This article was written by Christian O’Dwyer, Enrique Neves Martin, and Caroline Ward. It appeared first on the Bloomberg Terminal. This article was updated as of April 2023.

Scope 3 greenhouse gas (GHG) emissions have significant environmental impact, but little is known about them. According to the UN Global Compact, Scope 3 emissions account for a whopping 70% of the average corporate value chain’s total emissions, but Bloomberg’s company reported ESG data on 15,000 companies reveals that only about 20% of them disclosed their Scope 3 emissions for the 2020 fiscal year.

This data gap poses a problem for financial market participants who require Scope 3 emissions data to allocate capital in line with decarbonization targets and The Paris Agreement goal to limit global warming to below 2 degrees Celsius. Without data, firms are operating with incomplete and inconsistent information as they try to decarbonize their operations. To shine a light on this gap, Bloomberg has developed a Scope 1, 2 and 3 estimates model to cover both companies that do report but also those that do not self-report. These carbon estimates aim to provide a more reliable estimate for company-level emissions data than estimates generated from other models.

Challenges in Measuring Scope 3 Emissions

Scope 1 and 2 emissions are derived from a company’s own activities making them easier to measure. However, Scope 3 emissions come from a company’s value chain which can span the globe as well as many other constituents, so it is much harder to accurately capture all of the underlying data year over year. As a result, Scope 3 data can be quite sparse due to inconsistent company reporting, making it difficult to compare similar companies operating in the same sector or geography, as well as comparing the same company’s reporting to previous years.

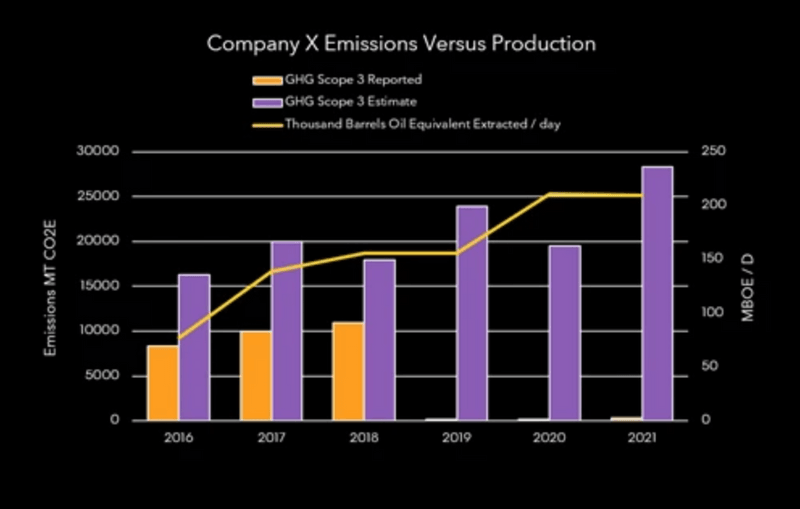

For example, in 2018, Oil & Gas Company X reported Scope 3 emissions of 11 million metric tonnes CO2 equivalent (mt CO2e). In 2019, the company reported significantly reduced Scope 3 emissions of around 150,000 mt CO2e, roughly a 70-fold decrease. Upon deeper research, the reason for this difference was that the Scope 3 category “Use of Sold Products” was omitted from reporting in 2019. This is a big miss because for most Oil & Gas companies, this category represents the majority of Scope 3 emissions as it is based on the amount of oil and gas sold or extracted. Bloomberg captures both metrics, and for this particular company we see that the barrels of oil equivalent extracted only decreased by a small amount. So, while Scope 3 emissions likely decreased year over year, it was nowhere near a 70-fold change.

Bloomberg’s data teams have observed many such inconsistencies due to changes in accounting methodology or reporting scope year to year. This could be due to a lack of mandatory reporting requirements which would otherwise clearly define how to measure and report Scope 3 emissions. To overcome these irregularities, many firms turn to estimates, though not all estimates are created equal.

For example, certain models use reported sector intensity averages to estimate Scope 3 emissions. The limitation with this approach is that it fails to account for differences between similar companies in the same sector, for example, Tesla versus Volkswagen when it comes to fuel source. Additionally, this approach does not solve for the inconsistent nature of the data on which the estimates are based, further perpetuating inaccurate Scope 3 emissions data.

Using Models to More Accurately Estimate Illusive Scope 3 Emissions

Since Bloomberg’s Scope 1 and 2 estimation models are trained on reported emissions data, the lack of quality Scope 3 emissions data means Bloomberg could not employ the same machine learning techniques. Instead, Bloomberg continues to refine its approach for estimating Scope 3 emissions for specific sectors using a combination of a bottom-up model with a top-down machine learning model. This approach works best for industries such as Oil & Gas and Metals & Mining since it requires the use and processing of sold products as a key input for estimating Scope 3 emissions.

To break this down further, the bottom-up model is composed of an operating metric multiplied by a GHG emissions factor. The best possible operating metric is the amount of product sold in the fiscal year, in units of production. When this detail is not reported by the company, Bloomberg uses production data as a proxy. The operating or production metric serves to represent the amount of a hydrocarbon or metal produced, extracted, or sold. For the carbon emissions factor, this is sourced from official government tables that show the number of emissions per unit that come from using or processing those materials.

For example, if a company had produced 10,000 units of coal and the conversion factor per unit was 10 mt CO2e per unit of coal, the calculated emissions would be 100,000 mt CO2e. The result is used to train the top-down machine learning model for these sectors. This model sits on top of the bottom-up model and estimates Scope 3 emissions by learning the relationship between calculated Scope 3 emissions, revenue per industry, and other key operating factors.

Going back to our previous example, Company X reported Scope 3 emissions of 11 million mt CO2e in 2018 and 152,000 mt CO2e in 2019. In comparison, Bloomberg’s Scope 3 model estimated 20.8 million mt CO2e in 2018 and 19.6 million mt CO2e in 2019.

Given how challenging it can be for companies to measure their Scope 3 emissions, the reported data is not always consistent. While companies work to standardize their Scope 3 emissions reporting, emission estimates can be a more consistent benchmark to use year over year. In this example, the model accounted for emissions from the ‘Use of Sold Products’ category each year, which Company X stopped reporting.

Until more companies routinely report their Scope 3 emissions data in a consistent and accurate way, there will be an industry need for transparent estimates to help firms make decisions around how to best decarbonize their operations and mitigate climate-related risks.

About Bloomberg’s Greenhouse Gas Estimates

Bloomberg provides company reported and estimated carbon emissions data for over 130,000 global public and private companies going back to 2010. For companies that do not report, Bloomberg has developed a proprietary machine learning model that incorporates more than 800 data points to estimate Scope 1 and 2 emissions. In addition to Scope 1 and 2 emission estimates, Bloomberg provides Scope 3 estimates for nearly 120,000 companies, with development of Scope 3 for the financial sector slated to be completed in 2023.To foster transparency, Bloomberg provides different percentiles in the probability distribution for each estimate to allow investors to decide which estimate to use in their models. Bloomberg also provides a confidence score that gives insight into the amount and consistency of data used to produce our estimate.

For more information about how Bloomberg’s estimates models work, view our whitepaper, Bloomberg’s Greenhouse Gas Emissions Estimates Model.