Purging the market order – A dangerous and outdated order type in the modern market structure

The Broker Is Responsible For Protecting The Customer’s Order In The Marketplace

In all of the debates and rhetoric surrounding the dangers of electronic trading, the industry has lost sight of the simple obligation of the broker to protect the customer’s order. The market structure has changed dramatically over the past three years, making the market order outdated and risky. As part of risk management and our long-standing position that the broker is responsible for protecting the customer in the marketplace, we have replaced the exchanges’ continuous trading market order types with limit orders based on price movement bands.

The Market Structure Is, On Average, Stable

Although our research shows that, on average, the markets are generally stable, we believe that, more than at any other time, the market is now dominated by a “thin crust” of liquidity and, once that crust is pierced, orders may experience liquidity gaps. Contrary to what some in the market are saying , Bloomberg Tradebook’s quantitative research shows that, on average, that “crust” isn’t pierced often. However, the stocks affected and the time of the day “liquidity gaps” occur are quite random. During times of extraordinary market events/stress (e.g., Greece default/Flash Crash), the thinness of the “crust” becomes particularly apparent.

Research by Bloomberg Tradebook’s quantitative research group supports the views of Greg Bergman, head of the SEC’s Office of Analytics and Research. At a June 18 conference sponsored by the Securities Industry and Financial Markets Association (SIFMA) he expressed, “. . . concern that American stock markets have become more susceptible to split-second crashes due to computerization isn’t supported by the data.”

A recent Bloomberg news article also asserts that, “Most ‘mini-flash crashes,’ a term sometimes applied when an individual U.S. stock briefly surges or plunges for nonobvious reasons, are the result of human error, not broken software.”

Analysis of Mini-Flash Crashes In The U.S.

Our quants looked at 5,858 U.S. NMS stocks priced more than $1 from January 2013 to June 21, 2013. They found that , there were only, on average, 68 instances per day (in 49 unique stocks) that experienced price moves of more than 5% in a 15-second period each day. The problem is not as rampant as some would try and lead Congress, the press and policy makers to believe.

| Price Range of the Stock |

Number of Instances (daily average) | % of Population |

| $1.00–2.00 | 24 | 36% |

| $2.01–10.00 | 33 | 48% |

| $10.01–50.00 | 10 | 14% |

| >$50.01 | 1 | 2% |

n fact, the quant group found the liquidity gaps are, on average, confined to mid- and small-cap stocks (not surprising)—62 of 68 random instances occurred in a stock that had an average daily volume of less than 1 million shares. These are not the stocks that electronic market making and statistical arbitrage strategies typically operate in (further supporting Mr. Berman’s analysis).

Market Orders Still Need To Go

Although the “liquidity gaps” appear to be infrequent, highly random events, it is still a risk management issue that needs to be addressed. Brokers need to protect orders so that traders’ execution strategies do not cause such an event as well as protect their order if they are trying to execute during an event.

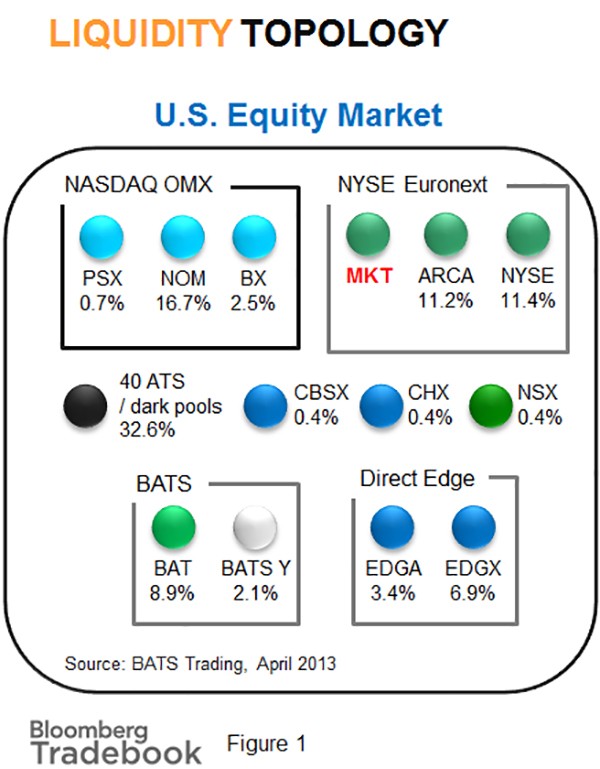

Theoretically, the concept of the market order is “I am willing to buy (sell) this stock at any price.” The market order is a dangerous and outdated order type in a fragmented market structure with no dominant exchange (Figure 1).

Why do stocks go to zero? Why do stocks go to the moon? Because the market order says to take them there – “Get me done at any cost!” Market orders may not be the only reason stocks “mini-crash,” but it is our belief that they may be a contributing factor. As part our obligation to protect the customer’s order, Bloomberg Tradebook is eliminating the market order. Now, for exchanges that do not support market orders or have protection in place, we have converted our market orders to proprietary TB Market order types, which feature price movement bands.

Ron Taur has been with Bloomberg since 2007. As the head of algorithmic trading for Bloomberg Tradebook, he is responsible for the design of the algorithmic trading products and quantitative research. His research interests include high frequency trading, global market microstructure, smart order routing, and dark pools.

Gary Stone has been with Bloomberg since 2001. As Chief Strategy Officer, he is responsible for the discovery of innovative and unique products and forming strategic relationships for Tradebook. He began as a Senior Analyst before being named Director of Trading Research & Strategy in 2004, adding Tradebook development to his responsibilities in 2007.