This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

A 30% drawdown in the Bloomberg Commodity Spot Index from the June 2022 peak echoes the 53% drop of the 2008-09 financial crisis, with little help from bouncing equities and a key caveat — most central banks are still tightening. Natural gas reverting to levels first traded in 1990 may portend predominant deflationary forces, refueled by last year’s price pump. Was the Federal Reserve more vigilant vs. inflation than necessary, spurring a severe recession? The inverted-yield curve and banking crisis suggest yes. If the stock market can’t sustain the 1Q bounce, there may be little hope for a commodity recovery. The rule of long and variable lags may be in the early days about a year after the start of the most aggressive global central bank rate-hike period in history. But rising gold appears on track to star in 2023.

A bear market facing central banks and lags: Commodities in 2023

The combination of unprecedented liquidity due to the pandemic and Russia’s invasion of Ukraine spurred a commodity peak in 2022 that appears poised to endure, reviving entrenched deflationary forces. A key question at the end of 1Q, is what stops the downward price trajectory amid current monetary policy until central banks are deep into easing cycles.

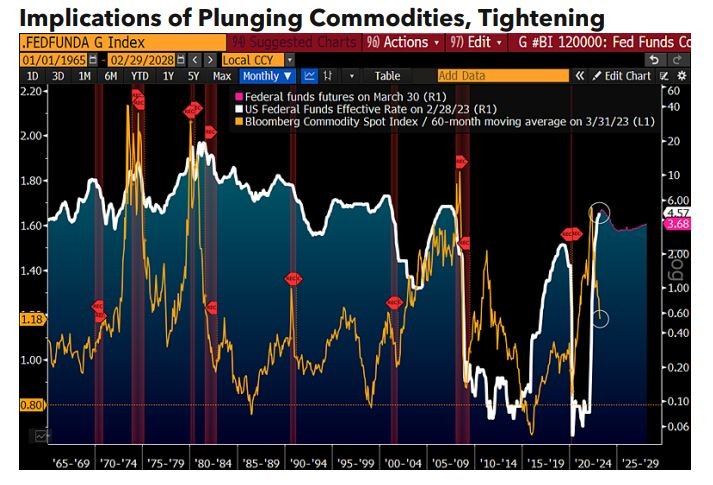

No risk here? Tightening vs. deflating commodities

A severe deflationary economic reset is gaining fuel, if commodities are a guide. The banking crisis may be a tree in the forest on the back of the sharpest Federal Reserve tightening cycle in our database since 1953, with long and variable lag implications. The chart of the federal funds effective rate on a logarithmic scale shows the unprecedented swiftness of the past 12-month rate-hike trajectory and a commodity-price freefall that’s akin to the financial crisis. The 25-bp rate hike on March 22 is notable because the Fed has never tightened with commodities falling at such a high velocity.

Federal funds futures show a ceiling near 5% and rates falling to about 3% in 2025. In a normal recession, this would be a historically slow pace of adding liquidity and may suggest lasting deflation, if commodities are an indication.

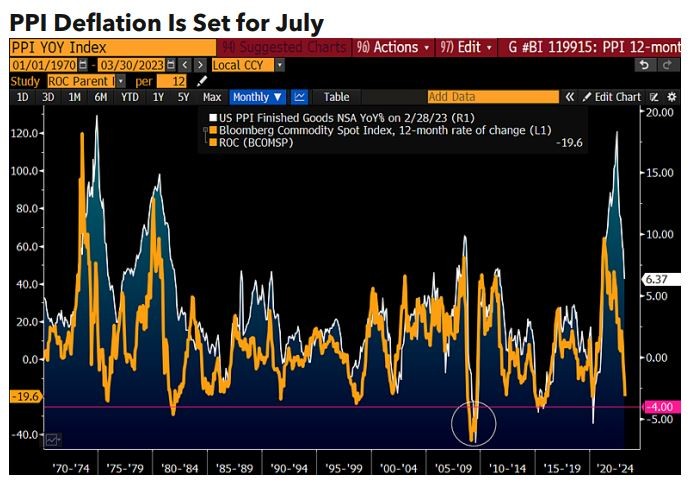

PPI on path for deflation unless commodities rally

The year-over-year producer price index for June (on July 13) may approach the minus 6.9% deflation extreme of the financial crisis. What stops this trajectory might be a greater question, as the Bloomberg Commodity Spot Index (BCOM) is falling at about the same pace as in 2008-09. A big difference is the Fed is still tightening. Our graphic shows the BCOM dropping from a higher plateau on a 12-month basis and at a similar velocity as about 15 years ago. The July 2008 commodity index peak led to the lowest PPI measure since 1948 in July 2009, and we see parallels.

The BCOM drawdown to March 30 is almost 30% vs. the June 2022 high. From the end of July to the same month in 2008-09, the drop was 27.7%. Unless commodities recover sharply, PPI deflation may rival 2009 and last longer due to central banks still tightening.

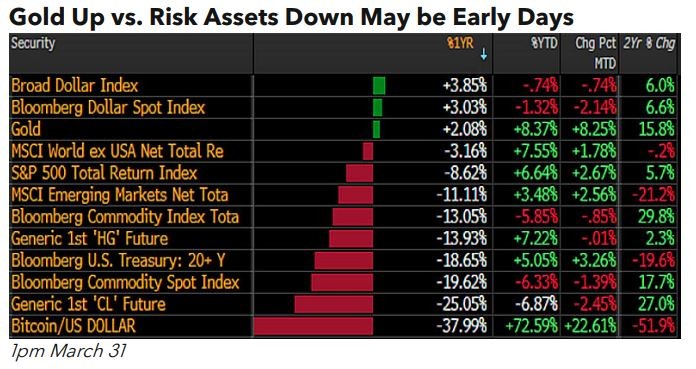

What stops gold from beating most risk assets?

The rule of bodies in motion with ample fuel may favor gold vs. most risk assets in 2023. Our macro scorecard shows the year-over-year upward trajectory of the precious metal near the top and crude oil at the bottom. With futures anticipating a Fed pivot in 2023, gold is a leading candidate to benefit vs. the potential lose-lose for risk assets. Federal Reserve chairman Jerome Powell has said that he doesn’t plan to lower rates this year, so for futures to be right, the deflation process in the stock market, copper, crude oil and most commodities appears necessary to trigger easing.

Diminishing liquidity, as evidenced by the banking crisis and central bank vigilance, is the current state of play and until these substantial headwinds reverse, lower risk-asset prices are likely.

Low plateau, easing typical for commodity bottom

The deflation exhibited by declining commodities may be in the early days, and contagious. Down about 20% on a 12-month basis, the Bloomberg Commodity Spot Index is juxtaposed with a 6.4% gain in the Producer Price Index. Inflation measures are keeping central banks vigilant, but if the rules of long and variable lags hold, this may reverse by the end of 2023 to how much easing it would take to help alleviate a deflationary recession. This is our base case that’s gaining fuel, as evidenced by all sectors showing losses on the year-over-year commodity scorecard.

Typically, arresting similar bear market trajectories would entail some combination of a lower plateau, aggressive central bank easing and plenty of time. With the exception of precious metals, our bias remains downward for commodities at the end of 1Q.