Smartphone study shows Apple clear favorite of Gen Z

This analysis is by Bloomberg Intelligence Senior Industry Analyst Anurag Rana and Bloomberg Intelligence Associate Analyst Andrew Girard. It appeared first on the Bloomberg Terminal.

Apple was the clear winner in Bloomberg Intelligence’s most recent US smartphone survey of those Gen Z consumers aged 18-24, with 79% preferring it vs. a current market share of 41%, leading us to believe iOS can become more dominant as these users age. Even if US smartphone units grow just 2% a year over the next decade, our analysis suggests Apple could gain 7% annually.

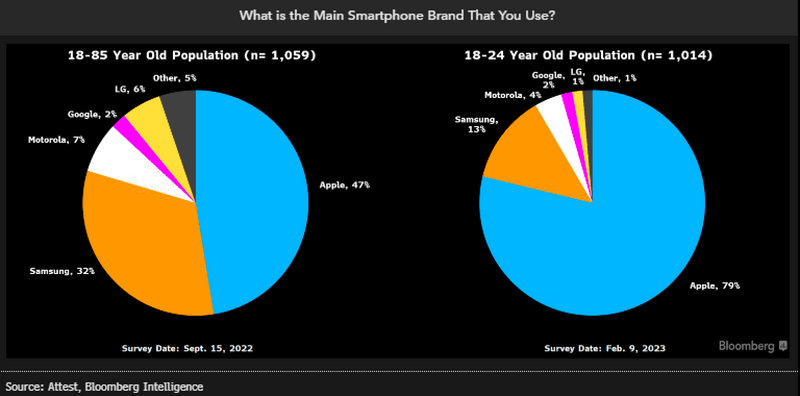

Apple clear winner as 79% of respondents prefer iOS

Apple is the dominant preference among participants aged 18-24 in our proprietary iPhone survey, with 79% choosing iOS over others. In a prior survey spanning ages 18-85, the figure was 47%, closer to Apple’s US smartphone unit market share of about 41%. This leads us to believe that Apple could continue to grow faster than the overall smartphone market in the US, taking share from other brands as this demographic cohort ages. Given that Apple enjoys very high brand loyalty, we don’t anticipate these smartphone users switching away from iOS in the future.

This survey includes only members of Generation Z, defined by the Bureau of Labor Statistics as people born from 1997-2012.

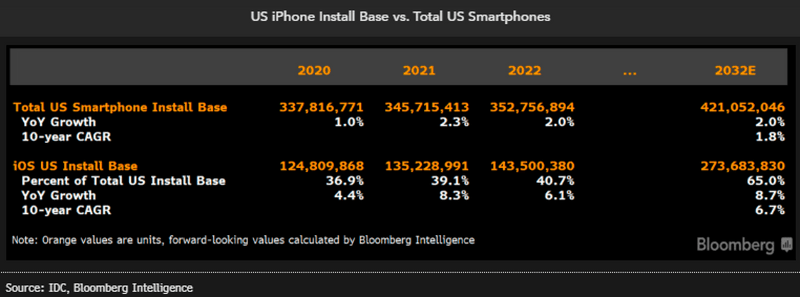

iPhone units may rise 7% annually, sales About 10%

Based on the above data, our conclusion is that Apple could continue to gain US share from other operating systems and grow faster than the overall market and most of its rivals. In 2022, iOS accounted for 143.5 million units, or roughly 41%, of the total 352.8 million smartphones in the US. If the US smartphone market grows just 2% annually for the next 10 years, and Apple’s share increases to 65% in 2032 from 41% in 2022, our analysis indicates that the iOS install base could grow 7% a year.

Adding a modest increase in average selling price (ASP) per year, we calculate that Apple could increase US sales about 10% annually, despite a higher degree of saturation than in emerging markets.

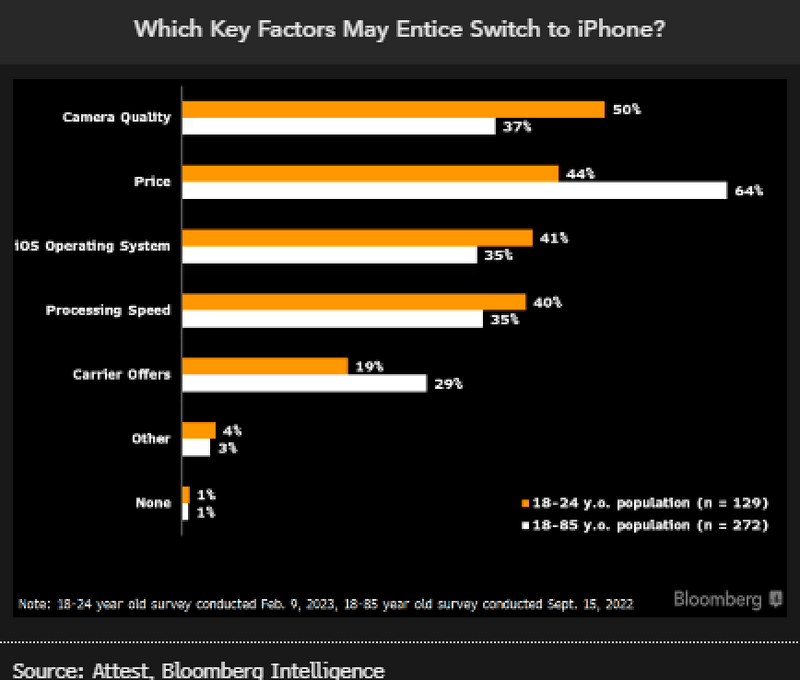

Gen Z views camera quality well above price

An important revelation of our survey was the higher importance placed on camera quality than price for Gen Z consumers. About 50% of respondents chose camera quality over price and processing speed, which leads us to believe that this cohort is more likely to opt for the higher-end Pro models. About 44% of Gen Z respondents cited price as most important. In our prior survey of people ages 18-85, price was the single biggest factor, with 64% of respondents picking this attribute over other key features. This supports our thesis that iPhone ASPs will likely trend higher over the next several years.

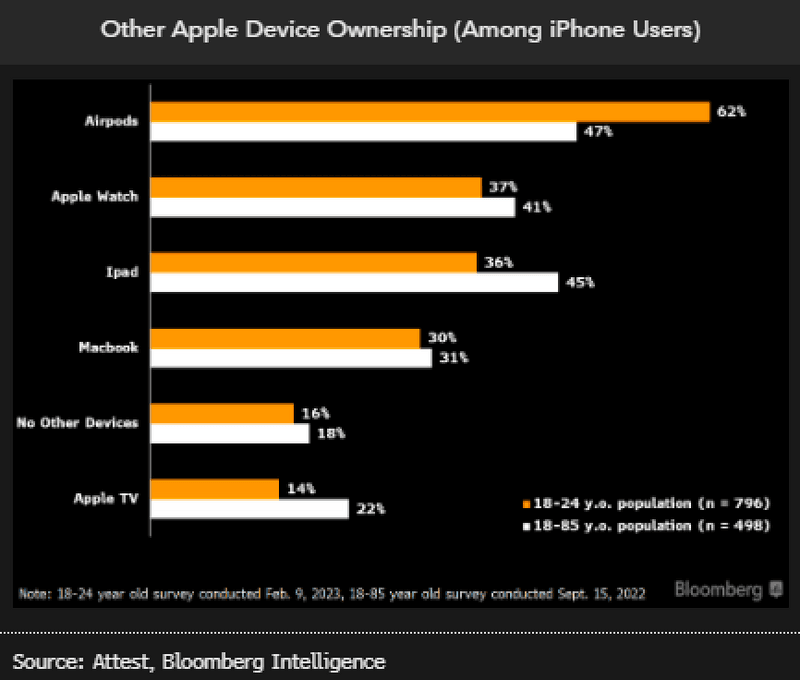

AirPods far more popular with gen Z consumers

AirPods jumped out as an Apple product that’s much more popular among those ages 18-24, with 62% of the respondents owning the headphones, compared with 47% in our prior survey of those 18-85. This high headphone attach rate in the US can be viewed as something that will also eventually occur in other regions. Globally, there are about 300 million AirPod units vs. an iPhone base of 811 million units, based on IDC data. This translates to an attach rate of 37%, which we believe will steadily rise to about 60%, driving steady growth for the Wearables, Home and Accessories segment.

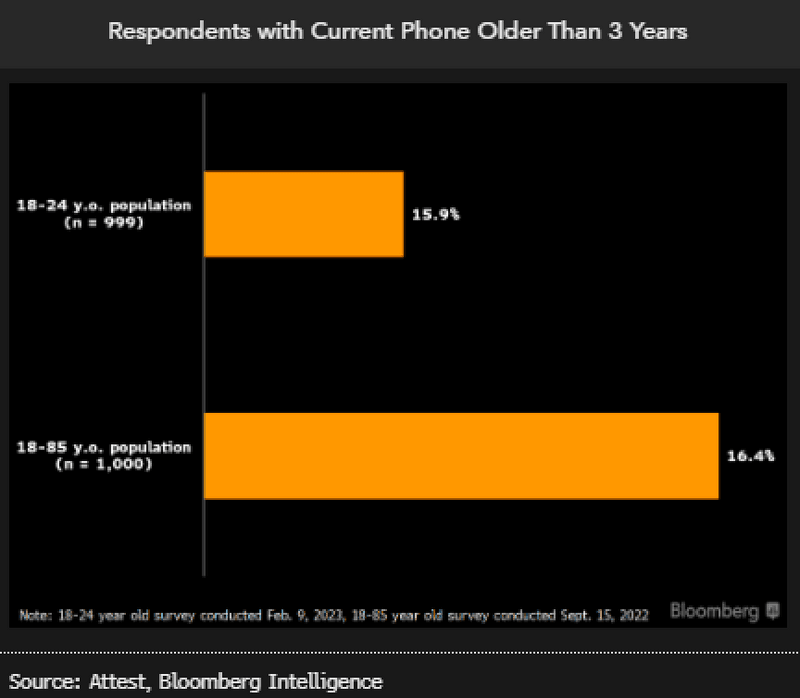

Gen Z no different than others in keeping phones

One surprising finding of the survey was that younger consumers keep their phones for the same time as the overall population. In both surveys, only about 16% of the respondents kept their phones for more than three years. This metric shows that Apple’s global refresh rate will likely remain around 3.5 years even a decade from now, despite a changing demographic mix. That in turn won’t shorten the smartphone selling cycle, driving new-unit sales. Therefore, market-share gain and ASP increase will likely be the two main determinants of future iPhone revenue growth.