APAC ex-JP

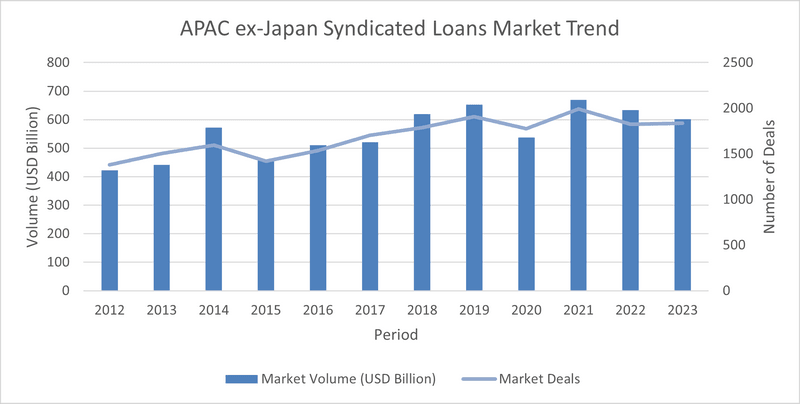

Continuing its downward trend since 2021, the APAC ex-Japan syndicated loans market volume in 2023 saw a 5.1% drop compared to 2022. A total of USD 601.6 billion was issued this year across the region, with almost half of the issued loans for refinancing purposes (22%) and capital expenditures (21%).

The market saw highest borrowing demands from China, Australia, and South Korea, which accounted for 37%, 13% and 10% of the regional deal volume respectively. It is worth noting that despite the muted growth, India borrowers showed a significant increase in borrowing activities with more than 75% year-on-year growth in volume. That being said, the India borrower market saw total borrowing activities worth USD 40.3 billion-equivalent (INR 3,347.9 billion), surpassing its pre-covid volume bank in 2019.

Across APAC ex-Japan, the 3 largest issuances syndicated this year were to HPCL Rajasthan Refinery Ltd for a USD 5.94 billion-equivalent dual currency INR-USD facility, Basf Integrated Site Guangdong Co Ltd for a CNY 40 billion deal and Alibaba Group Holding for a USD 4 billion deal priced at 80 bps over Term SOFR.

This year, Bank of China leads as the top bookrunner and mandated lead arranger, followed by bookrunners HSBC and Agricultural Bank of China, and mandated arrangers Industrial & Comm Bank of China and KB Financial Group Inc. As for the newly released APAC ex-Japan ex-CNY Loans League Table, HSBC, KB Financial Group Inc and ANZ Group Holdings are the top 3 bookrunners and KB Financial Group, DBS and Bank of China are the leading mandated arrangers.

Greater China

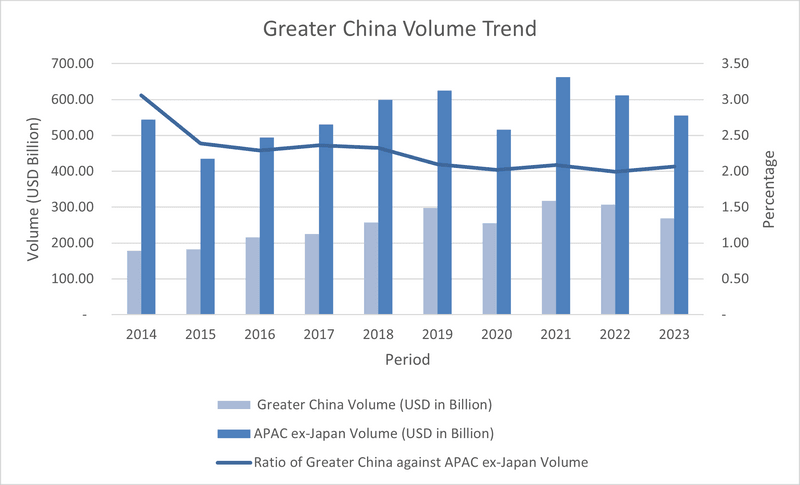

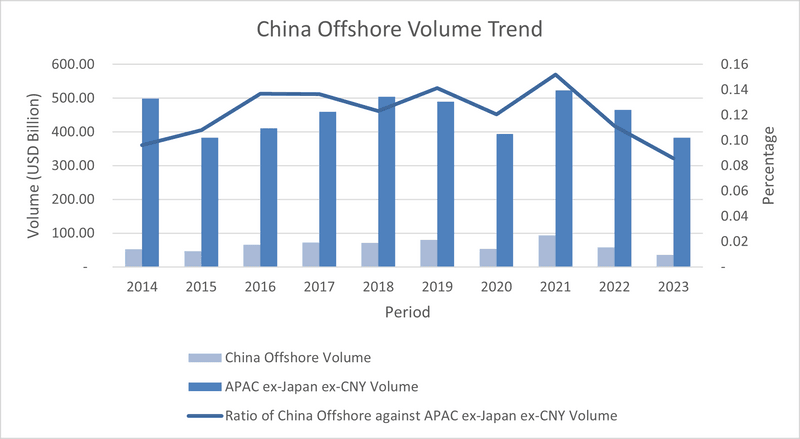

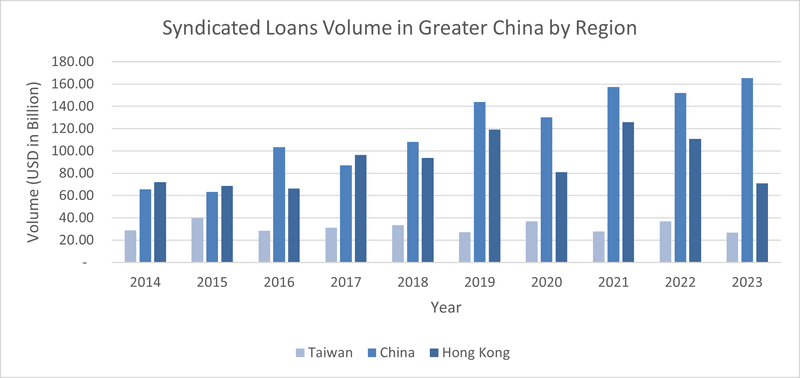

Syndicated lending in Greater China dropped by 12.36% year-on-year, with a total issuance volume of USD 269.17 billion in 2023. The ratio between China Offshore and APAC ex-Japan ex-CNY League Table volumes saw a 2.55% decrease in comparison to FY2022, marking record lows in issuance volume over the past 10 years. Looking at individual markets within Greater China, while Hong Kong and Taiwan experienced significant drops in issuance, the loan transaction volume in China has increased by 8.76% year-on-year, marking a record high in the last ten years. The interest rate hike this year by the Federal Reserve increased the cost of overseas funding and resulted in a large interest rate differential between the Renminbi and the US dollar. As a result, the APAC ex-Japan market saw higher issuance volumes denominated in RMB than USD for the first time in recent years, and the China onshore lending volume increased by 16% while offshore China loan transaction volumes fell by 38% year-on-year. Syndicated lending volumes in Hong Kong, a major offshore center, dropped significantly by 26% from with the previous year.

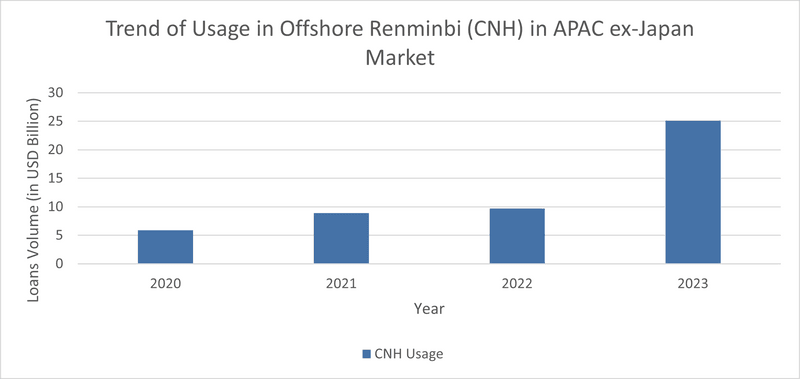

In terms of currency, due to the active syndicated markets in India and Southeast Asia, the use of local currencies increased compared with the previous year. It is worth noting that with the issuance of Circular No. 27, Chinese banks can participate in more overseas financing and loans to promote the internationalization of RMB. In the APAC ex-Japan, the use of RMB (CNY) in 2023 has reached a record high in the past 10 years, totaling approximately USD 2,514 billion-equivalent across the region. A significant increase in the usage of offshore renminbi (CNH) was also observed, with the lending volume 2.6 times higher than the previous year.

ASEAN

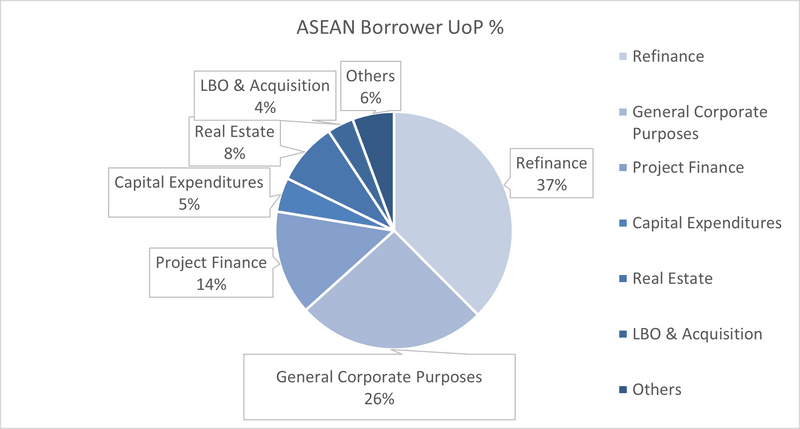

Syndicated borrowing amongst ASEAN borrowers YTD remained consistent with the activity level seen in 2022 with a modest 3.3% increase YoY, totalling USD 118.5 billion. The region outperformed the rest of APAC ex-Japan, with the sole exception of India. Despite the weak supply of loans in the Greater China region, ASEAN borrowers showed high appetites in refinancing (37.5% vs 31.2% of APAC ex-JP loans), general corporate purpose loans (25.8% vs 13.4%) and project finance loans (14.2% vs 11.0%) in 2023. As the global economy ubiquitously anticipates a policy pivot in 2024 from the current high interest rates, the already strong demand from ASEAN borrowers this year provides a solid foundation for a hot market in 2024.

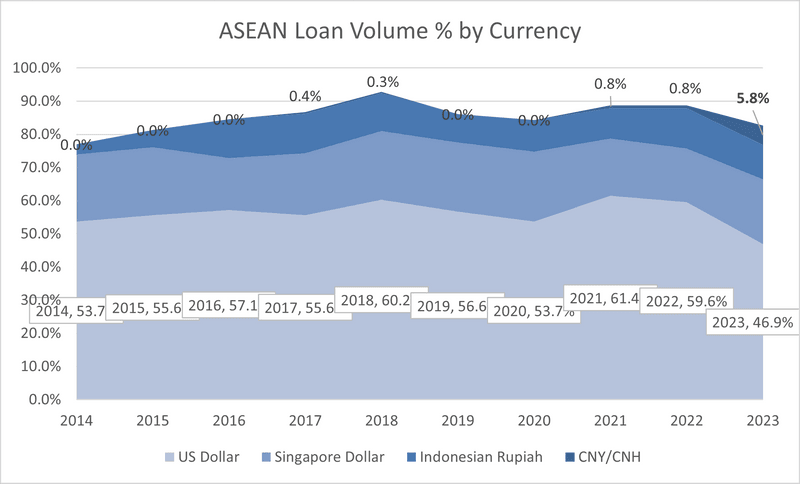

The high US dollar policy rate tested the regional dollar loan demand resilience. The rates appear to have pushed regional borrowers to secure financing in other currencies. By Q3 2023, Bloomberg data showed that the percentage of syndicated loans denominated in US dollar amongst ASEAN borrowers was down 12.7% Year-on-Year and at the lowest level in 10 years. With the expected rates pivot in 2024, the extent of dollar loan issuance recovery would be worth looking out for.

The 3 largest corporate syndicated loan issuances in the region in 2023 were Trafigura Pte Ltd for a USD 2.73 billion equivalent dual currency CNH-USD facility, Vitol Asia Ptd Ltd for a USD 2.60 billion facility, and CIP V Singapore Holding Pte Ltd for a CNY 16 billion facility. Among the mandated lead arranging banks, DBS maintained the top spot from 2022, followed closely by Oversea-Chinese Banking Corp and United Overseas Bank, making up market shares of 8.64%, 7.31% and 7.04% respectively. Among the bookrunners, SMBC claimed the top spot, followed by DBS and United Overseas Bank, with market shares of 7.82%, 6.70% and 6.64% respectively.

ESG

2023 has seen the lowest volume of sustainability-linked loans issuance since 2020, closing the year with USD 40 billion issued across the APAC ex-Japan region, a 44% drop from the $72 billion issued in 2022. This slump follows a period of rapid growth during the pandemic, with rising challenges around reporting transparency and potential for greenwashing. Innovations such as “sleeping” sustainability-linked transactions in which ESG targets are not disclosed until a later date during a loan agreement, have raised questions about the eligibility of certain loans to be classified as ESG debt. However, 2024 is expecting to see a pick-up in volume as roughly $27 billion SLL are set to be due across the region and may seek refinancing.

Across the APAC ex-Japan markets, most syndicated lending volume for SLL came from issuers based in Singapore (20.32%), China (17.50%), and Australia (13.37%). In terms of sustainability targets, Greenhouse gas emissions continued to be the most popular KPI (50%), followed by Gender Equality (19%) and Water consumption (15%). The Airtrunk deal syndicated for AUD 4.7 billion was the largest SLL of the year, attracting more than 30 banks and credit funds. The loan’s key performance indicators include carbon usage, power usage, water usage, gender diversity, and gender pay parity. HSBC leads as the top bookrunner for SLL issuance across the region this year, followed by Standard Chartered and China Merchants Bank. Among the mandated lead arrangers, Bank of China takes the top spot with Standard Chartered and DBS in second and third.

Syndicated lending for Green assets and projects totaled USD 30 billion in 2023, a 27.3% decrease in issuance volume from 2022. Singapore borrowers (32%) continued to issue the most green loans within the region, followed by Australian (17%) and Taiwan (16%) borrowers. Renewable energy projects (49%) dominated amongst the ESG project categories, followed closely by Green buildings and infrastructure (38%).

Most notable in the renewable energy space are the Hai Long Offshore Wind Power (USD 3.6 billion-equivalent loan) and Yunneng Wind Power (extension of USD 2.7 billion-equivalent loan) projects, both of which aim to build wind farms and wind power generation infrastructure in Taiwan. Within the green buildings and infrastructure space, deal to note is the USD 1.6 billion loan issued to Boulevard Development Pte Ltd. The Boulevard Midtown development of residential and hotel components at Marina View in Singapore is expected to achieve a Green Mark certification by the Building and Construction Authority. UOB leads as the top bookrunner and mandated lead arranger in green loan issuance this year, followed by bookrunners Mizuho Financial and ANZ Group Holdings, and mandated arrangers DBS and OCBC.