategies involve selling in anticipation of a decline in the price of a stock. Because U.S. SEC Regulation SHO requires short sellers to locate where they can borrow stock prior to selling the shares in the market, most traders naturally look to the stock loan market for rates at which they can borrow the stock. Stock loan is not the only market to determine borrowing costs, however. Equity short sellers should also look at the options market to see if, via an options strategy, they can generate alpha by saving on their borrowing costs.

Put-call parity tells us that puts and calls should have the same premium less the carry. Buying a put option and selling a call option with the same strike and maturity in the option market is comparable to short selling stock and borrowing it at a fixed rate (cost) to the option expiry date.

The implied carry cost is:

[price of the call – price of the put +the strike – stock price]

The simplified implied borrowing rate is the annualized carry cost calculated on a 360-day basis:

[carry cost / strike price * 360 / # days to expiry]

The implied borrowing rate can be compared with stock loan rates to determine if traders can generate alpha by doing the “borrow” in the options market. Borrowing rate differentials occur in the options market because stock loan rates are determined, in part, by relationships and access to inventories as well as by supply and demand. The stock loan market tends to be an overnight borrowing market because lenders have daily variations in their inventories. Stock lenders will, therefore, place a risk premium on term borrows—where the borrower of the stock is seeking to lock in borrowing costs on a specific stock to a specified date.

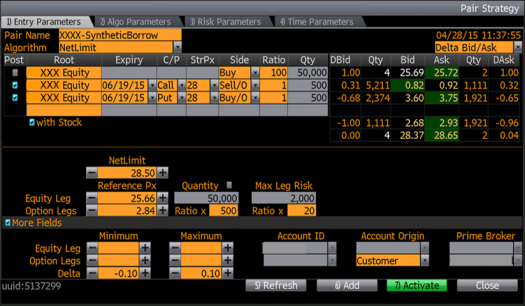

Most traders involved in short selling strategies will locate and then short the stock. Of course, when there are wide differentials, traders could enter the options market with the put-call (combo) strategy. However, when either it makes sense to lock in desirable term rates or reduce reliance on borrowing sizes, traders can buy back their stock short while simultaneously selling the call and buying the put. Both the two-legged put-call and the three-legged put-call-stock (Figure 1) strategies can be algorithmically managed on multi-asset class execution platforms like Bloomberg Tradebook’s PAIR.

In this example, the trader is looking save on borrow costs by 4.70%. The trader, who is already short the stock, would simultaneously buy back the short and use options to replicate that short. Let’s assume that there are 48 days to expiry and the borrow rate being quoted is –18.09%.

The implied carry cost is:

[premium (bid) of the call – premium (offer) of the put + the strike – stock price]

[0.9 – 3.70 + $28.00 – $25.70] = –0.5

The implied borrowing rate is the annualized carry cost calculated on a 360-day basis:

[carry cost / strike price * 360 / # days to expiry]

[–0.5 / $28.00 * 360 / 48] = –13.39%

In this example, the 470 bps implied rate differential may suggest consideration for the options strategy. A Tradebook execution consultant can help you fine-tune the calculations and describe the strategy in more detail.

Looking cross-asset to the options market can provide liquidity opportunities for traditional equity players. As we explained in our March 16 post “Equity Traders Looking for Stock Liquidity Can Find It in the Options Market,” traders wishing to borrow stock should consider looking to the options market for stock loan bargains.

Options trading involves substantial risk and is not suitable for all investors. This post is written for educational and discussion purposes for qualified institutional investors only. You must speak with an execution consultant about how to use options situations and execution algos to aggregate stock liquidity and to determine if options and this strategy are right for you, your firm and your investment goals.