Benefits Of Treasury Centralization

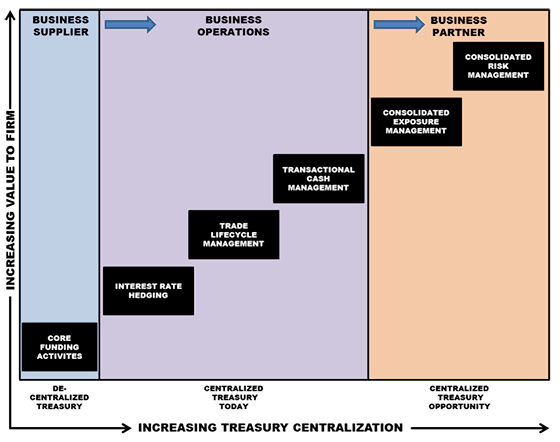

Historically, corporate Treasurers have only been responsible for their firm’s core funding activities. Treasurers in this context were funding suppliers to the firm’s constituent business lines, and their ability to add value to the firm was limited.

As the business environment has become more complex, however, some firms and their treasuries have evolved as more and more activities become centralized within Treasury operations. Funding activities requires tools to hedge issuances. Hedging activities requires an infrastructure to be able to execute and monitor trades. Globalization requires that cash is managed across various currencies with diverse banking partners. Regulatory burdens have increased since the financial crisis, requiring cross-border management of the varying regulatory regimes.

Although the role of Treasury under today’s centralized model enables Treasurers to add increasing value to their businesses, there remain opportunities for Treasurers to maximize the value they add to their firm and, in turn, maximize the firms’ value overall.

Why centralize in the first place?

Centralization, as practiced today, eliminates duplication of effort across the firm. For example, centralizing hedging and trading operations eliminates the need for each business line to have their own traders and trade lifecycle management resources. Agreements with counterparties are streamlined, reducing the operational burden of managing different external agreements and associated KYC requirements for different legal entities within your own firm.

Centralized cash management can provide similar efficiencies. Banking relationships can be optimized across the regions and partners with which a firm transacts. Central management of bank-to-bank payments increases the controllership over these transactions, reducing interest and other claims against the firm.

Barriers to centralization?

Why don’t more corporates centralize Treasury operations today? Some corporates may find that a “hybrid” approach works better for their business – for example, subsidiaries are tasked with identifying exposures related to their line of business and then request head office operations to execute hedges.

The largest impediments to centralization, however, are technology limitations. Although Treasury activities are linked with each other, few systems offer the wing-to wing capability of connecting cash management with hedge management, requiring manual touch points or interfaces and manipulation of data. Many Treasuries manage forecasted cash exposures within spreadsheets, for example, making the aggregation of exposures at the consolidated level a time-consuming and error-prone process. Those systems that do offer this functionality are expensive, with implementation taking months or years.

Optimize benefits of centralization

Those corporates that have achieved some level of centralization can take the opportunity to reflect whether their operations have been optimized – in effect, transforming themselves from serving as business operations to becoming business partners. Best-in-class treasuries will ask themselves:

1. Do I look at my firm’s cash transactionally or holistically.

- Holitstic cash management – a complete view of bank balances, short-term liquidity needs (through A/P or A/R, for example) and long-term cash forecasts allows optimization of banking relationships and enhancement of return on cash through cash pooling and target balance management.

2. Do I have a complete view of my firm’s financial exposures?

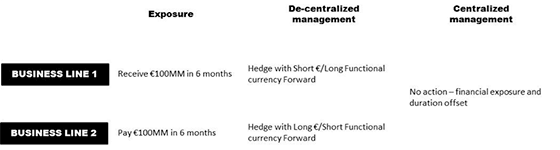

- Holistic cash management leads to having a consolidated view of exposures. Treasurers can then take action to mitigate the risk of their exposures through hedging actions efficiently by netting exposures, for example.

3. Are my hedging activities executed efficiently?

- Electronic trading of OTC derivatives reduces execution costs. Solutions such as SWIFT connectivity allow confirmation and settlements to occur automatically.

4. Am I able to use risk management tools to mitigate the entire universe of risks to the firm (e.g., market risk, credit risk, operational risk, compliance/regulatory risk)?

- Understanding and defining a firm’s risk appetite is the first step to using risk management tools effectively. Once this is accomplished, best-in-class firms integrate their risk policy into their execution systems – exposure limits, trader limits, counterparty credit limits as well as ensure compliance with regulatory requirements.

5. Simply stated – How much time do I spend on information gathering vs information analytics?