This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Jamie Douglas Coutts. It appeared first on the Bloomberg Terminal.

Layer-1 (L1) chains that have bounced hard this year from technically deep oversold levels will need adoption metrics to reverse and sustain further price appreciation. Active addresses remain a statistically valuable fundamental metric for most L1s, highlighting relative value in the space.

Layer-1 sector’s strong start to year

The L1 sector has experienced a scorching run after heading into December 2022 down by more than 90% on average. But price momentum will need to be matched with strengthening fundamentals in what is likely to be a volatile year for risk assets. As we expand coverage to L1 assets, markers for adoption and protocol monetary policy will be paramount. For this note we analyze a subset of the L1 sector — Solana, Avalanche, Binance Smart Chain or BNB, and Ethereum.

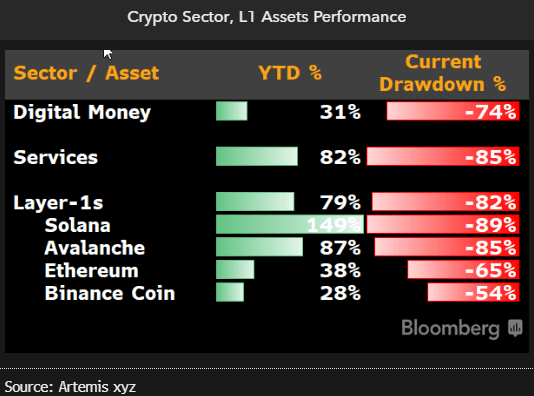

Bloomberg’s listed L1s are up 79% year-to-date, outperforming Bitcoin by 27%, but remain 82% below their all-time highs. Solana has been an L1 standout in 2023. The asset has rallied 149% this year but remains 89% from the record high. The two largest networks, Ethereum and Binance Smart Chain (BNB), have lagged the sector, posting gains of 38% and 28%, respectively.

Assessing the moats for L1 networks

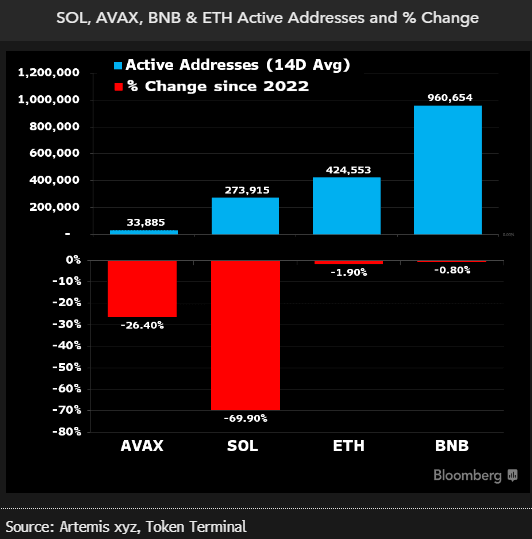

The recent bear market taught us a lot about the strength of the L1 franchises in the crypto economy. All L1s saw activity decline throughout 2022 when the bear market stepped into high gear. Yet distinct divergences exist, and this helps critical assessment of each L1 competitive moat.

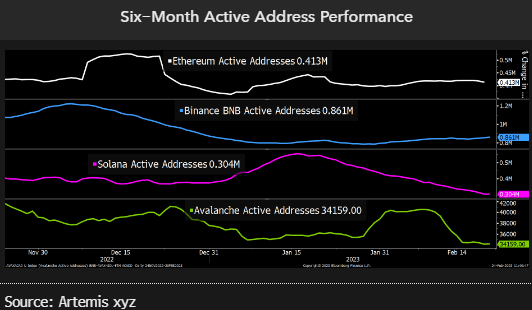

Ethereum and BNB chain withstood the 2022 drop in blockspace demand (fee revenue) with only a moderate drop in active addresses. The bull market’s top performers, Solana and Avalanche, fell 69.9% and 26.4%. As the market recovers from a bear market, the current level of active addresses provides an accurate representation of “real users” for each chain. With hundreds of thousands of daily users, Ethereum, BNB Chain and Solana have established strong franchises. Avalanche hasn’t done so.

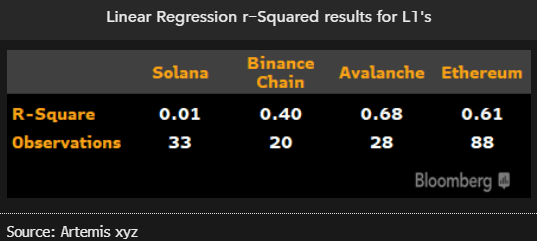

Explanatory power of active addresses for L1s

Our analysis confirms that changes in active addresses account for a large portion of the price change for the majority of L1 assets in this small and limited data set. Using the same methodology as we used for Ethereum and Bitcoin, the r-squared for three of the four L1s ranged from moderate (BNB) to strong (Avalanche, Ethereum). Yet the analysis is less significant due to the smaller monthly samples — statistical significance requires a minimum of 30.

Solana is an unusual outlier, with no statistical relationship between active addresses and price. This relationship may have been distorted by the high level of venture capital interest in the project, vesting unlocks, and the heavy influence of FTX’s proprietary trading group Alameda Research. We anticipate that active addresses will begin to align with price.

L1 activity trends still weak

The strong recovery in asset prices since the start of 2023 reflects a slowing of monetary tightening and an oversold bounce rather than a strong recovery in on-chain activity. Though BNB is the only chain that has begun to add more daily active addresses, in all fairness, the Ethereum ecosystem has grown by more than 20% when the L2 addresses are considered, which are up from 330,000 to over 400,000 since 2022. During the bear market, Ethereum was the only network that grew. There’s no better example of a competitive moat in the asset class, reinforcing the community’s decision to prioritize scalability only after decentralization and security were firmly established.

For Solana and Avalanche, any further price gains will likely require a requisite increase in active users.

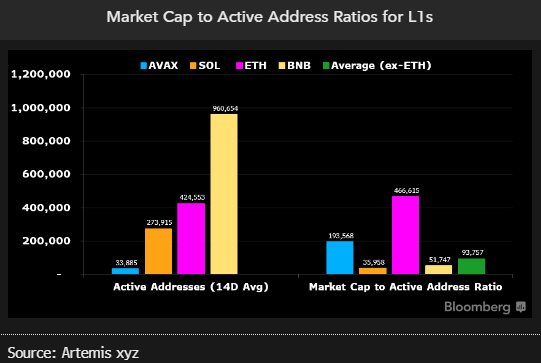

Active address ratio highlights potential mispricing

Though ratios based on market cap to active addresses in isolation are another oversimplification of network value, they illuminate possible mispricings. Ethereum commands a significant premium, and rightly so. It is significantly more decentralized and commands a monetary premium due to its store-of-value properties. All other L1s assets are akin to high beta equity with an inflationary supply schedule.

Solana may have experienced the greatest drop in activity over the past year, but based on its existing user franchise, it appears to have relative value compared with its competitors. Avalanche appears vulnerable at current valuations due to its smaller user base. Avalanche trades at more than a 500% premium on a market cap to active address ratio, with 12% of Solana’s daily active addresses.