EU payment fight could cut 40% from gene therapy sales

This analysis is by Bloomberg Intelligence Senior Industry Analyst Ann-Hunter Van Kirk and Bloomberg Intelligence Associate Analyst Jack Maltby. It appeared first on the Bloomberg Terminal.

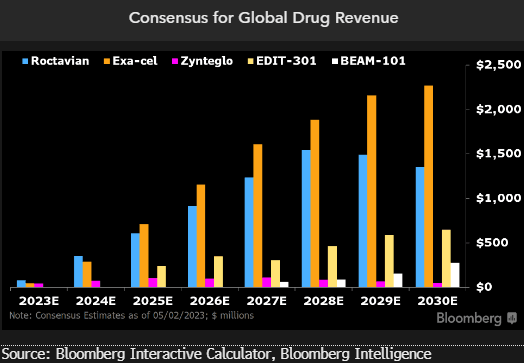

Up to 40% could be slashed from projected global gene-therapy sales if companies follow Bluebird by exiting Europe amid reimbursement stalemates, which looks increasingly likely after our discussions with EU regulators found hard resistance to high prices. BioMarin could have $3 billion at stake this decade. Therapies like Vertex/CRISPR’s Exa-cel also may be exposed.

BioMarin, Vertex, CRISPR Have billions at stake

As prices climb with biopharmaceutical advances, the inability to negotiate EU reimbursement could put as much as 40% of global gene-therapy revenue at risk. BioMarin Pharmaceutical has up to $3 billion in cumulative revenue at stake in Europe through 2030. And we believe that Exa-cel — Vertex Pharmaceuticals and CRISPR Therapeutics’ market-leading gene-edited treatment for blood disorders — also could face roughly a 40% downside to consensus for global sales over the period.

Early 2021 estimates on global peak revenue for Bluebird Bio’s Zynteglo were nearly $1.2 billion, which dropped 39% after the company announced the drug’s withdrawal from the European market that August. Consensus for Bluebird’s Skysona dropped about 17% on notice of its exit from the region.

Multimillion-dollar treatments spark EU ire

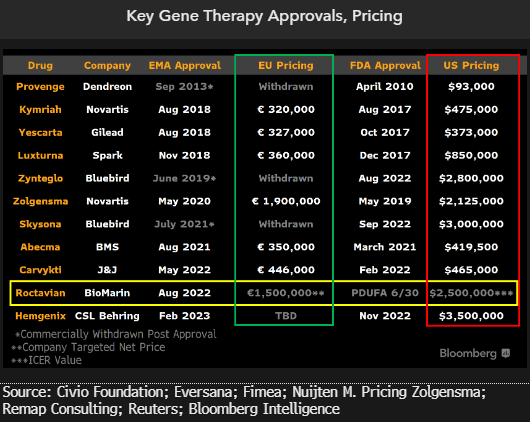

More makers of multimillion-dollar drugs may follow Bluebird’s exit from Europe, as our conversations with European Commission and European Medicines Agency officials found significant resistance to therapies costing over $1 million. Though negotiations continue over BioMarin’s Roctavian, for severe hemophilia A, the possibility of conflict appears to be rising after the company scrapped plans to pursue outcome-based agreements in Germany and pivoted to working with the National Association of Statutory Health Insurance Funds.

Bluebird withdrew marketing authorization for two approved gene therapies in the region: Skysona for cerebral adrenoleukodystrophy and Zynteglo for beta thalassemia. Germany reportedly countered Zynteglo’s $1.8 million asking price by offering less than $800,000, leading Bluebird to exit.

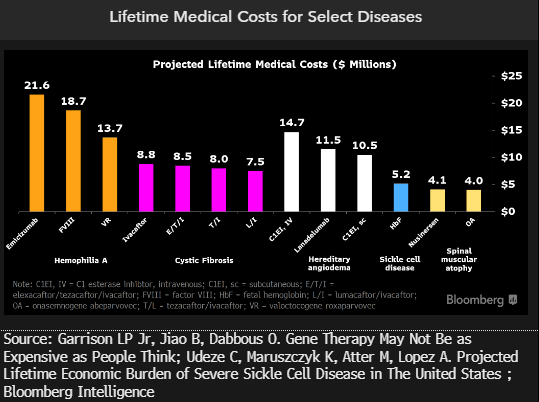

Weighing development, health system burdens

Gene-therapy prices should be weighed against high development and approval costs, as well as potential health-system savings. Traditional treatments can reach $20 million for diseases like hemophilia A, cystic fibrosis, hereditary angiodema and sickle cell disease. We’ll be watching for pricing of Vertex/CRISPR’s ex vivo gene-edited Exa-cel (CTX-011) for sickle cell disease and beta-thalassemia, for which an EMA decision is expected in 2H or 1H24. The lifetime cost of typical sickle cell treatment is around $5 million, according to a recent estimate by the European Hematology Association.

At $1.9 million, Novartis’ Zolgensma for spinal muscular atrophy is the most expensive gene therapy in the EU, while the estimated lifetime cost of traditional treatment is about $4 million.

Separate markets, regulations add friction

European Commission plans released last week highlight the need for a single health-care market, yet adoption could be slow and still may not relieve regulatory burdens on drugmakers. The proposals represent the largest European legislative revision in over 20 years and encompass a wide range of topics, including possible expansion of the framework in which hospitals can use advanced therapies not yet approved by the European Medicines Agency. Committees for advanced therapies and orphan drugs would be reorganized as working parties with no decision-making power, while the definitions and requirements for genetically modified organisms will be updated.

Outcome-based agreements remain a focus, and our conversations underscored their value in aligning incentives and building trust between regulators and providers.