Can the Magnificent 7 ride again, rescue the U.S. stock rally?

Bloomberg Market Specialists Constantin Cosereanu, Adam Cohen and Michael Pruzinsky contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

U.S. stock investors have a lot riding on expectations that the Magnificent 7 technology giants will boost earnings because of artificial intelligence applications.

The AI-driven equity rally was fading this quarter until blowout results from Nvidia Corp. reinvigorated the whole market. Nvidia’s shares hovered near record highs in early September, with data center operators stocking up on the tech company’s processors to run the heavy workloads required by AI.

Thanks to blockbuster earnings, the Bloomberg Magnificent 7 Total Returns Index is up 93% in 2023 and has valuations in line with five-year averages. The Bloomberg US Large Cap Index (B500) would have delivered less than half of its 2023 gains without these seven stocks: Nvidia, Tesla Inc., Meta Platforms Inc., Amazon.com Inc., Alphabet Inc., Apple Inc. and Microsoft Corp.

The issue

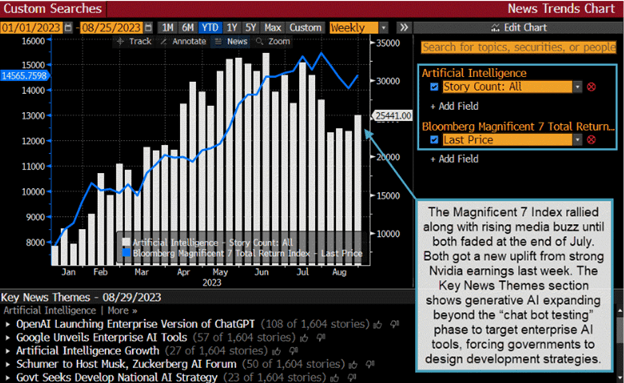

The Magnificent 7 index rallied until mid-July, when fading excitement over AI preceded a retreat. Weekly media posts about AI on the Bloomberg terminal climbed back above 25,000 last week amid Nvidia’s strong earnings, propping up the index. Meanwhile, Amazon, Alphabet and Meta are all busy designing, manufacturing and deploying advanced semiconductors for their own use.

The Key News Themes section shows generative AI expanding to target enterprise AI tools amid regulatory angst. Microsoft CEO Satya Nadella, for example, recently compared AI with the early internet, calling it a “tidal wave” in a callback to Bill Gates’ famous memo from 1995.

When looking at the performance and valuations of the Magnificent 7 index, price-to-forward-earnings ratios for Amazon, Tesla, Nvidia and Alphabet are all lower than their five-year averages. Meta is in line and back on track after last year’s record stock plummet. PEG Ratios, which consider long-term earnings growth expectations, show Nvidia trading two standard deviations below its average valuation and Microsoft one standard deviation lower.

The Bloomberg US Large Cap Index (B500), excluding the Magnificent 7, has underperformed the benchmark strongly this year (7.6% versus 17.3%) and in the second quarter (4.7% versus 8.9%). So far in the third quarter, there is a slight outperformance.

Tracking

Use Bloomberg’s NT, EFMF, WATC, UNCL and PORT tools to analyze the impact of these tech giants.

To see how the Magnificent 7 has been driven by AI buzz:

- Type “nt ai” in the command line and hit <GO>. NT enables users to chart articles published on topics over time, drawing on more than 150,000 news and social media sources.

- Type “magnificent 7” in the search box at top right and select BM7T Index – Bloomberg Magnificent 7 Total Return Index. Set the box below to Last Price.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.