Energy deflation may be fueling gold inflation

This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

Russia’s invasion of Ukraine on the back of the global liquidity pump was unprecedented, but the energy-price reversion process may not be done. Our view is there might be little to stop the trajectory of falling energy vs. rising gold prices with the global economy leaning into recession and most central banks still hiking in 3Q.

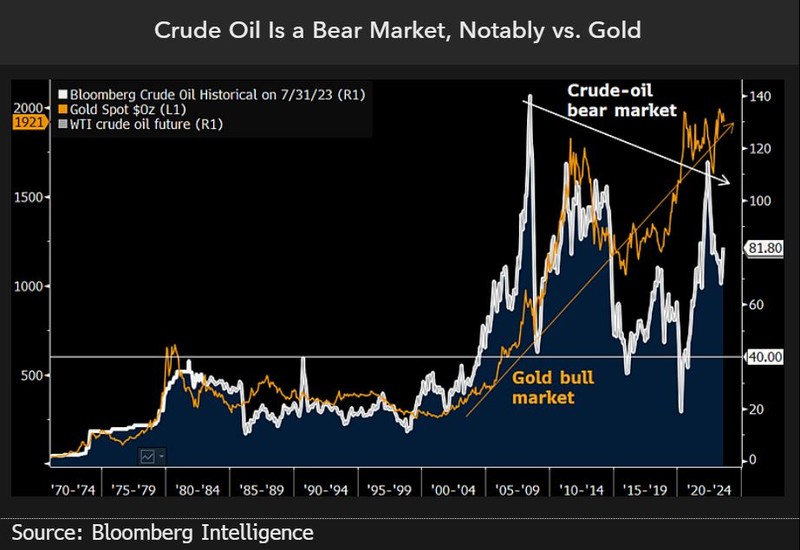

Crude oil has been in a bear market since the 2008 peak and the key question is what might change the propensity for lower lows and highs. Our bias remains with the trend since about when zero and negative interest rates started, and as the global economy tilts toward contraction following the most aggressive coordinated central bank tightening in history. Deteriorating growth in the top crude importer — China — and with Bloomberg Economic’s probability of US recession within 12 months at 100%, it may be prudent for OPEC to curtail supply.

About $40 a barrel has been the WTI crude pivot since 1981, and we see risks leaning that way. The graphic shows the distinct difference between the upward trajectory of gold — a bull market — and the opposite in crude, for about the past 15 years.

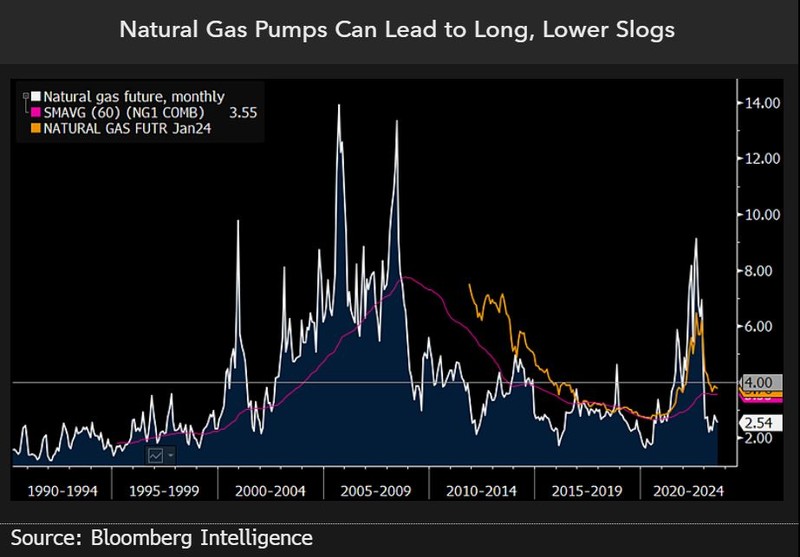

Natural gas in a $2-$4 cage

It’s hard to extract anything other than deflationary forces from the benchmark source of heat, electricity and fertilizer in the US — natural gas — dropping in 2023 to the same price as first traded in 1990. The ability to produce more with less is epitomized in US gas, and the big pump to the 2022 high of $10.03 per MMBtu, then dump in March to $1.94, may set up an elongated trading range of $2-$4. Our graphic shows the January 2024 future at about $3.80 and the 60-month moving average closer to $3.60 vs. a front price of $2.60 on Aug. 29.

Extreme backwardation in 2022 indicated lower prices this year, and normal contango may do similar for identifying resistance. Natural gas is the most volatile major commodity and the shock of Russia’s invasion of Ukraine could have strengthened price resistance.

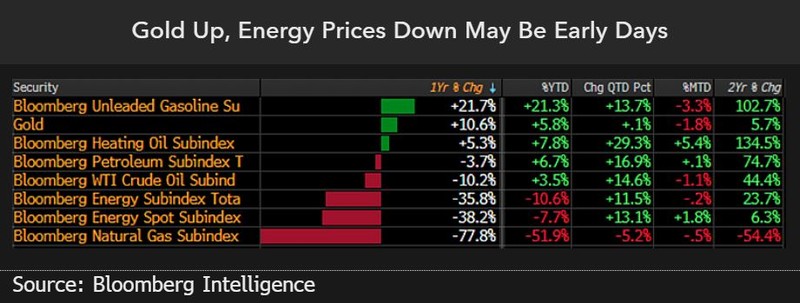

Energy deflation may be fueling gold inflation

Down about 40% on a one-year basis to Aug. 29, the Bloomberg Energy Spot Subindex may move lower before finding a plateau. Our bias is a bottom is unlikely until prices drop enough to do the opposite of what high prices did in 2022. The global economy is leaning into recession and most central banks are still tightening. With US Treasury two-year yields in the world’s largest energy producer and net exporter at about 300 bps above the largest crude importer (China), commodity prices may be facing a train wreck. The unlikeliness of a reversal in weakening China and the strong dollar may keep pressure on energy.

Deflating energy prices could be fueling gold inflation. Up about 10% on a one-year basis, the metal shows this is the trajectory. We see risks toward acceleration vs. reversal.

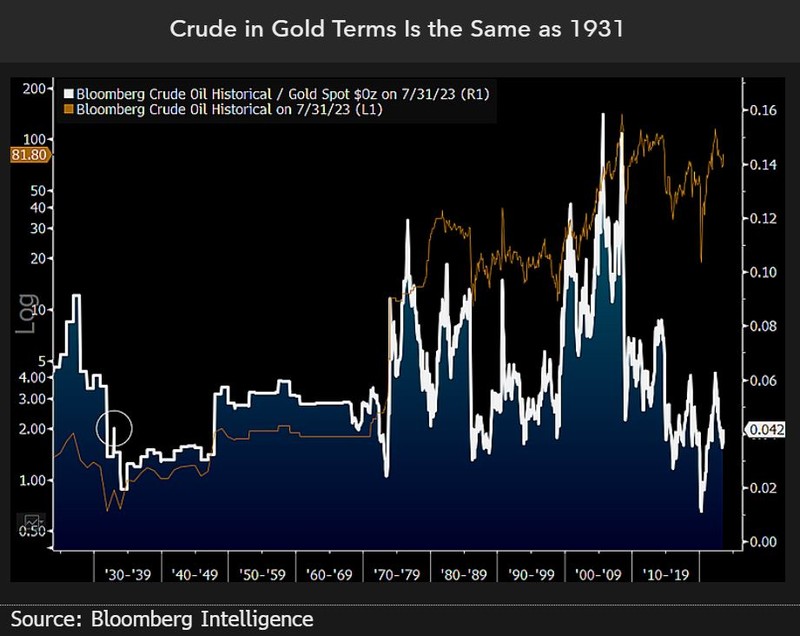

Crude oil has been a deflation leader

A century of crude oil in terms of gold shows a key factor: Autocorrelation is a primary force. The dollar price of crude on Aug. 22 at about $80 a barrel was first traded in 2007, but at about .042 ounces of gold per barrel, the same level can be traced back to 1931. Deflation has been a predominant force emanating from the world’s most significant commodity for most of the past 16 years, as indicated by the unchanged price vs. about a 50% rise in the producer price index.

A key question is what stops this bearish crude trajectory? Our bias is little, with most central banks hiking rates at an unprecedented pace, a global tilt toward recession and typical elasticity of supply and demand forces on the back of the 2022 price spikes.