Supply chain financing also goes “green”

Banks have recently been increasing sustainability-linked supply chain financing.

There is a good reason for this, as traditional Supply Chain Financing is already a win-win for both suppliers and buyers. Suppliers don’t have to wait long in order to get paid, while buyers can keep cash in hand longer.

That said, sustainability-linked supply chain financing has added benefits as it improves financial efficiency, and can also proactively enable both suppliers and buyers to improve their sustainability.

The inner workings of supply chain financing

Suppliers who meet a firm’s for supply chain financing will qualify for discounted financing. Meanwhile, the buyer encourages its suppliers to become more sustainable by offering them more favorable payment conditions compared to their less sustainable counterparts.

A great example is Cummins Inc., a Columbus, Indiana based a global power technology leader. Earlier this year, President Joe Biden visited the Cummins Inc. plant in Fridley, Minnesota, which will soon be home to the company’s clean hydrogen technology manufacturing.

Cummins currently utilizes traditional supply chain financing. CMI US, per 10K(12/31/2022) P50. The company says, “We currently have supply chain financing programs with financial intermediaries, which provide certain vendors the option to be paid by financial intermediaries earlier than the due date on the applicable invoice. When a vendor utilizes the program and receives an early payment from a financial intermediary, they take a discount on the invoice.”

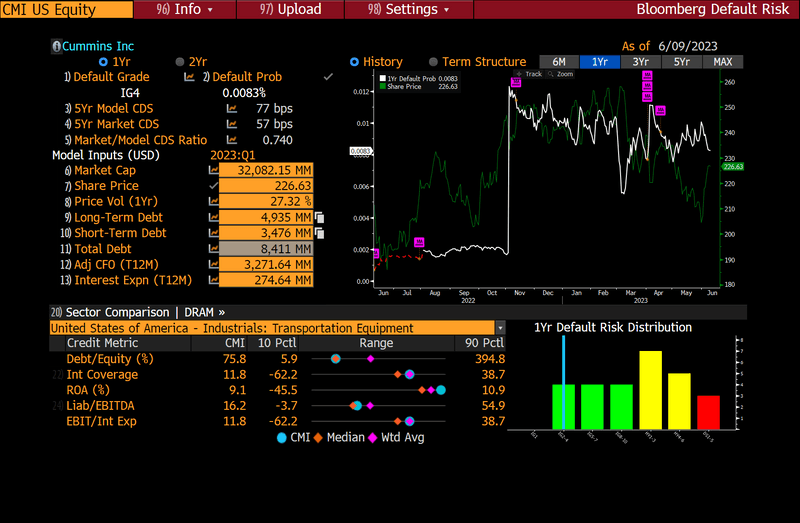

As of 5/3/2023, Cummins has a Default Risk rating of (IG3 */+), which is the 3rd highest Investment Grade, as well as a strong credit score with Moody’s score of A2 and S&P score of A+.

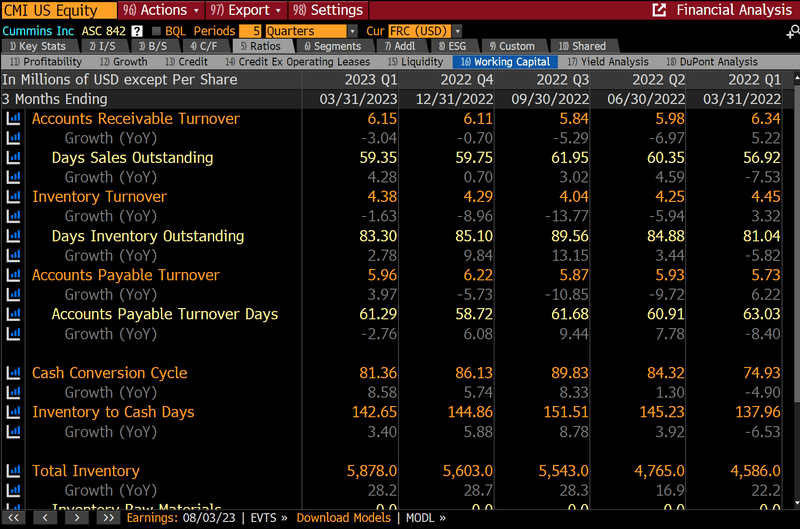

Cummins’ Days of Accounts Payable outstanding is 61 days. A Cummins supplier who participates in its supply chain financing program could get paid much faster than this if the company utilized a sustainability-linked supply chain program.

Cummins could benefit from using this method to strengthen its sustainable supply chain

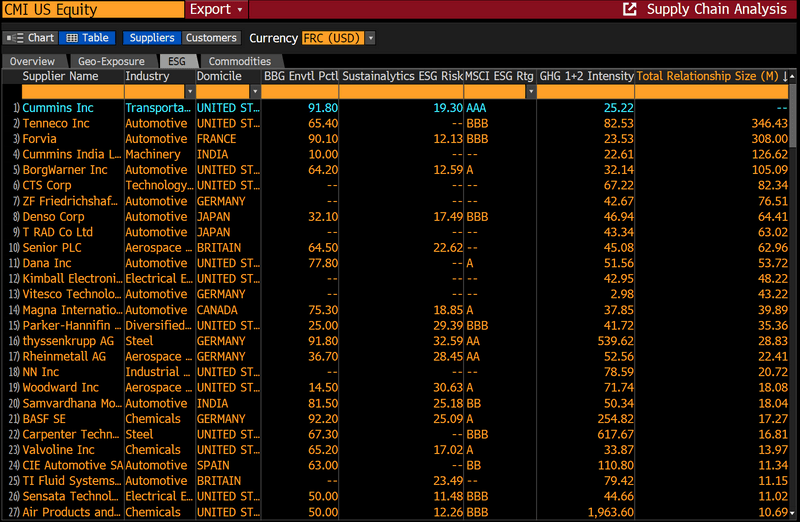

Currently, Cummins has the score of 94.1 in Bloomberg Environmental Pillar Percentile (Score 0 (Worst) to, 100 (best)), 19.28 in Sustainalytics ESG Risk score (0 (best) to (100)) and 25.81 in GHG 1+2 Intensity- these are good scores across the board. However, some of suppliers seem to have a room for improvement.