Taking the uncertainty out of CLO analytics

The collateralized loan obligation (CLO) market suffers from several misconceptions.

The first is that it is a small, risky corner of the financial system. In fact, more than US$ 850 billion is invested in the US CLO market alone. Europe’s accounts for another $207b. In total, the global CLO market is comparable in size to some of the better-known asset-backed securities markets, including those that package home loans and auto loans.

Also, the CLO market is not too risky to deter some of the biggest names in finance. Blackstone, Carlyle and Apollo are among the more than 170 asset managers that oversee CLO vehicles, structures that buy and sell the leveraged corporate loans that make up the asset pools underpinning the securities.

On top of that, there are at least many hundreds of institutional holders of CLO assets listed on Bloomberg’s databases, and there are even CLO-focused exchange traded funds that are bringing the asset class to a wider audiences including retail investors.

The reason why fewer people know of CLOs compared with other ABS markets is attributable to a second misconception.

There is a concern that the market is a black hole; CLOs can draw in money with ease but little data or information emerges from them, making investment and risk assessments difficult. Certainly, as aggregated securities that are issued privately, they are more difficult to research than publicly traded assets.

But technology and data has helped redress that, and Bloomberg is at the heart of this analytical change, providing a depth of transparency into CLOs that eliminates some of the uncertainty around investing in the assets.

Underlying loans

CLOs are complex. Backed by bundles of largely speculative-grade corporate bonds and then issued in tranches according to their level of risk, they need to be analyzed from many perspectives. The performance of the underlying loans can be influenced, like other assets, by a multitude of factors financial and non-financial. The behavior of these loans impacts the aggregated security’s performance.

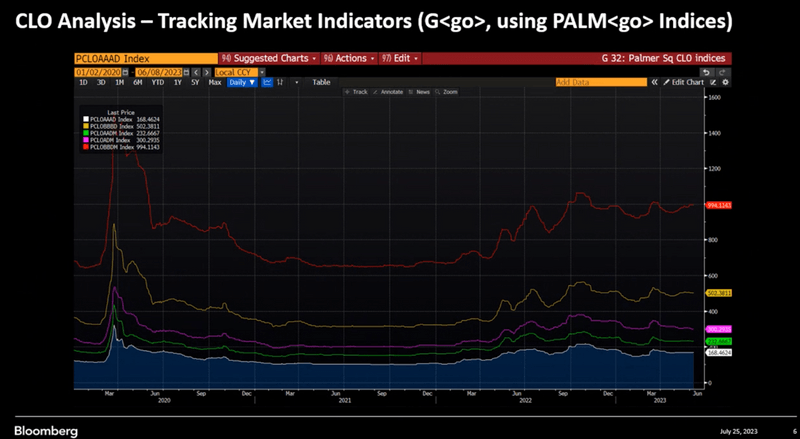

The events of the past few years offer a glimpse into how sensitive they can be to economic and political externalities. The Covid pandemic, conflict in Ukraine, rising interest rates and the threat of recession have all caused yield spreads on CLOs to widen, indicating the rising of default among the underlying loans.

It’s within this field that the influence of external events on CLOs becomes apparent. The riskier, junior tranches of CLOs, for instance, which are more exposed to credit losses, can be seen to have been worse affected by recent fragility in the global economy. This is expressed in wider yield spreads against SOFR, indicating that investors want more compensation to cover the higher risk of default.

There are many factors that investors need to track if they want to keep on top of the market.

Starting with new issues, our PREL tool enables the easy monitoring of CLOs within a data-rich dashboard that clearly presents all tranches of the securities in order of their seniority within their risk structure. It will also show other attributes including their risk ratings and their spreads against SOFR, all of which can be examined individually or tracked through indices.

Management skills

CLOs are actively managed assets, meaning that the loans underpinning them may be replaced over time. Poor performing loans can be removed and more attractive loans added on a regular basis to optimize the CLO. It follows, then, that the performance of a CLO can depend greatly on the skill of the asset manager.

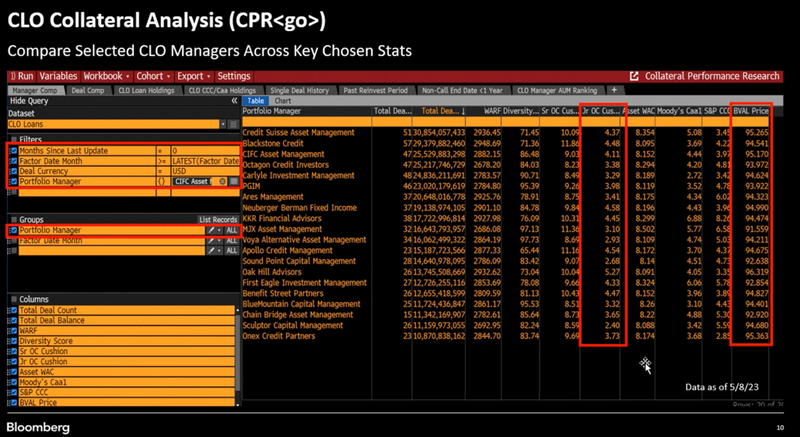

Investors can interrogate this through CPR <GO>. One of the most important indicators of how well CLOs are being managed is through coverage tests. These are ratios designed to measure the CLO’s capacity to sustain losses of principal and income within the underlying asset portfolio. Within CPR, this is expressed as a metric relative to a target range of capital cushions set at the security’s creation. The higher the number, the greater the cushion against default.

By examining the differences in these readings, the different approaches to risk and reward of individual managers can be ascertained, as can their weightings towards different factors, such as the industrial sectors from which the loans originated. Managers’ performances can also be ranked according to preferred criteria set by the investor.

Together these enable investors to examine whether those strategies suit their own objectives.

Price tracking

Another Bloomberg function that’s useful for CLO market participants is BVAL <GO>, a potent tool that provides pricing for a wide range of assets, including CLO securities and the leveraged loans that underpin them.

BVAL’s CLO pricing can help add transparency to this market which lacks sources of secondary market pricing such as exchanges and regulatory-driven trade disclosure. And the story is similar for BVAL pricing of loans. For example, prices of these loans can be sensitive to changes in the economy and other influences, so having visibility into their price movements gives strong indications on the likely performance of the CLOs that contain them. The loans’ prices are also often used as a signal of market perceptions of credit, another good reference point for investors considering allocating capital to CLOs.

CLO market participants also need to track CLOs’ key performance metrics. TRIG <GO> provides insight into how CLOs are performing relative to threshold levels now and over time, and this data also can used to compare CLOs to one another..

No one can see into the future, but with Bloomberg, investors can use the best data available to forecast the likely performance of a CLO over a variety of time horizons. Scenario analytical models let investors test assumptions about how they see factors such as interest rate volatility or future default rates impacting the performance of CLOs. These powerful scenario analyses can be made at the CLO level or customized at the portfolio level and can also be applied to a target list of potential CLOs to examine their suitability for inclusion in a portfolio.

The CLO market is a complex one to master. Thanks to the industry-leading data and technology that Bloomberg has developed over the past four decades, tools are available to help investors make the best decisions based on their chosen strategies.