Bond greenium surfacing in developed markets

This analysis is by Bloomberg Intelligence Analyst Senior Industry Analyst Matt Ingram. It appeared first on the Bloomberg Terminal.

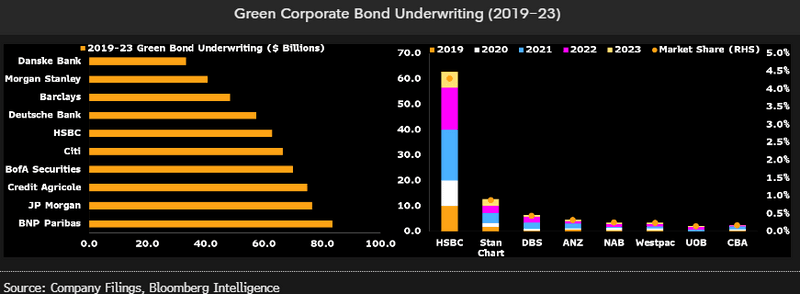

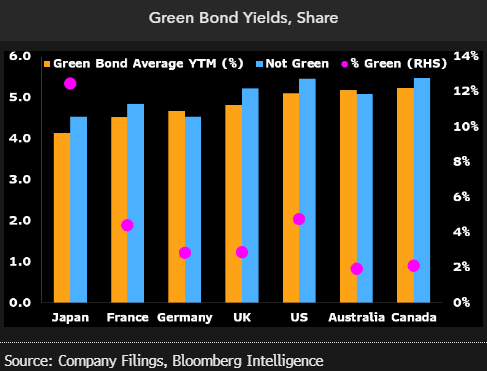

A greenium has emerged across developed markets, with yields up to 40 bps lower for green vs. corporate bonds. This could save $1.1 trillion in funding costs through 2050. Green bonds were just 4% of over 12,000 corporate issues since 2019. BNP Paribas and JP Morgan dominate underwriting, each with more than $70 billion in deals over this period.

Greenium present, issuance low

Yields to maturity for green bonds issued in select developed markets over 2019-23 are up to 40 bps lower, in the case of Japan and the UK, than other corporate bonds, suggesting a greenium is emerging. Germany and Australia are the only markets where green bonds still trade at a discount, although supply in the latter is limited.

Japan also leads green bond issuance, comprising 12% of all corporate bonds to hit the market so far in 2019-23. Australia and Canada were laggards, at just 2% each, while the US’s $124 billion is the most by value.

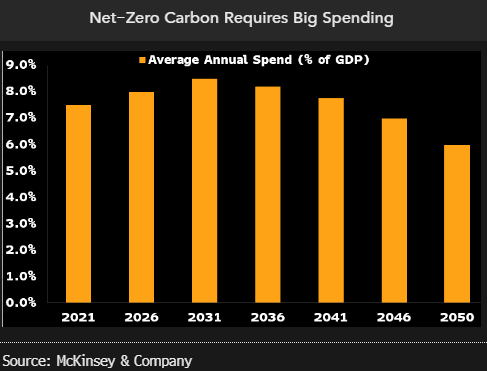

Greenium cuts cost on huge investment

The transition to net-zero carbon by 2050 will cost about $250 trillion, around 53% of global GDP, according to a McKinsey report. The spending would be front-loaded at over 8% of GDP annually until 2031. Governments will likely bear a large share of the load, but companies will also need to transition to reduce scope 1 and 2 emissions. The current greenium of up to 40 bps would reduce the funding cost of this investment by about $1.1 trillion, a significant reduction given a large portion of the investment will occur in emerging economies.

French banks, JP Morgan lead underwriting

BNP Paribas, Credit Agricole and JP Morgan dominate green corporate bond underwriters in 2019-23, each with over $70 billion in deals, out of total issuance of about $275 billion. The top 10 is dominated by bulge bracket banks, with only Denmark’s Danske Bank coming from outside this group. BNP has consistently finished in the top two, yet JP Morgan’s ascendancy is more recent. Volumes in 2023 might top 2021’s peak if the current run-rate persists.

Asian banks lag developed market peers, with only HSBC ranking in the top 10, with 4% market share. Australian lenders have had minimal participation, with a combined market share of just 1%, as have Singaporean banks at just 0.6%.