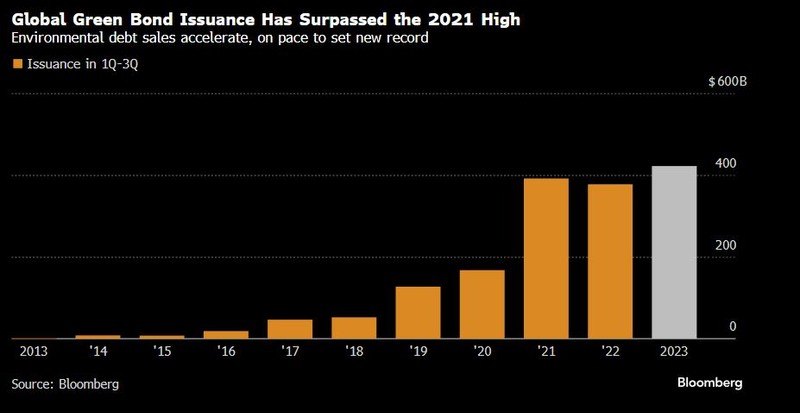

Global green bond issuance accelerates to record-setting pace

Global green bond sales are on track for the biggest year ever, largely propelled by government issuance.

Sales for green bonds, the largest sustainable debt category by volume, totaled $43.9 billion in September, according to data compiled by Bloomberg. That pushes the total issuance to $422.97 billion for the first three quarters of this year.

There’s been significant growth year-on-year in the supranational, sovereigns and agencies part of the market, according to Philip Brown, global head of sustainable debt capital markets at Citigroup Inc. “The growth in the market overall in the first three quarters of the year has been primarily due to public sector issuance and sovereigns in particular,” he added.

The outperformance is mostly led by Europe, outpacing last year’s total issuance by 33%, according to BNP Paribas SA, the market’s biggest underwriter. That means climate-friendly bond sales are now closer than ever to the bank’s forecast of $600 billion by the year’s end.

The Inflation Reduction Act in the US has spurred a lot of investments, said Anne van Riel, BNP’s head of sustainable finance capital markets for the Americas. Some of it will get financed by the public bond market.

The European Union taxonomy, a classification framework of environmentally sustainable economic activities for investors, has also driven sales.

“We see much more demand from European investors for labeled transactions, so they can put it in their ESG funds and there’s increasingly more clarity on what that should look like,” van Riel said. “And issuers have been responding with green-labeled bonds to satisfy that demand.”

Additionally, green, sustainable, social and SLB bonds beat 2021 history in number of issues so far this year. The market has seen 2,599 issues with total volume at $729.9 billion for the first three quarters, according to data compiled by Bloomberg. The World Bank Group is the leading party for ESG issues.

It’s a turnaround from 2022, where general corporate markets were taking a hit. But the rebound now is boosting the ESG-labeled markets, according to van Riel.

“Last year was a rough year for flows, but flows out of sustainable products weren’t as bad as non-sustainable products,” said Stephen Liberatore, head of ESG and impact, global fixed income at Nuveen. “This year you’ve had additional flow into sustainable products that is greater than non-sustainable products.”

BNP says they see a lot more green issuance coming. The bank’s outlook is panning out, and “this is just the tip of the iceberg,” said van Riel.

She cited investments across renewable energy, battery manufacturing in EVs and the transmission lines to accommodate all the new renewable energy coming online.

“Those are really the big trends that we’ll continue to see,” van Riel said.