This analysis is by Bloomberg Intelligence Senior Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

It may be illogical to expect a sharp recovery in global crude oil demand with the largest economy leaning into recession and central banks undertaking their most aggressive tightening campaign ever. Our graphic shows the bear-market inception when Brent crude peaked in 2008 and the potential for resumption, with a key outlier — consensus is for demand to come back strong. The one-year Brent future (CO13) highlights the tendency for lower highs and lows since the financial crisis. We see risks slanted toward more of the same downward price moves, notably if optimistic demand expectations don’t pan out.

“Priced in” is the risk for bulls given the propensity of most commodities to gravitate toward costs of production, as shown in US natural gas, particularly when spiking prices akin to 2022 stress consumers and economies.

What stops crude from following natural gas?

A key question at the end of April is what stops the mean-reversion process in energy prices that were too hot last year. Typically, markets drop sufficiently to curtail supply and buoy demand, and US natural gas falling 80% from the 2022 peak to about $2 a million British thermal units appears to have

been enough to stabilize prices. It’s crude oil that’s still the main commodity and energy outlier, and we see gravity-pull risks toward about $40 a barrel in WTI. This level has been a pivot since Iraq’s invasion of Kuwait in 1990. The US transition to net exporter has shifted the burden of demand and price

buoyancy toward China and emerging markets.

It’s a bear market – Crude oil, energy

But most of the world depends on the US for economic fuel, and the country heading toward recession with its central bank still tightening isn’t bullish for crude oil.

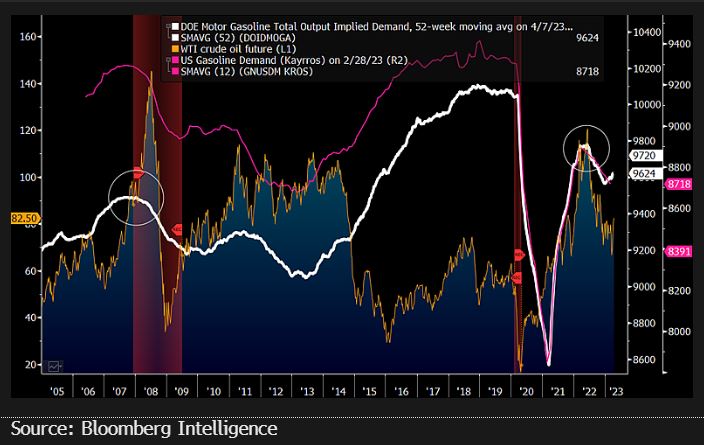

Low prices vs. gasoline demand and the Fed

When unleaded-gasoline consumption falls sharply in the world’s largest demand-pull economy it means something, and that tilt from 2022 remains negative. Last year’s demand drop on the back of the high-velocity price spike was unambiguous, but it’s the economic headwinds that markets are facing that

may be more complicated — and enduring. That the Federal Reserve was easing the last two times demand and prices fell at a similar velocity shows the juxtaposition: Futures on April 17 point to about an 85% chance of a 25-bp hike on May 3.

Risks remain tilted downward if recession

Most markets and demand vs. supply metrics have dropped in significance on a 1-10 scale, with the Fed still tightening marking the 10, in our view. Following a long and variable lag from the start of an easing cycle is when risk assets and demand for unleaded gas may be expected to revive.

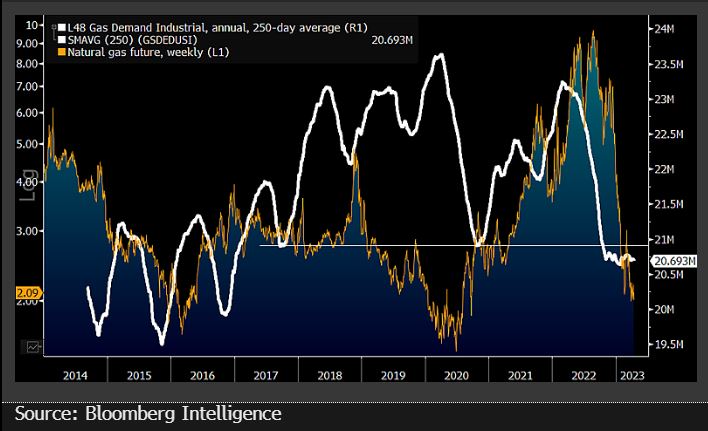

Industrial natural-gas demand tilting recessionary

Industrial demand for the US benchmark for heat, electricity and fertilizer — natural gas — has dropped to the lowest in about six years, with implications for economic growth and prices. It makes sense that gas consumption would decline on the back of the sharp price rise to about $10 per MMBtu at

the 2022 peak, but it may be a while for demand to rebound after this year’s plunge to around $2. Our graphic showing the unusually low and stubborn 250-day average of gas demand appears consistent with the highest probability of recession from the yield curve since 1982 and the Fed still tightening, despite deflating commodities.

Severe recession indication? Natural-gas demand

Natural gas prices may have little room below $2 and could show what to expect in crude, a lower plateau beforebottoming. Plunging industrial-gas demand appears consistent with a severe recession.

Global economic fuel tilting toward recession

Known as the fuel that powers the global economy, diesel may be foretelling an economic contraction akin to 2008-09. US diesel consumption peaked in 2019 at about 5.1 million barrels a day and is rolling over from a lower level to April 17 at a pace like that during the Great Recession. Aggressive Fed easing is a big difference from the last two similar demand peaks. The graphic adds to our base case for a severe economic contraction, on the back of the greatest pump in 2022 of the Department of Energy’s on-highway diesel price vs. its 50-week moving average.

US diesel demand is rolling over rapidly

The previous record spike was in May 2008, and the reciprocal price dump to a discount of about 40% below its annual mean in 2009 helped to boost demand and curtail supply. At about 20% now, the discount may be insufficient for a reset.