Hong Kong’s catastrophe bond market can reach $2 billion by 2025

This analysis is by Bloomberg Intelligence Industry Analyst Steven Lam. It appeared first on the Bloomberg Terminal.

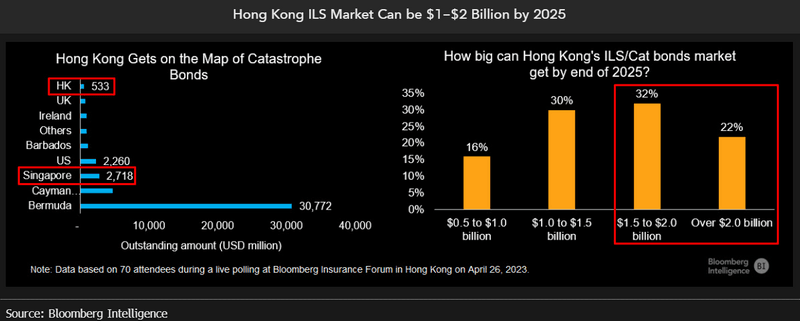

Hong Kong’s catastrophe bond market may grow to $2 billion by 2025, accounting for 4-5% of global cat bonds, according to a poll conducted at Bloomberg’s Insurance Forum. Authorities recently extended a grant program in a bid promote the city as a regional hub for insurance-linked securities, a $40 billion market dominated by Bermuda.

Budding Hong Kong ILS market could reach billions

Hong Kong’s insurance-linked securities market could grow to at least $1.5 billion by the end of 2025, according to more than half of respondents in a poll of 25 insurers during the Bloomberg Insurance Forum in Hong Kong on April 26. That’s partly driven by local-government subsidies to cover issuance costs for instruments such as catastrophe bonds — a bid to promote the city’s nascent market. A size of $1.5 billion would be at least a threefold jump from the current $500 million, and 22% of respondents said the market could top $2 billion. That could be roughly 4-5% of the global catastrophe bond market now dominated by Bermuda and the Cayman Islands, we calculate.

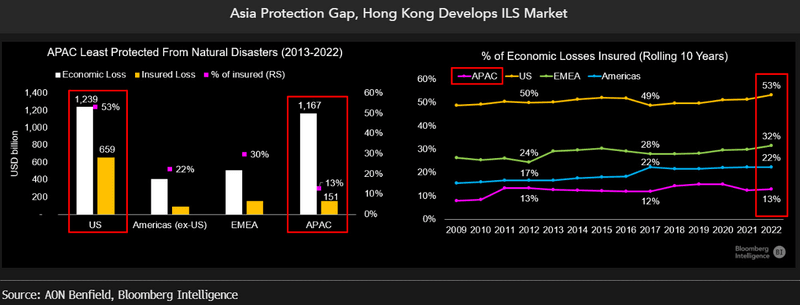

Asia protection gap drives ILS growth

Hong Kong’s ILS market can play a major role as Asian nations play catch-up on insurance penetration, especially in terms of natural-disaster protection. Only 13% of Asia’s $1.16 trillion in economic losses caused by natural disasters were insured in the 10 years through 2022, based on data from Aon. Coverage was 53% for the US’s $1.23 trillion in economic losses in the period, and 32% for EMEA’s $469 billion. APAC remained the least protected region and didn’t improve much over the years, while insurance coverage rose in the already-developed US and EMEA markets.

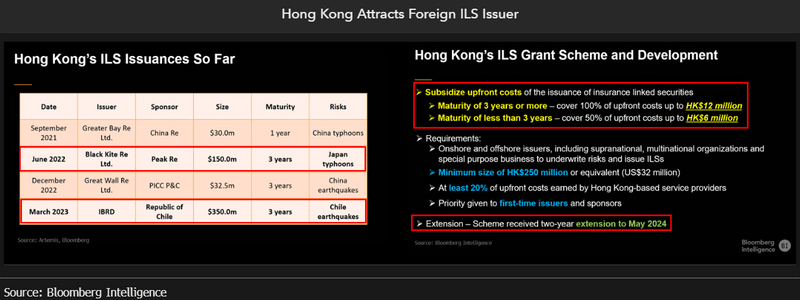

Grant program attracts international issuer

Hong Kong recently extended a grant program to May 2024 in a bid promote the city as a regional hub for insurance-linked securities. Qualified issuers and sponsors can get a subsidy of up to HK$12 million ($1.5 million) on the upfront cost of issuing ILSs with maturity of three years or longer. The savings are equivalent to 1.2% of the median size of outstanding catastrophe bonds of $125 million. ILSs allow insurers to tap institutional capital to take on risks such as typhoons and earthquakes.

Cat bonds issuance in Hong Kong is picking up, with March’s $350 million issue the largest, sponsored by the World Bank. It gives the Chilean government financial protection against severe earthquakes for three years. The second-largest was Peak Re’s June 2022 issue of $150 million to cover Japan typhoon risks.

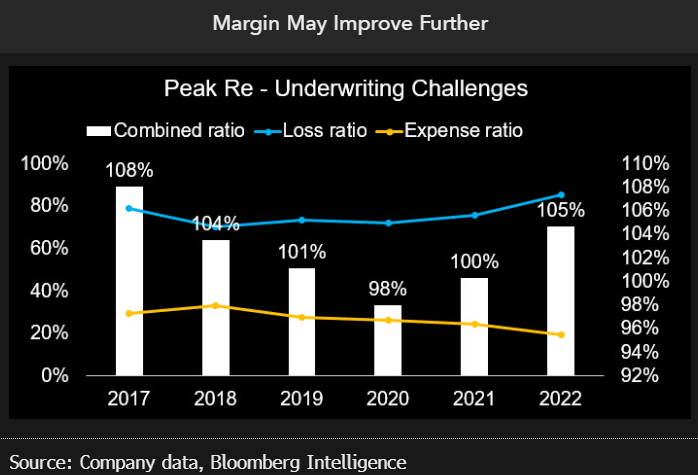

Market hardening, alternative capital aid margin

A key market trend in the reinsurance industry is the hardening of rates, or price increases, as higher interest rates curb the supply of capital while more intense natural catastrophes drive demand for direct insurance and reinsurance. Meanwhile, insurance-linked securities can diversify reinsurers’ risk, helping Hong Kong-based peers such as Peak Re protect underwriting margin, which was dragged down in 2022 by secondary perils such as hailstorms, flash floods and wildfires.

The combination of price increases and tapping alternative capital can help insurers reduce the impact of costlier claims due to inflation, and the increased frequency and severity of claims spawned by natural disasters.

Paring down natural catastrophes exposure

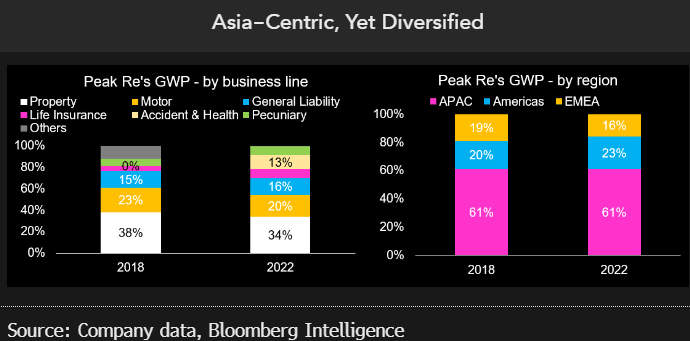

One way reinsurers can reduce underwriting profit volatility is to alter their exposure to natural catastrophe risks. While Peak Re tapped into catastrophe bonds to help shoulder its exposure, it also pared down lines such as property and motor that are more prone to natural perils to 54% of its gross written premiums in 2022, from 61% in 2018. By contrast, more business has come from life, accident and health lines of late.

Peak Re’s gross written premiums (GWP) more than doubled to $2.23 billion in the five years through 2022, with a 61/23/16 split across the Asia-Pacific region, the Americas and emerging markets, Europe and Africa (EMEA) as of 2022. Peak Re’s diversified business mix may continue, as its size allows it to cherry-pick business lines with more desirable risk-reward profiles.