This analysis is by Bloomberg Intelligence ETF Analyst Athanasios Psarofagis and Bloomberg Intelligence Associate Analyst Andrew Yapp. It appeared first on the Bloomberg Terminal.

The inability of bank savings accounts to keep up with rising rates has led to surge in assets of cash-like ETFs and money market funds, which are offering better yields. This trend toward ETFs can be seen globally, especially in countries such as Canada, where a quarter of the flows are going to such alternatives.

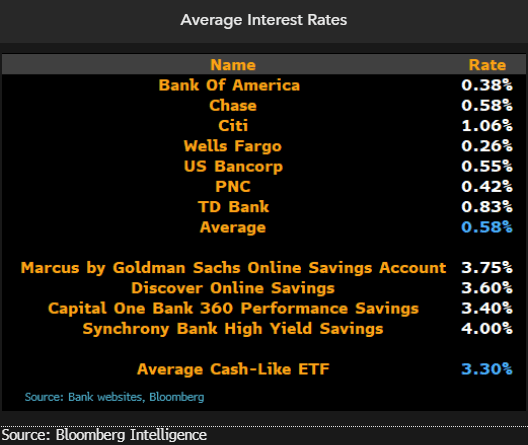

Cash-like ETFs pay higher rates than regular savings

Having looked at the average deposit savings rate across the largest traditional banks in the US, we found it was only 58 bps. Online banks, however, such as Marcus by Goldman Sachs, offer high-yield-savings-account options for account holders. The shortest-duration cash-like ETFs have a current yield of 3.3%, but we feel the key reasons for the growth in the category’s assets are the wrapper’s daily liquidity and trading ease within a standard brokerage account. Also, as an alternative to other options such as CDs, ETFs don’t need a minimum investment amount and typically pay out income on a monthly basis.

Bank run leading to a record in cash-ETF assets

The inability of the traditional banks to increase their savings rates has led to a record inflow of assets into cash-like ETFs, which is now approaching $100 billion. In addition to the higher yields, allocating to ultra-short-term bond ETFs has sheltered investors from recent market volatility, with 90% of ETFs lagging behind the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) over the past 12 months, the highest reading since 2018. We think the reason investors prefer to use the ETFs is they can keep it in a brokerage account and easily sell, transfer out or use it to get back into the market if need be, via other ETFs.

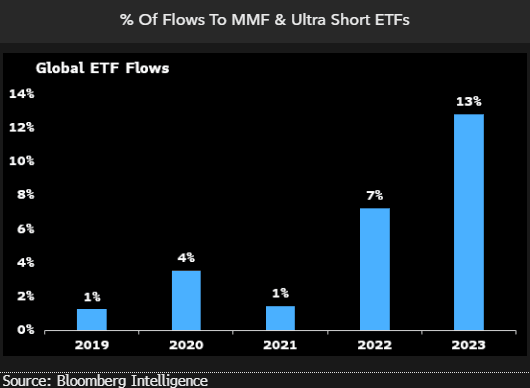

Dash for cash-like ETFs is a global trend

The shift to cash-like ETFs isn’t just a US phenomenon, with ultra-short and money-market ETFs taking in 13% of global flows, the highest pace on record. Canada is witnessing the largest share of its flows, 24%, going to such funds, mainly those investing in high-interest deposit accounts. The Asia Pacific region also has a big offering of money-market-type ETFs, accounting for 23% of the region’s flows. Ultra-short ETFs in the US represent 18% of the year’s flows, compared with 9% the prior year.

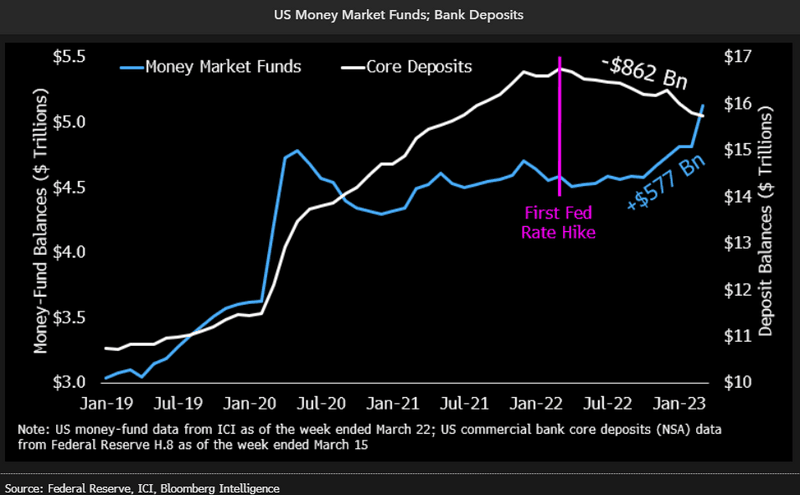

Money-market funds swell alongside ETFs

Even at near $100 billion, ETFs still represent only a small part of cash alternatives when compared with money-market mutual funds, which have surged to a record $5.1 trillion, according to data from ICI. Either way, they both tell the same story in that investors are seeking alternative income options from traditional bank savings accounts.

Money markets in, bank deposits out

Money market funds may continue to garner inflows supported by better yields and could see demand accelerate if deposit outflows pick up amid concerns in the US banking sector. Though larger institutional balances surged in recent weeks’ data — as corporates scrutinize their cash-management decisions — retail investors remained a steady allocator. Growth in retail assets comes as market sentiment tempers, yields improve and stubbornly low US bank deposit rates persist.

The 13% increase in money market fund balances ($577 billion) since the end of February 2022 compares with a 5% decline ($862 billion) in US commercial bank core deposits, based on Fed H8 data as of March 15. Deposit data trails money market fund figures by seven days.